14 January 2022

Kai Kong Chay, Senior Portfolio Manager, Greater China Equities

2021 was an eventful year for the Greater China equity market. During the first quarter, better-than-expected macroeconomic data attracted investors. However, in the second half of the year, Beijing introduced a series of targeted industry regulations that dulled sentiment and drove investors to the sidelines, causing offshore Chinese equities to plummet throughout the third and fourth quarters. In contrast, the mainland A-shares market remained relatively stable, and tech stocks propelled Taiwan equity to record highs. Kai-Kong Chay, Senior Portfolio Manager for Greater China equities, believes that amid unprecedented change, such as the pandemic accelerating China’s transition process, investors can capture potential opportunities in onshore (A-shares), Hong Kong and Taiwan equity markets by employing a bottom-up, stock-picking approach, as current valuations present compelling opportunities.

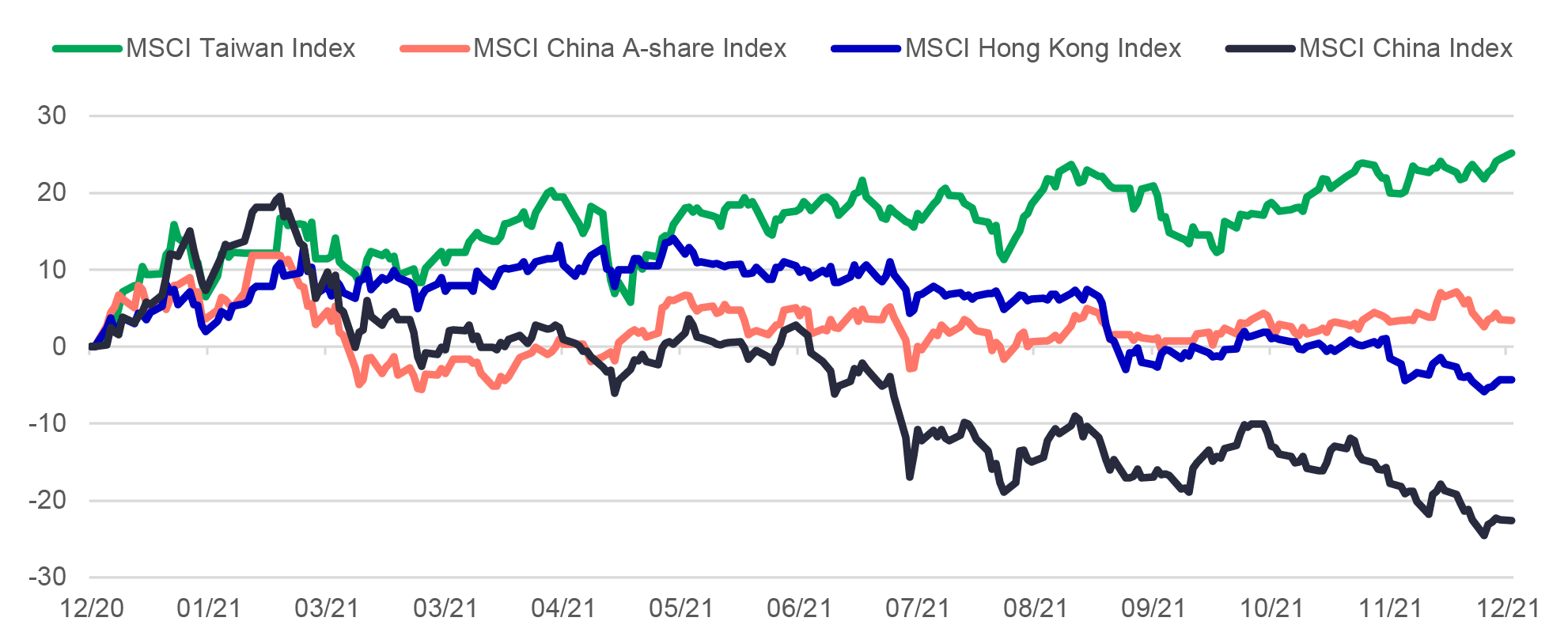

Chart 1: 2021 market review for China, Hong Kong, and Taiwan equities

Bloomberg, as of 28 December 2021.

