20 September 2023

Recent developments in Artificial Intelligence (AI) like breakthroughs in Natural Language Models (e.g. OpenAI’s ChatGPT), and advancements in Deep Learning, robotics and autonomous vehicles have sparked investor interest globally.

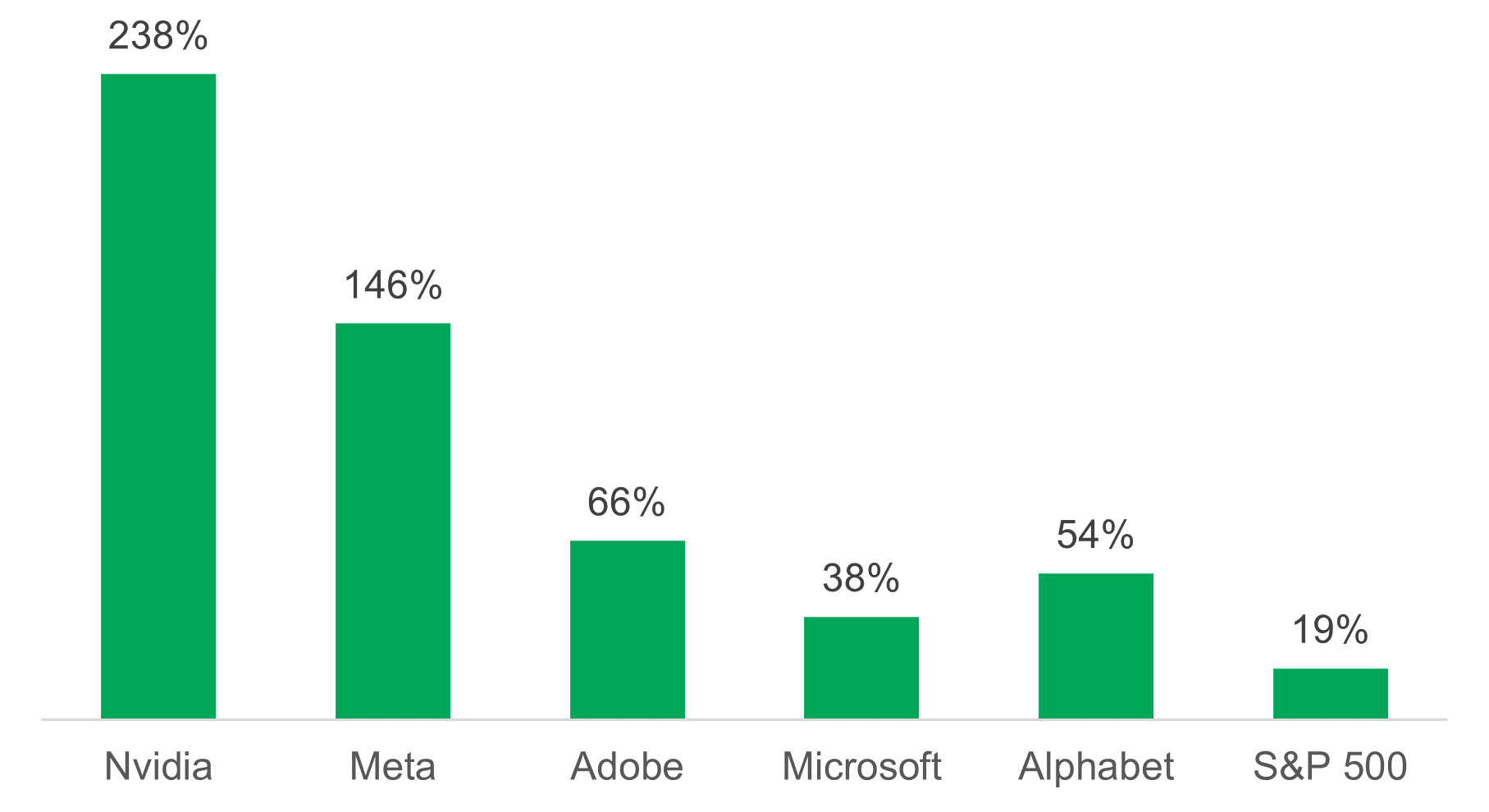

While markets are still facing headwinds from the current high-inflation, high-interest rate environment, this excitement in AI has contributed to strong returns for technology stocks year to date. The broader US stock market as represented by the S&P 500, which has a significant allocation to the information technology sector, has also benefited (see Chart 1).

