16 December 2022

Joseph Bozoyan, Portfolio Manager

US rapidly rising consumer prices in 2022 has compelled the Federal Reserve (Fed) to respond with aggressive interest rate hikes. Unsurprisingly, fixed-income asset classes, including preferred securities, have endured a challenging period. In 2023, higher rates are likely to hamper growth and possibly push the US economy into recession. However, we believe that there are various tools within the preferred securities space that we could bring to bear, along with three investment themes that could prove supportive. In our view, when the Fed pivots in its rate hikes policy, we think this would be positive for preferred securities, which have strong rebound potential. The current low level may be an attractive entry point for income seekers.

Inflation has been a major issue in the US, owing to high oil and natural gas prices, partially a result of the war in Ukraine which has hampered Russian exports of both. In addition, pent-up demand after the COVID lockdowns, coupled with supply-chain issues, have elevated the prices for many goods and services. In fact, inflation was once running at over 9%1. Expectedly, this only served to reinforce the Fed’s aggressive monetary policy stance.

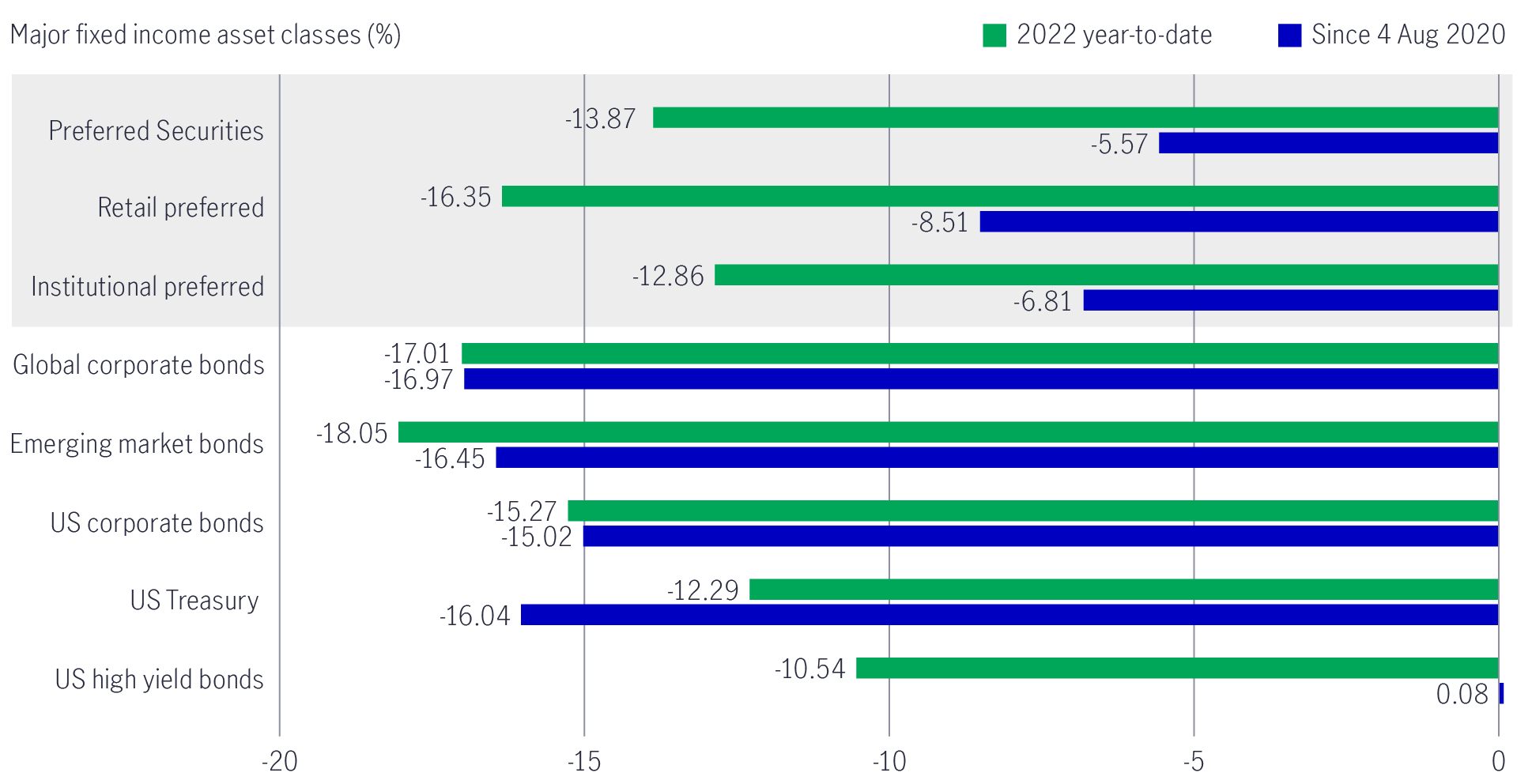

Understandably, this has made for a very difficult year for fixed income investors, with investment-grade corporate bonds down some 15% falling by almost the same degree as stocks on the S&P 500. However, from chart 1, we can see it is obvious that preferred securities (-13%) have outperformed global corporate bonds by a significant margin in the first eleven months of 2022. This can be attributed to the high-quality nature of preferreds, which – on average – is investment-grade credit quality (BBB), in addition to having a relatively low duration with less interest rate sensitivity. It is worth noting also, that this was not the only year in which the relative performance of preferreds have outshone global corporate bonds.