In the second half of 2021, investors grew concerned about default risk among high-profile property developers given tighter regulation and tighter liquidity. During the third quarter, several market segments, such as after-school tutoring, property- management services, and internet platforms, also faced a regulatory squeeze that resulted in a sharp sell-off in some sectors.2

The situation became more settled in the fourth quarter of 2021, as investors digested the most severe measures.

Turning to internet platform providers, it’s worth noting that the October study session of the Politburo called for the “co-existence of regulation and development for internet platforms” – stating that the digital economy is crucial for enhancing productivity and international competitiveness. Thereafter, the finalising of antitrust fines on some major platforms provided clarity, as the issue had clouded the sector. We believe the year-to-date correction, led by the regulatory clampdown in the third quarter, has allowed fundamental value to emerge in these sectors of Chinese equities.

Regarding the real-estate sector, potential credit events still grabbed the headlines, but the Chinese government signalled that the debt crisis relating to a leading property developer was manageable, and any spillover risks would be contained. As a matter of fact, there are signs that credit conditions may be easing for the battered real estate industry. Bank lending to property developers rose sharply in October and November, with momentum expected to continue.

Despite the market volatility triggered by negative sentiment and industry regulation, China’s macroeconomy was supported by a rebound in exports, rising foreign reserves, and a steadily appreciating renminbi. These factors allowed it to recover from the pandemic.

Besides internal macroeconomic tailwinds, both onshore and offshore Chinese equities can potentially benefit from a more accommodative monetary policy. In December, the US Federal Reserve (the Fed) began tapering its bond-purchase programme. Meanwhile, the PBOC took advantage of the timing to cut its reserve requirement ratio (RRR) for the second time in 2021 and slashed rates for the second time in 20 months, raising liquidity in onshore stock markets. While some industries experienced corrections, they were helped by accommodative government policies. Given accelerated structural transitions, Chinese equities still offer investors a great deal of potential that can be categorised into major themes known as the “5Cs”.

