21 August 2019

In early August, the US government unexpectedly announced tariffs on the remaining US$300 billion of Chinese imports. These levies, which could impact the consumer, were scheduled to begin on 1 September. However, the start date for duties on certain goods was deferred to 15 December in order to mitigate the potential impact on Black Friday and Christmas sales.

This game-changing development alters our earlier, more bullish view of the markets. In addition to our traditional thoughts about the impact of tariffs on the global economy, we are now considering additional factors that create nonlinear headwinds to growth. Furthermore, we now expect the Fed to cut interest rates by 50 basis points in September with the potential for more further reductions down the line.

What a difference a day makes.

The last day of July brought the first US interest-rate cut in more than a decade—an event that was widely expected, marred only perhaps by an unusually robust accompanying press conference that confused markets briefly. But a sense of positivity returned quickly, and investors were getting ready to down tools and settle into the lazy, hazy days of summer. Then, without a word of warning, everything changed.

On 1 August, the Trump administration announced a new set of tariffs on the remaining US$300 billion of Chinese imports to be imposed on 1 September. Even if the announcement was subsequently amended do defer tariffs on certain goods until 15 December, this development is in our opinion game changer that single-handedly alters our earlier, more bullish view of markets. We had previously expected US growth to accelerate as domestic business investment stabilised along with improvements in global trade activity, supported by a stabilising China—in short, a scenario that was supportive of risk. The new tariffs, however, substantially weaken our argument and, by extension, our view that risk assets can outperform, particularly over the next three months.

We suggest thinking about the impact of impending tariffs in two phases.

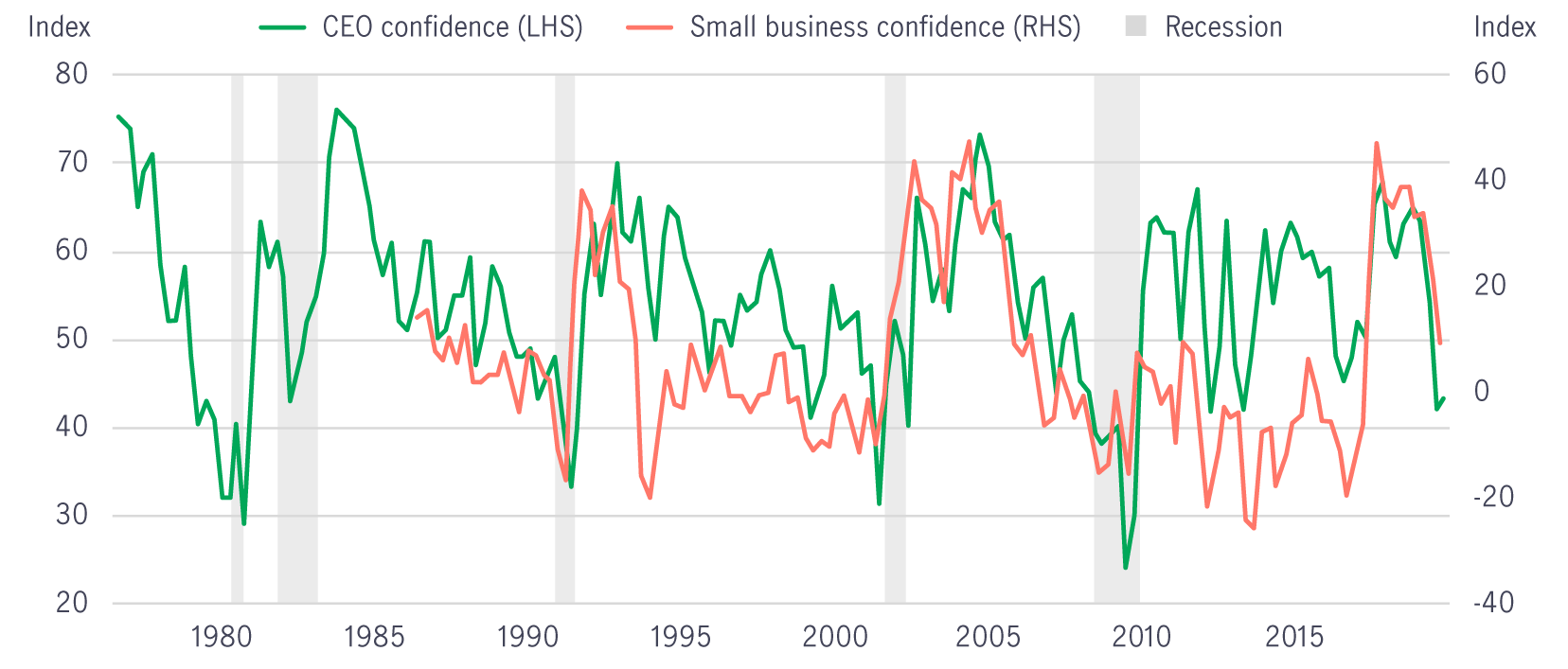

Prior to the 1 August announcement, our research had found some preliminary green shoots, suggesting that the macroeconomic environment—particularly in the areas of business confidence, business investment, global trade, and global manufacturing—might have been stabilising, with growth potentially accelerating during the latter months of the year. We now think that chances of stabilisation in these areas are at risk, and we’ll experience continued weakness in the global economy—particularly in the United States and China—for the remainder of the year.