During the periods of elevated inflation over the past 20 years, preferred securities have outperformed other fixed-income asset classes, with the exception of US high-yield bonds, which have an average credit rating of B-, meaning investors are exposed to a lot more credit risk than preferreds.

Chart 1: 2022 year-to-date global fixed income performance (as of 30 November)2

While we can take some comfort from the past performance of preferreds relative to their peers in the broader investment universe, there are many tools that investors can rely on in their toolbox, which – when combined with active management – can help investors generate potential excess returns as we respond to the unfolding macroeconomic conditions.

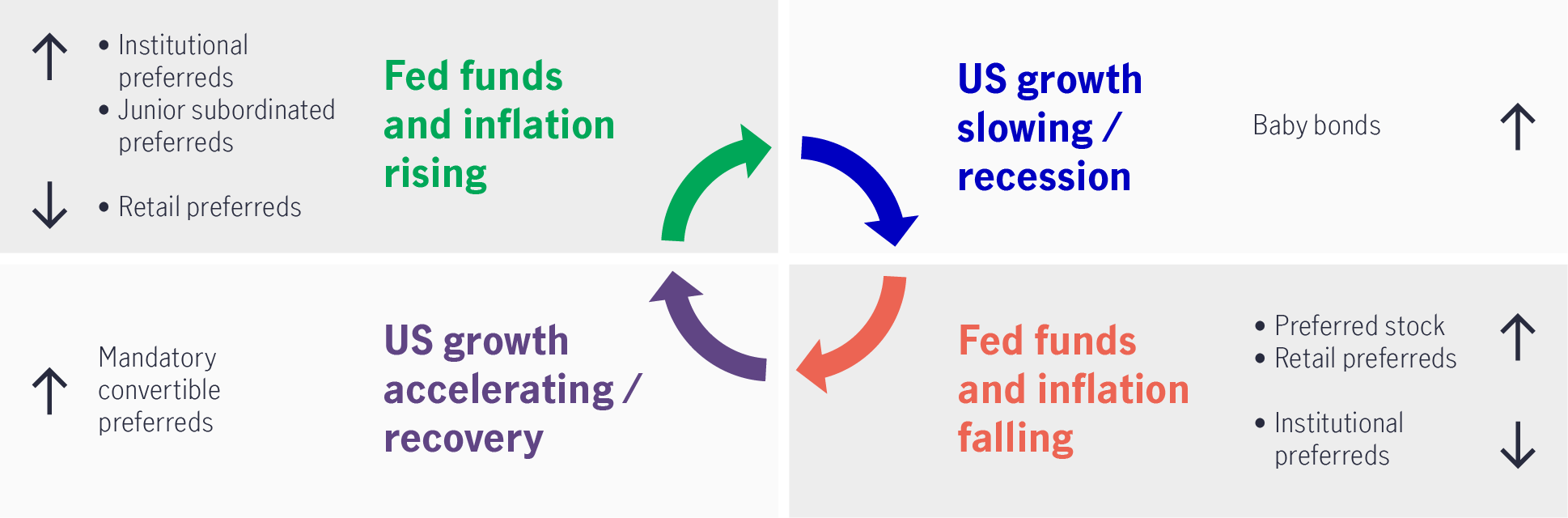

For instance, under a hawkish Fed, rising rates and an inflationary environment like the one we are facing now, we think active managers could – first – increase their position in floating-rate securities. Indeed, that’s what we have been doing over the past two years. These are older preferreds that were issued as fixed to floating rate securities and weren’t called on their initial call date and, therefore, have a floating rate coupon. Also, these are mostly institutional preferreds, in contrast to the many retail preferreds that are fixed for life. As the Fed Funds rate has risen aggressively in 2022, these coupons, which reset quarterly, have also increased significantly. This has resulted in a lot of price stability amid a very volatile and downward-trending environment.

Chart 2: Dynamic strategies responding to changing macroeconomic environment3

For illustrative purpose only.

In addition, active managers could also increase their positions in junior subordinated notes because many of them are fixed to floating-rate securities. Again, these would help protect investors against a rapid rise in rates.

In a period of slowing US growth or even a recession, we would increase exposure to baby bonds (senior debt). These are higher up in the capital structure relative to preferreds, which should provide some protection against spread-widening amid an economic slowdown.

Aside from the tools that we can lean on under adverse market conditions, we also have identified three themes that should underpin preferreds should the US head into an economic slowdown or a mild recession in 2023.

The biggest of these themes is the quality play. We know that the Fed’s goal is to bring down inflation and that they can only do this by slowing the economy. As such, we have to be careful in avoiding securities that are susceptible to spread widening. While most preferreds are issued by high quality companies, there are some low quality preferreds that we need to stay away from. Also, because of the market conditions, we would expect defaults to rise in the high-yield market. This is why we have been taking steps to raise the overall credit quality of our strategy, essentially buying quality on sale. By focusing on quality companies, default risk will not be a big worry.