First “C”: COVID-ZERO policy

Promoting industrial production

Second “C”: Common prosperity

Encouraging domestic consumption and innovation

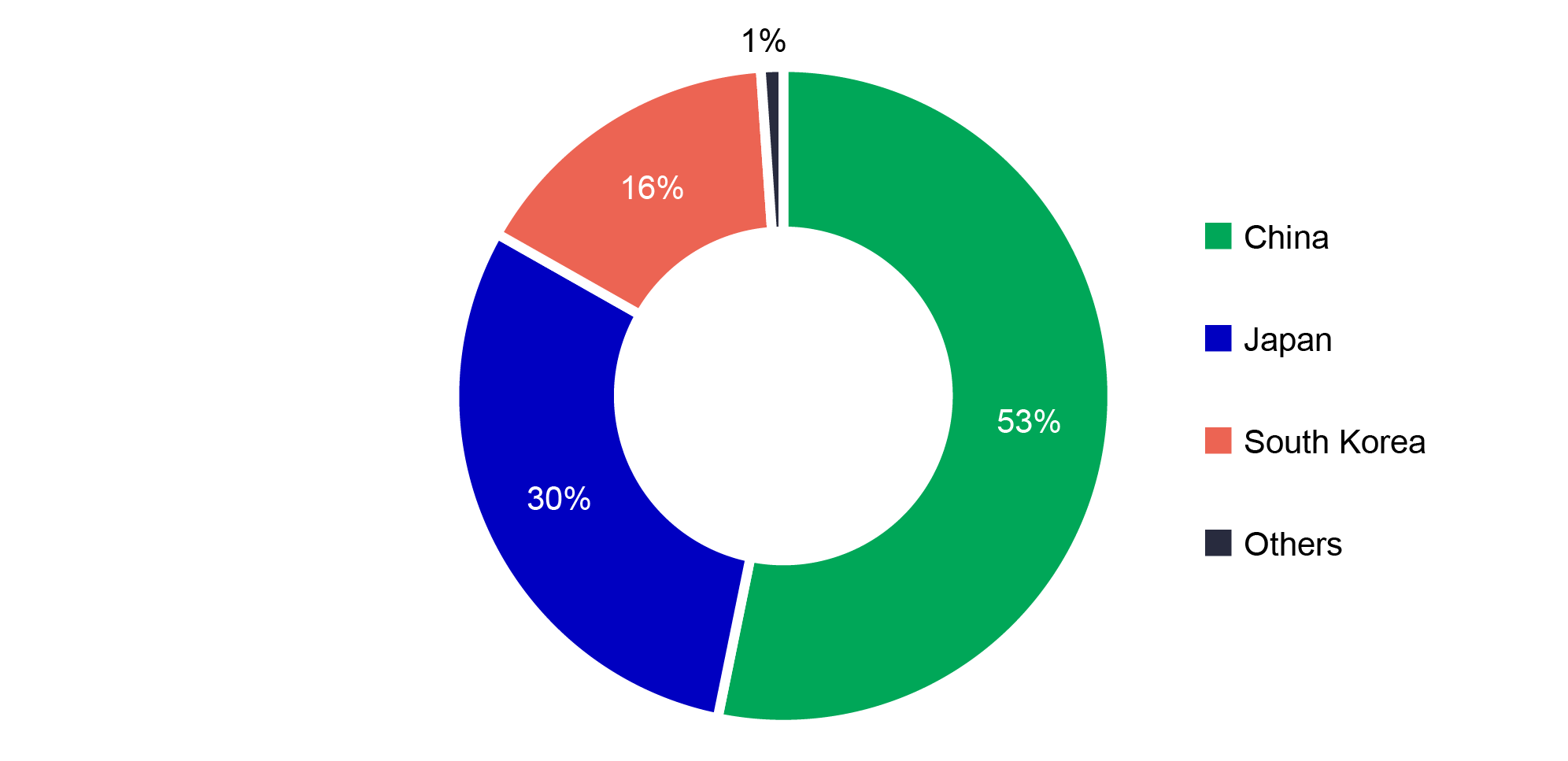

Chart 2: China’s domestic innovation delivers results, as electric-vehicle battery manufacturers have already captured over half of the global market share

Citic Securities, Bloomberg, as of August 2020.

Third “C”: Co-existence of regulation and development for IT and e-commerce

Promoting digitalisation over the longer term

While it may be too early to say if the current regulatory tightening cycle is over, we believe the most severe measures had been released and digested. The swift rectification of businesses and operating models, along with the implementation of necessary measures in the affected industries mean that growth expectations can be reset. Here, we reiterate the forward-looking, long-term drivers of technology and digitalisation.

