9 June, 2021

Frances Donald, Chief Economist

We’re entering a period where concerns about inflation have reached fever pitch. As such, inflation-related data releases are likely to be scrutinized closely for clues pertaining to what could happen next. In this market note, Frances Donald, Global Chief Economist and Global Head of Macroeconomic Strategy, shares her inflation outlook.

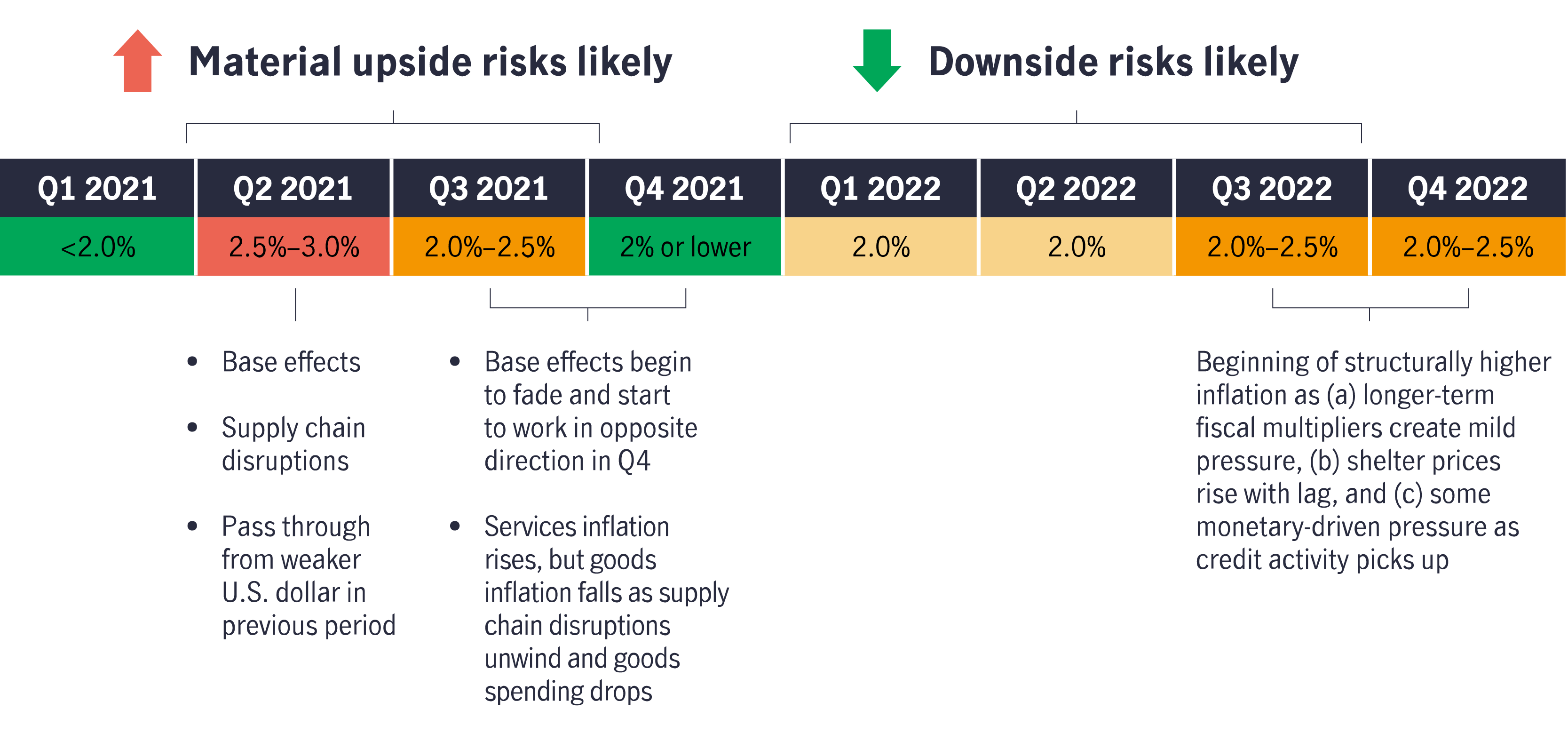

First, we expect to see a sizable pop in the already relatively elevated Consumer Price Index (CPI) readings, beginning with April’s 4.2% year-over-year rise¹—which is likely to head even higher in May. Throughout the end of Q2 and into the beginning of Q3, we’re also likely to encounter ongoing upside surprises across a host of price measures, from import prices to prices paid indexes in surveys.

Second, the pace of inflation should then begin to slow meaningfully in late Q3 2021 and continue into 2022 as the mismatch in demand and supply begins to ease. The handoff from goods price inflation to services price inflation, which typically takes some time, should also feed into that narrative. Crucially, we also expect labor supply to improve by late Q3, which should mollify concerns about wage pressures. This period should confirm that sizable increases in headline inflation were, indeed, transitory.

Finally, as we peer into 2023 and beyond, we see scope for slightly higher structural inflation (in the 2.0% to 2.5% realm versus the 1.5% to 2.0% range during the prepandemic period) as the delayed effects of higher shelter costs, infrastructure spending, lending activity, and medical costs translate into moderate longer-term price pressure.

Note that throughout our forecast period, we expect core inflation to remain below headline inflation (nearly all the time) and, crucially, within the U.S. Federal Reserve’s (Fed’s) average 2.0% inflation targeting mandate.

The United States isn’t an island—U.S. inflation is heavily correlated to global inflation, which remains muted. Notably, Chinese credit trends are consistent with future weaker inflation in China, which tends to filter through to U.S. inflation through trade and global forces. Crucially, the relatively weaker U.S. dollar has been an important contributor to inflation in the United States and signs of further weakness will translate into higher import prices.

US inflation outlook: an overview

Source: Manulife Investment Management, as of 13 May 2021.

1 U.S. Bureau of Labor Statistics, May 12, 2021.

Global Healthcare Equities Q&A

This Q&A provides an updated overview of sector performance, examines the impact of recent US healthcare policy developments, and outlines key investment strategies and themes. It also highlights the growing role of artificial intelligence (AI) in healthcare innovation and shares practical tips to help investors navigate market volatility.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

Fed’s first rate cut of 2025: Implications & takeaways

After nine months on pause, the US Federal Reserve (Fed) announced another rate cut of 25 basis points (bps) on 17 September (US time), bringing the federal funds rate into a target range of 4%-4.25%. Alex Grassino, Global Chief Economist, and Yuting Shao, Senior Global Macro Strategist, share their latest views on the rate decision and its implications for Asia.