Chart 1: Select Large Tech Companies and S&P 500, YTD returns (%)

Source: Bloomberg. Data as of August 31, 2023. Past performance is not an indication of future results.

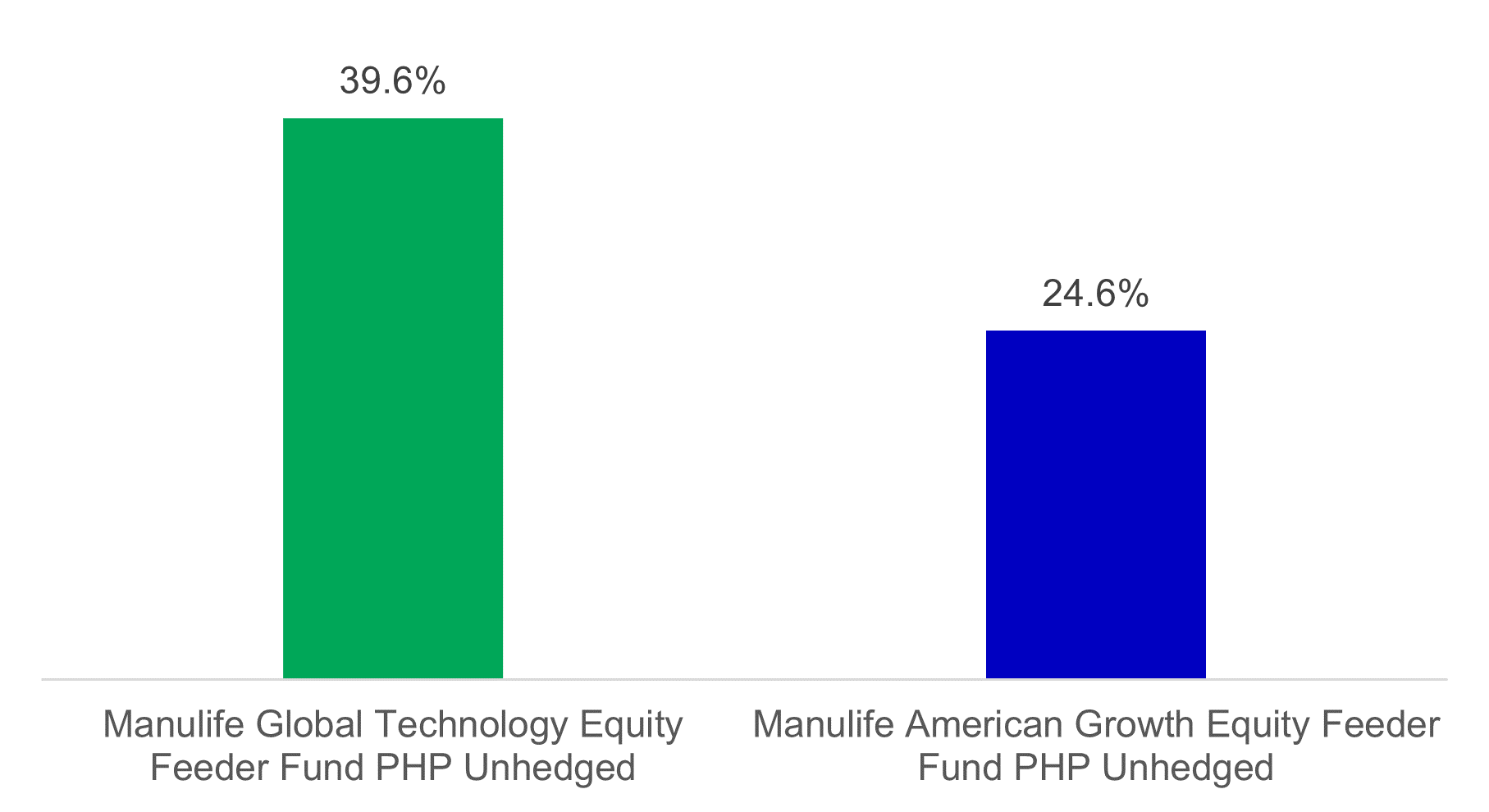

It is, therefore, no coincidence that the best performing UITF in the country today1 is a tech-focused one, the Manulife Global Technology Equity Feeder Fund PHP Unhedged share class, earning 39.6% YTD. Our US Equity Fund, Manulife American Growth Equity Feeder Fund PHP Unhedged share class, is also one of the top performing UITFs, earning 24.6% YTD, benefiting from its positive view on the tech sector (see Chart 2).