Fourth “C”: Carbon peak and carbon neutrality

Peak carbon emissions and promoting new energy

Fifth “C”: Changing demographics

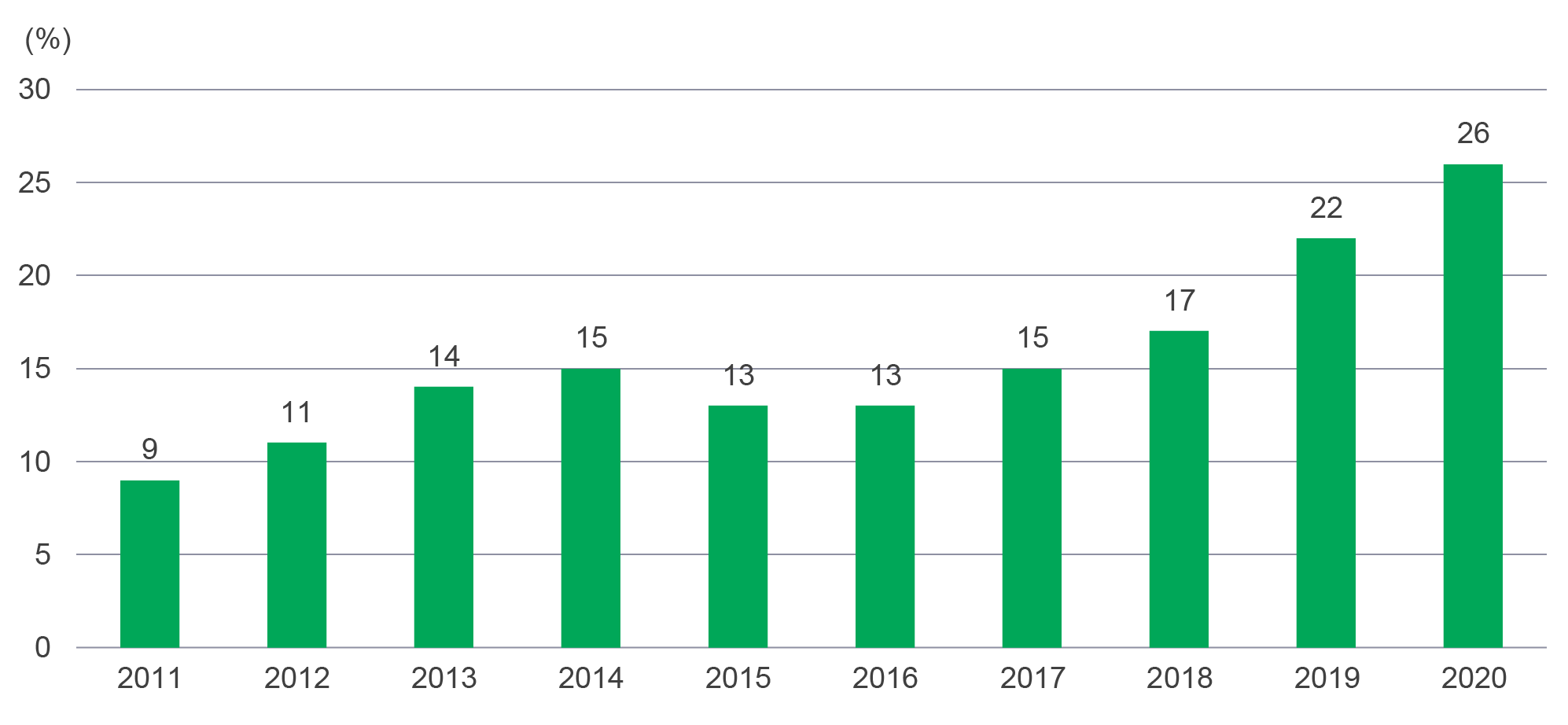

Chart 3: Chinese brands’ share trend in cosmetics (%)

Euromonitor, UBS, as of September 2021.

The following section explores investor opportunities in the onshore and offshore markets.

We see three unique opportunities in A-shares:

Given China’s goal of carbon neutrality, solar and wind energy installations may experience higher growth in the coming years. Despite higher raw-material prices affecting solar energy developments in 2020, which resulted in new installations falling short of expectations in 2021, we believe the number will grow markedly in 2022. With solar energy costs remaining high, new energy operators are more optimistic about wind energy and, therefore, the number of installations may exceed forecasts in 2021 and 2022.

It’s worth mentioning that new-energy sources are leading to changes in the power-grid sector. To cope with competition, capex investment here should also exceed expectations.

In terms of opportunities, new-energy operators are mainly listed in Hong Kong, while new-energy-related materials and equipment companies are primarily traded in A-share markets.