Global Healthcare Equities Q&A

This Q&A provides an updated overview of sector performance, examines the impact of recent US healthcare policy developments, and outlines key investment strategies and themes. It also highlights the growing role of artificial intelligence (AI) in healthcare innovation and shares practical tips to help investors navigate market volatility.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

Fed’s first rate cut of 2025: Implications & takeaways

After nine months on pause, the US Federal Reserve (Fed) announced another rate cut of 25 basis points (bps) on 17 September (US time), bringing the federal funds rate into a target range of 4%-4.25%. Alex Grassino, Global Chief Economist, and Yuting Shao, Senior Global Macro Strategist, share their latest views on the rate decision and its implications for Asia.

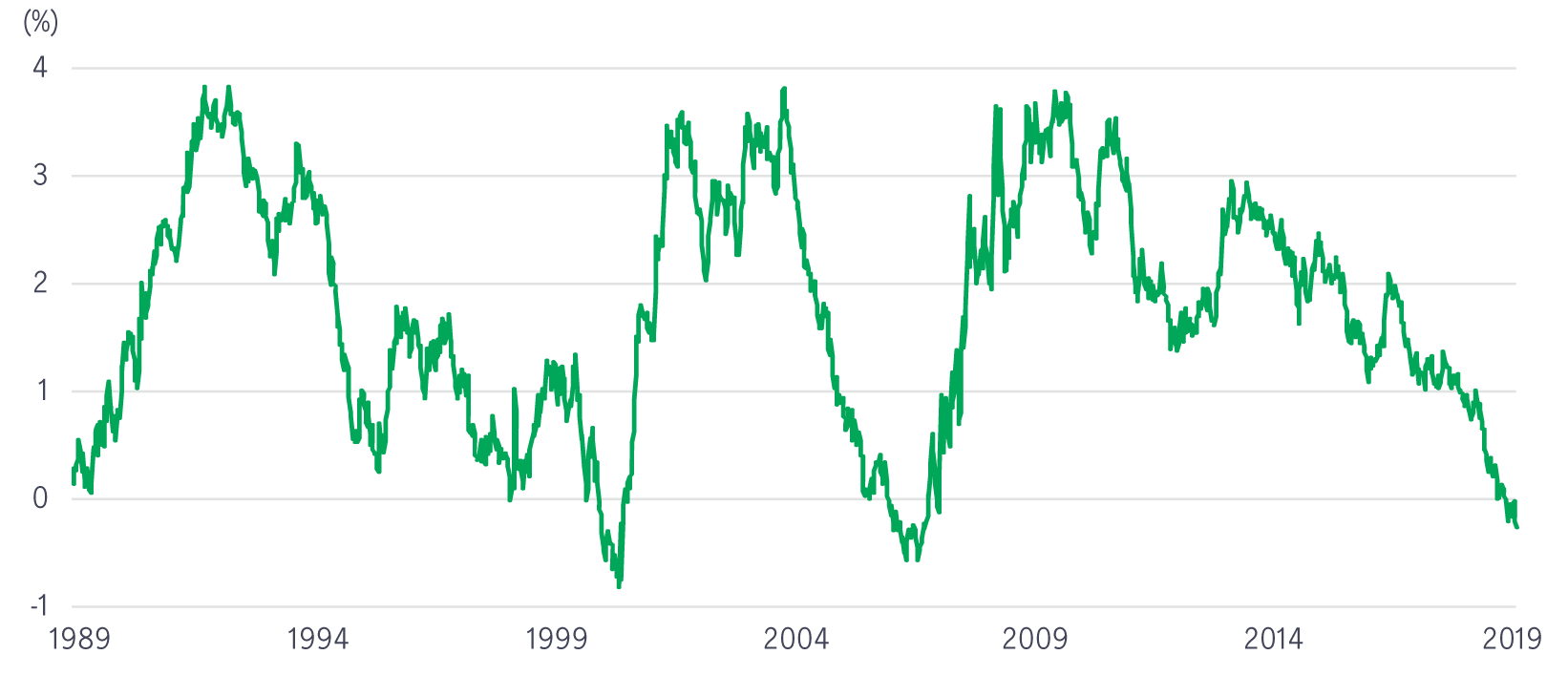

Source: Refinitiv, Manulife Investment Management, as of 29 March, 2019

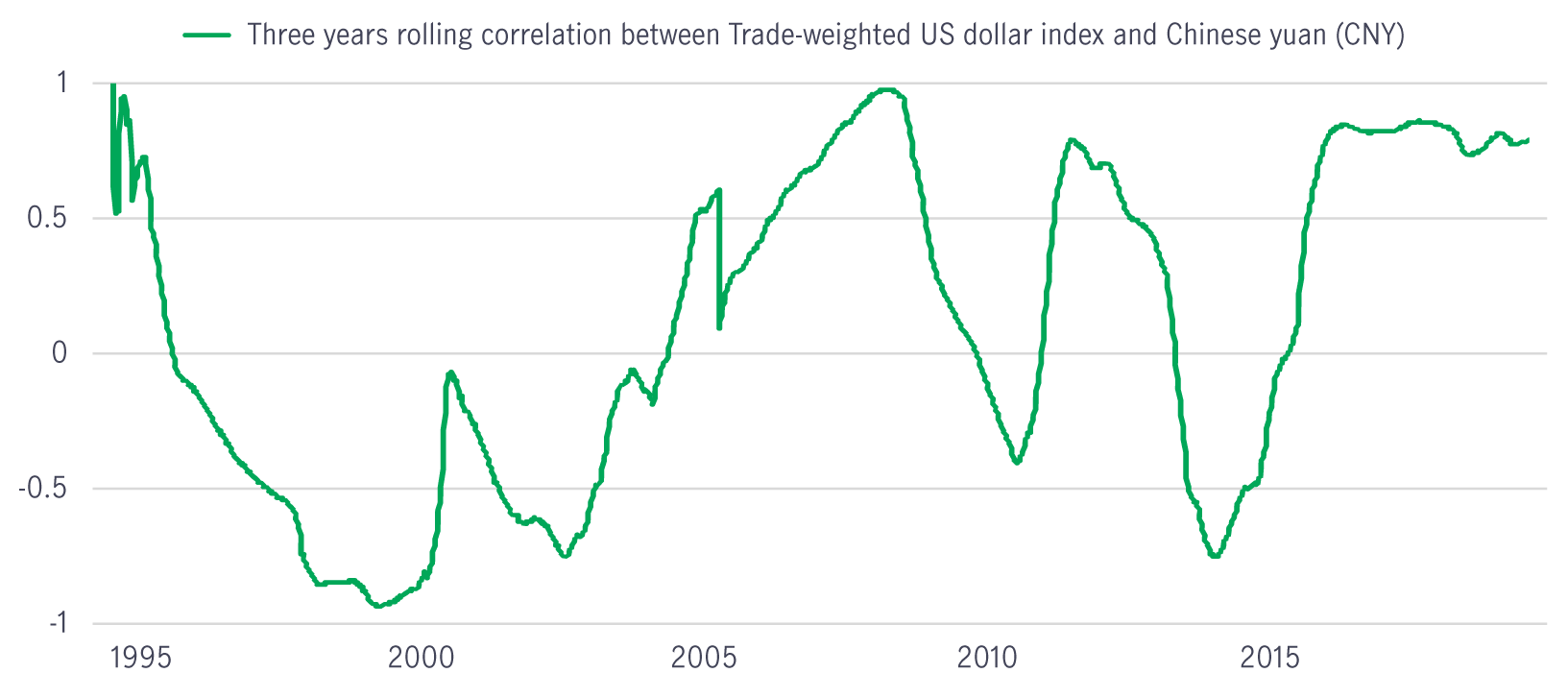

In addition to the more “traditional” economic consequences of trade tensions and tariffs, this new round comes with additional factors that, in our view, are creating nonlinear headwinds to growth.

Source: Refinitiv, Manulife Investment Management, as of 12 August, 2019

As a result of recent developments, we now expect the US Federal Reserve (Fed) to cut interest rates by 50 basis points (bps) with the potential for more further down the line, up from our original forecast of a 25bps cut followed by an extended pause. We’d also suggest monitoring for an increasing dialogue about an intra-meeting cut, though that is not our base case.

In our view, in addition to broad concerns about growth and inflation, the Fed will likely be moved to cut 50bps in order to:

To be clear, we don’t believe that a 50bps interest-rate cut will single-handedly salvage business or consumer confidence (or inflation for that matter), but it could provide some support for market sentiment and economic growth, which look particularly vulnerable at the moment.

Source: Refinitiv, Manulife Investment Management, as of 12 August, 2019.

1 “How Trump’s Tariffs on Chinese Goods Will Hit Your Shopping Cart,” New York Times, 10 May, 2019.

2 FactSet, as of July 2019.

3 Bloomberg, 8 August, 2019.