Chart 2: Manulife Global Technology Equity Feeder Fund and Manulife American Growth Equity Feeder Fund, YTD returns (%)

Source: Bloomberg. Data as of August 31, 2023. Past performance is not an indication of future results.

Is this sudden excitement over AI a true long-term game changer that investors should seriously consider? Or will this just be this decade’s version of the dotcom bubble of the 2000s? To help us understand the impact of AI and what it means for investors, the fund manager of the target fund of the Manulife Global Technology Equity Feeder Fund, Franklin Templeton, recently released an article on the “Age of AI”.

Here are the salient points of the article:

1. Artificial Intelligence is a key pillar of the digital transformation theme, which is driving significant disruption and spurring new growth.

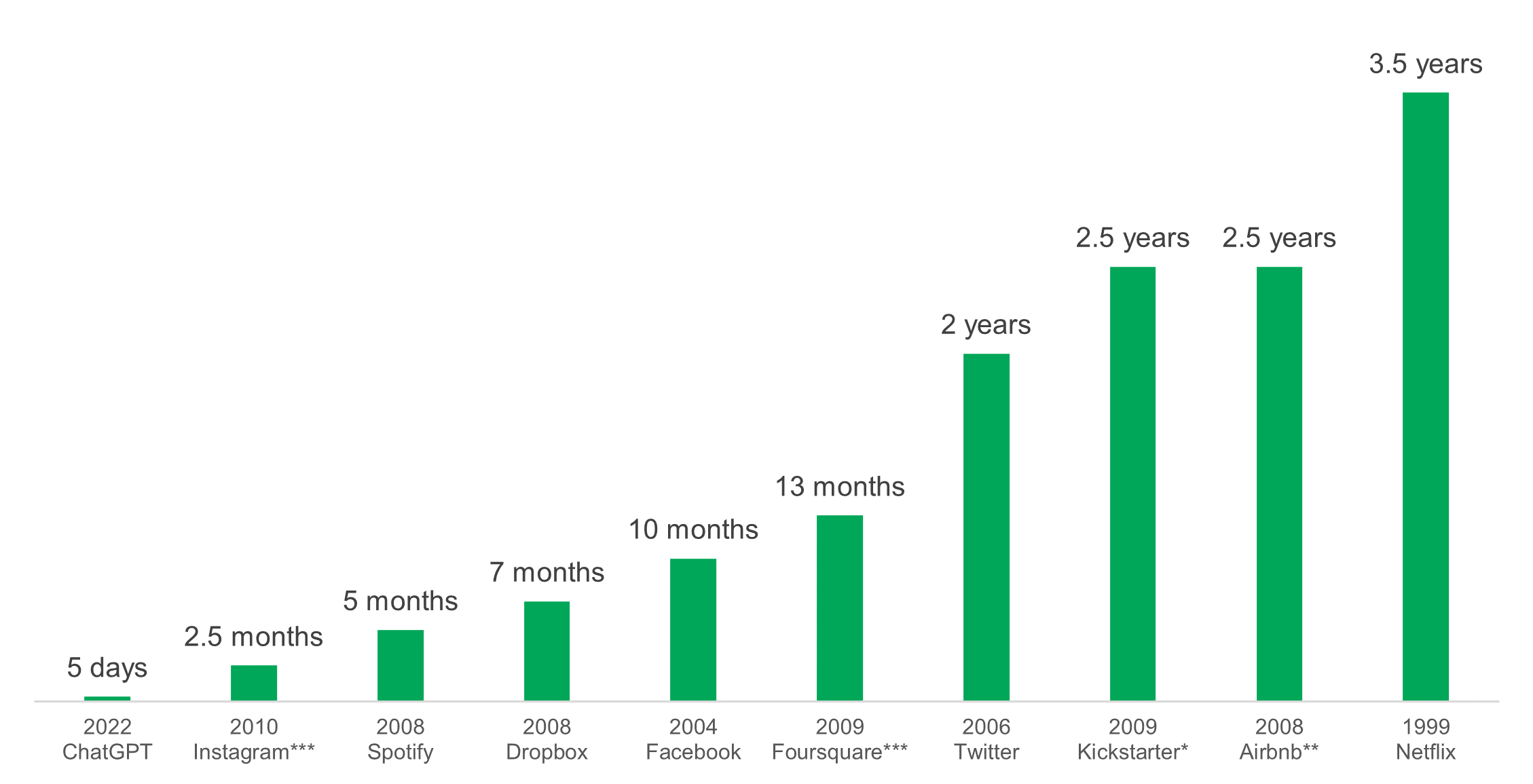

2. While AI has been in development since the 1950s, its adoption has exploded recently. For example, ChatGPT, a natural language model that can understand and engage in human-like conversation reached 1 million users in less than a week, overtaking the speed of adoption of popular platforms like Instagram, Spotify and Facebook (see Chart 3). This evolution can improve existing automated customer service chat bots – increasing productivity in the workplace.

Chart 3: Time to reach one million users for various applications

Source: Statista. Note: *One million backers, **one million nights booked, ***one million downloads.

3. The potential economic impact of AI is estimated to be at US$15.7T by 20302, more than the combined output of China and India. The following will likely drive this economic impact:

4. Sectors that will see massive opportunity in incorporating AI are as follows:

5. Investment opportunities in AI include companies involved in the following areas:

While the tremendous opportunities that AI can bring are indeed exciting, investors should always consider their risk appetite, financial needs and investment objectives when deciding to invest in any fund. Alongside this, we believe that long-term investing, diversification and cost averaging are important strategies that investors can leverage to optimize the potential returns of their investments.

Download the full Franklin Templeton article here.

Click here to learn more about Manulife Global Technology Equity Feeder Fund.

2 Source: Rao, Anand S. Verweij, Gergard. “Sizing the prize. What’s the real value of AI for your business and how can you capitalize?” PWC 2017.

Unit Investment Trust Funds are trust products and NOT DEPOSIT products and are not insured nor governed by the Philippine Deposit Insurance Corporation (PDIC). These UITFs are not an obligation of, nor guaranteed, nor insured by Manulife Investment Management and Trust Corporation, its parent company or its affiliates. Due to the nature of the investments of these products, the returns/yields cannot be guaranteed. Any losses and income arising from market fluctuations and price volatility of the funds and their underlying securities, even if invested in government securities, are for the account of the client. As such, the units of participation of the client in the UITF, when redeemed, may be worth more or less than the client’s initial investment/contribution.