The penetration of EVs continues to rise – especially given the subsidies introduced in Europe and the US. The EV market has evolved from one driven by government subsidies to one led by consumption. With many EVs produced by traditional automobile manufacturers due to hit the market in 2022, EV sales should maintain high levels of growth throughout the year. Many companies that provide materials and equipment to EV supply chains are listed on the A-share market.

The replacement of imported semiconductors with those locally produced in China will be an industry trend lasting several years. In 2021, the semiconductor industry was highly cyclical, and we are optimistic about capital spending in 2022. Overall, then, we are constructive on semiconductor equipment companies. The higher penetration of EVs and solar energy will enhance the structural demand for power-management semiconductors (i.e., semiconductor components related to power and voltage control). As such, the outlook of power semiconductor companies is also more favourable.

Although Hong-Kong listed Chinese equities trailed China A shares and Taiwan equity by a considerable margin in 2021, we need to consider the valuation of the Hang Seng Index over the past five years and a price-to-book (P/B) ratio of less than one, which signals a bottoming out. As of end December 2021, the historic P/B ratio of Hong Kong equities was 0.97, implying that downside risk is limited. Catalysts for Hong Kong’s equity market include an increasing number of IPOs, especially those returning from the US.

Besides, the China Securities Regulatory Commission recently announced that if companies meet compliance requirements and use the variable interest entities (VIE) structure, they will be allowed to list offshore after registration. As the US Securities and Exchange Commission has passed a new rule ordering the delisting of foreign companies that fail to comply with audit regulations for three consecutive years, we expect the number of China concept stocks heading to Hong Kong for IPOs or homecoming listings to grow continuously. This should provide a liquidity boost for Hong Kong equities.

Finally, growth expectations for the large-cap internet and e-commerce sectors have been reset, and we believe that current valuations price in most of the negative news flow. Looking ahead, the long-term drivers of technology and digitalisation remain intact. Catalysts for re-ratings in 2022 could be further clarity on the approval of gaming titles and time-spent limits, strong growth among new retail offerings (e.g., group community purchase), and the increasing penetration of fresh food and grocery e-commerce services. We believe that any risk is on the upside.

After experiencing rapid growth in 2021 (projected at 6%), Taiwan’s GDP is set to expand by 3.3% in 2022, which is slower than 2021 but higher than pre-COVID levels. Corporate earnings may slow to 0–3%, with negative growth in the materials sector and cyclical equities being the leading detractors. The earnings prospects for most electronics companies remain bright. For example, semiconductor and server companies, as well as automotive electronics, are expected to achieve double-digit earnings growth.

Stock-picking rather than market selection should be in favour throughout 2022. Corporate profits may recede in the second quarter of the year, and the Fed is widely anticipated to raise interest rates. Historical data suggests that Taiwan equity performance would, to a large extent, be negatively correlated to Fed policy, meaning we may see Taiwan equities peak in the first quarter of 2022. Key investment themes include mid-cap electronics such as integrated-circuit (IC) designers, servers, EVs, and the metaverse-related names; banks that can benefit from rate hikes; and stocks that will be boosted by the post-pandemic recovery.

We believe the ongoing semiconductor shortage will extend into the first half of 2022, with Taiwan’s IC foundries emerging as major beneficiaries. Given chip prices are set to rise further in the first quarter of 2022, gross margins are expected to trend upwards. Meanwhile, IC design companies can also gain from the shortage. The substitution effect has begun to occur, with Taiwan chips gradually replacing supplies from Europe and America, implying that IC prices have room for upward adjustments.

Having borne the brunt of the pandemic in the third quarter of 2021, Southeast Asia is showing signs of recovery. Downstream electronics account for most of the Taiwanese manufacturers in China, and their production has not suffered severely thanks to redeployment strategies and an easing of power rationing measures since the final quarter of the year. Manufacturers have also taken steps to lower the risks associated with power rationing. Furthermore, the current factory utilisation rate of Taiwanese manufacturers in Southeast Asia, most of them being textiles and shoe producers, has rebounded by over 80%. Manufacturers are also actively diversifying to avoid overexposure to Vietnam.

