April 24, 2020

In times of extreme market volatility, staying calm and thinking long-term are sensible decisions that investors can make to use time to their advantage.

This current market situation is not new to us. We’ve been through other crises before and there are lessons that investors can learn and apply at present times.

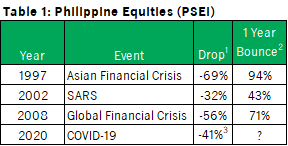

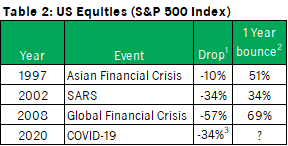

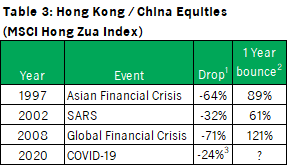

We looked at three equity markets – Philippine Equities, US Equities and Hong Kong/China Equities through their benchmarks and how they fared during the last four crises (see Tables 1, 2 and 3).

Notes:

1Return from previous peak before event to bottom after event

2Return from bottom to 1 year after

3As of last bottom before April 15, 2020

TBD – To be determined

Source: Bloomberg.

Past performance is not an indication of future results. Event may not be 100% responsible for the drop in prices.

Based on the data of each market, we can see that after steep sell-offs, markets generally had rebounds that were significant and sustained. For example, the SARS epidemic influenced the Philippine Stock Exchange Index (PSEi) to go down by 32%. After that, the market experienced a bounce that lasted more than a year, with investors earning 43% over a one-year period.

While it is uncertain whether we are now near or at the bounce already, what history can teach us is that despite our emotional instincts, it makes sense to invest and stay invested, particularly for those with a longer investment horizon.

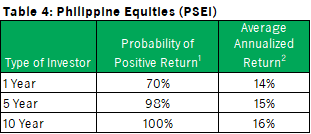

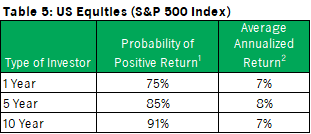

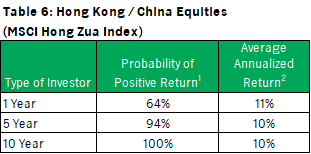

We looked at the same benchmarks’ history across three investment horizons – 1 year, 5 years and 10 years (see Tables 4, 5 and 6) to determine the impact of investment horizon on the probability of generating positive returns.

Notes:

Based on monthly rolling return data from December 31, 1999 to March 31, 2020.

1Count of periods that had positive returns over total count of periods. For example, for the PSEi, from Dec 31, 1999 to March 31, 2020 there were 232 total 1 year periods, 163 of which had positive returns; 184 total 5 year periods, 181 of which had positive returns; and 123 total 10 year periods, all of which had positive returns.

2Average of annualized returns of all periods. For example, the average annualized return for all the 123 ten-year periods for the PSEi was 16% p.a.

Source: Bloomberg.

Past performance is not an indication of future results.

While several black swan events caused sharp market disruptions over the last 20 years, the data from the three different markets suggest that the investment horizon has an impact on the probability of generating positive returns.

History gives this second lesson - as investment horizon increases, the chances of earning positive return also increase as longer time helps smooth out the volatility of returns.

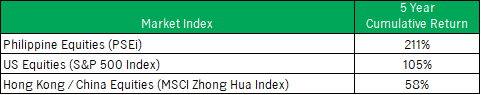

Now that we know that markets generally rebound after a crisis, the next logical question is – should we invest now? If we invest now, prices might still go down; but if we don’t, we may lose the rare opportunity to buy at low levels. Market timing is indeed hard, if not, impossible.

Let us look at regular investing or cost averaging - a strategy involving periodic investing. The next table shows us what investors could have earned after five years if they made regular investments over 12 months as the Global Financial Crisis (GFC) unfolded, even if they didn’t catch the market bottom.

Notes:

Source: Bloomberg.

Past Performance is not an indication of future results.

Assumptions:

History now shows us a third lesson – catching the bottom is not crucial in generating good returns if investors adopt regular investing or cost averaging. It is a proven investment strategy that can mitigate investors’ behavioral biases - being too fearful when prices are low and being too greedy when prices are high, and at the same time, enable them to ride out market volatility in a more proactive way.

These history lessons show that with the right strategies – long term investing and cost averaging/regular investing, investors can take advantage of opportunities to grow their wealth despite market volatility.

Investors can apply these strategies with the diverse range of unit investment trust funds (UITFs) of Manulife Asset Management and Trust Corporation. These UITFs provide access to local and global investment strategies that suit different goals, needs and risk profile.

Talk to our Wealth Specialists to learn more

The information and/or analysis contained in this material have been compiled or arrived at from sources believed to be reliable but Manulife Asset Management and Trust Corporation (MAMTC) does not make any representation as to their accuracy, correctness, usefulness or completeness and does not accept liability for any loss arising from the use hereof or the information and/or analysis contained herein. Neither MAMTC or its affiliates, nor any of their directors, officers or employees shall assume any liability or responsibility for any direct or indirect loss or damage or any other consequence of any person acting or not acting in reliance on the information contained herein.

Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances, or otherwise constitutes a personal recommendation to you. Past performance is not an indication of future results. Investment involves risk. Proprietary Information: Please note that this material must not be wholly or partially reproduced, distributed, circulated, disseminated, published or disclosed, in any form and for any purpose, to any third party without prior approval from MAMTC.

How to Protect Yourself and Your Accounts Online

Technology has enabled us to live with convenience and accessibility more and more each day. We have great power at our fingertips and can effortlessly perform numerous tasks from our phones and laptops, including managing our finances online. However, as we grow more adept at using these apps and tools, and as technology evolves and becomes increasingly sophisticated, we must continually educate ourselves on how to safeguard our data and security,and avoid becoming targets of cybercriminals.

Manage your expenses but don’t forget retirement planning

By the time you hit 30, the cost of hosting a wedding, having kids, and buying property should not be taken lightly. It’s worth adhering to the three principles of wealth management.

Tips to manage your budget

Keeping an eye on income and spending is not easy. However, working to a budget can simplify matters. Once you have established a reliable system that tracks your money, you’ll find it easier to take control of your finances.