Historical performance, when presented, is purely for reference purposes and is not indicative of similar future result. Manulife Investment Management and Trust Corporation is not liable for losses except for willful default, gross negligence, or bad faith of its officers, employees, or authorized representatives. Prospective investors must read the complete details in the Declaration of Trust for the Fund which may be obtained at our website, make his/her own risk assessment, and when necessary, seek an independent /professional opinion or consult a Financial Advisor/Wealth Specialist and take the Client Suitability Assessment to determine the suitable Fund before proceeding with the investment.

Manulife Investment Management and Trust Corporation, its products and services are regulated and governed by the Bangko Sentral ng Pilipinas (BSP). For inquiries or complaints relating to our products and services, you may call our Customer Care Hotline. To know your rights under BSP Circulars 857 and 1048 (Regulations on Financial Consumer Protection), please access a copy at the BSP's website.

Manulife, Manulife Investment Management, and Manulife Investment Management & Block Design are trademarks of The Manufacturers Life Insurance Company and are used by it, and by its affiliates under license.

Whilst Manulife Investment Management and Trust Corporation (MIMTC) believes that the information provided on this document is correct at the date of production, no warranty or representation is given to this effect and MIMTC expressly disclaims liability for errors or omissions in such information. No reliance may be placed for any purpose on the information and opinions provided on this document or the accuracy or completeness thereof and no responsibility can be accepted by MIMTC to anyone for any action taken on the basis of such information or opinions.

Global Healthcare Equities Q&A

This Q&A provides an updated overview of sector performance, examines the impact of recent US healthcare policy developments, and outlines key investment strategies and themes. It also highlights the growing role of artificial intelligence (AI) in healthcare innovation and shares practical tips to help investors navigate market volatility.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

Fed’s first rate cut of 2025: Implications & takeaways

After nine months on pause, the US Federal Reserve (Fed) announced another rate cut of 25 basis points (bps) on 17 September (US time), bringing the federal funds rate into a target range of 4%-4.25%. Alex Grassino, Global Chief Economist, and Yuting Shao, Senior Global Macro Strategist, share their latest views on the rate decision and its implications for Asia.