Given its increasingly diverse range of investment opportunities, the Greater China equity universe will be best approached from a bottom-up, stock-picking perspective rather than by focusing on a narrower band of individual markets. We are encouraged by developments across all share types, most notably the swift growth in renewables, Hong Kong’s burgeoning IPO sector, and changes in the semiconductor supply chain. Furthermore, China’s expanding middle class and its desire for domestic brands provides us, as active managers, with a deeper well of ideas from which to draw. Lastly, we believe that the most stringent regulatory measures are now behind us. This, coupled with a hoped-for easing of COVID-related concerns, should see investor confidence accelerate in 2022.

1 Bloomberg. Total return in USD, as of 27 December 2021. MSCI China Index measuring performances of large-to-mid cap SOEs, red chips, A-shares, B-shares and Chinese stocks listed overseas fell 22.62%; MSCI Hong Kong Index declined 4.31%, MSCI China A-share Index rose 3.38%; MSCI Taiwan Index increased 25.18%. Past performance is not indicative of future performance.

2 On 24 July 2021, the “Opinions on Reducing Homework Burden and After-school Tutoring Burden of Students in the Compulsory Education Stage” (aka "Double Reduction" policy) was officially released by Chinese government. Ministry of Housing and Urban-Rural Development of the People’s Republic of China, 23 July 2021. The Cyberspace Administration of China (CAC) announced a cybersecurity inspection on certain ride-hailing platforms in early July soon after the IPOs of a few concerned companies in the US.

Semiconductors poised for long-term growth amid AI boom

The global semiconductor industry remains strong – arguably the most robust we have seen in over three decades. This strength is supported by cutting-edge innovation, rising revenues and robust capital spending. While risks remain, the outlook for 2026 appears constructive, with demand for artificial intelligence (AI) applications showing few signs of slowing. Beyond AI, the non-AI markets could be poised for positive revisions as cyclical recovery gains traction after several years of consolidation.

2026 Outlook: Clearer picture, better growth

This year’s outlook spotlights a world in flux – U.S. stimulus, Europe’s rebound, China’s policy pivots, and Japan’s innovation surge all shape a landscape full of both opportunities and challenges.

2026 Asian Fixed Income Outlook: Positive momentum poised to continue amid ample investment opportunities

Asian fixed income posted strong gains in 2025 amid myriad challenges. Entering the new year, the asset class is poised for continued momentum on the back of numerous beneficial tailwinds. In this 2026 Outlook, the Asian Fixed Income team analyses the key factors likely to propel performance and identifies opportunities for investors based on key themes and developments in three regional bond markets: China, Japan, and India.

Semiconductors poised for long-term growth amid AI boom

The global semiconductor industry remains strong – arguably the most robust we have seen in over three decades. This strength is supported by cutting-edge innovation, rising revenues and robust capital spending. While risks remain, the outlook for 2026 appears constructive, with demand for artificial intelligence (AI) applications showing few signs of slowing. Beyond AI, the non-AI markets could be poised for positive revisions as cyclical recovery gains traction after several years of consolidation.

2026 Outlook: Clearer picture, better growth

This year’s outlook spotlights a world in flux – U.S. stimulus, Europe’s rebound, China’s policy pivots, and Japan’s innovation surge all shape a landscape full of both opportunities and challenges.

2026 Asian Fixed Income Outlook: Positive momentum poised to continue amid ample investment opportunities

Asian fixed income posted strong gains in 2025 amid myriad challenges. Entering the new year, the asset class is poised for continued momentum on the back of numerous beneficial tailwinds. In this 2026 Outlook, the Asian Fixed Income team analyses the key factors likely to propel performance and identifies opportunities for investors based on key themes and developments in three regional bond markets: China, Japan, and India.