Next, our second theme is continuing to overweight the utility sector. We believe that many sectors within the S&P500 will struggle in 2023, with their earnings likely to face downward pressure. In contrast, utilities will show their resilience once again, by maintaining their allowable earnings growth of between 5 to 7 percent, which we believe will outpace that of many other sectors.

Finally, our third theme is increasing in duration. We steadily decreased duration two years ago, as we were expecting interest rates to rise. If the Fed slows down and eventually pause rate hikes into 2023 – as is widely expected – this would be positive for preferreds. This is because they tend to perform well when rates are stable or declining. Now that we believe we are nearing a peak in rates, we have started thinking about increasing duration again, partially by buying more fixed-for-life securities (retail preferreds). In parallel, we would reduce our exposure in fixed to floating-rate securities (institutional preferreds).

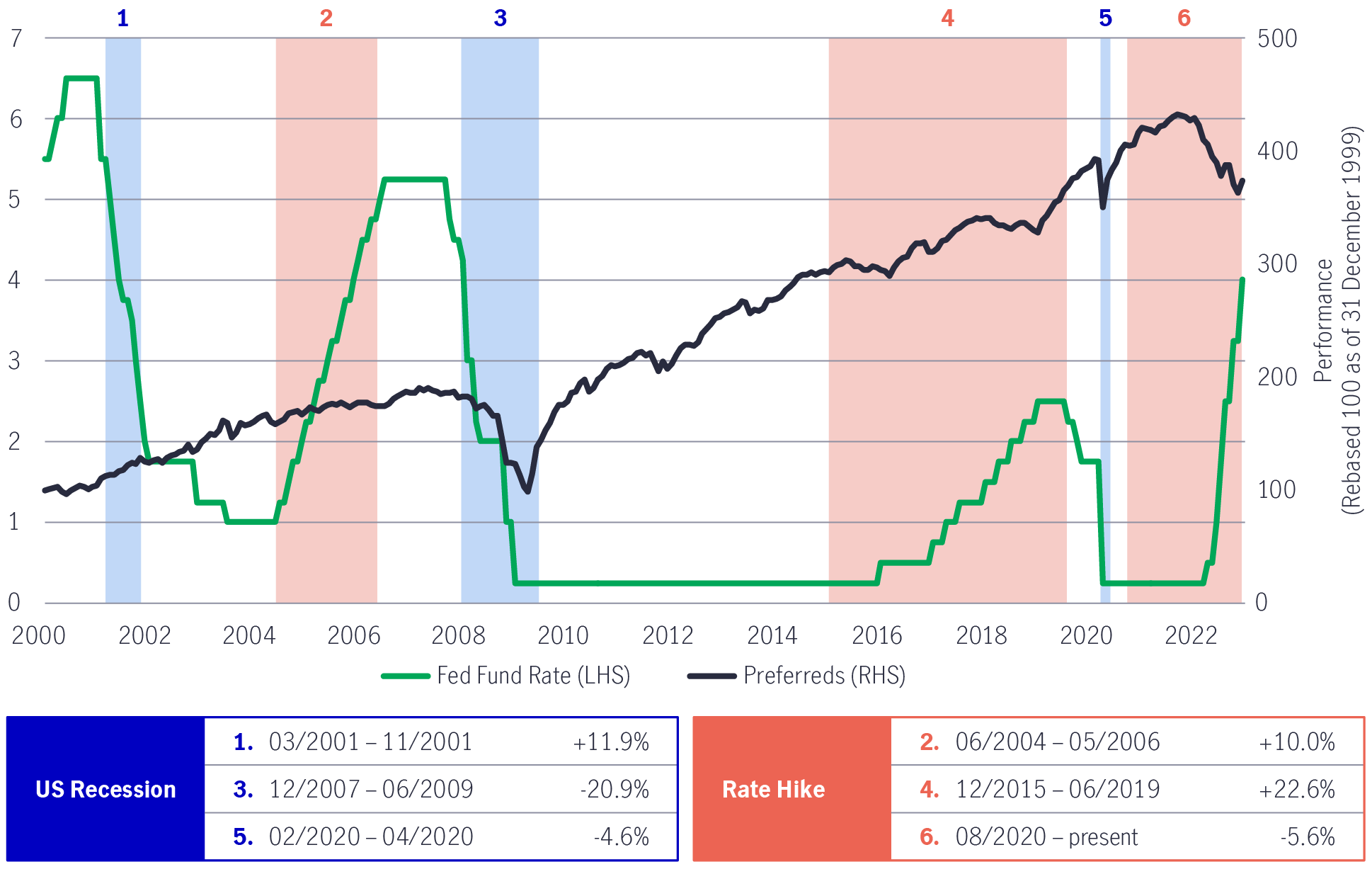

Having considered the opportunities available to us above, let us turn to the track record of preferreds during challenging periods in the past. It is worth noting that preferreds have performed fairly well during US recessionary periods, especially in 2001. We would expect them to perform much better compared to the 2008-09, particularly given that:

Chart 3: Preferreds performed fairly well in the past recessions4

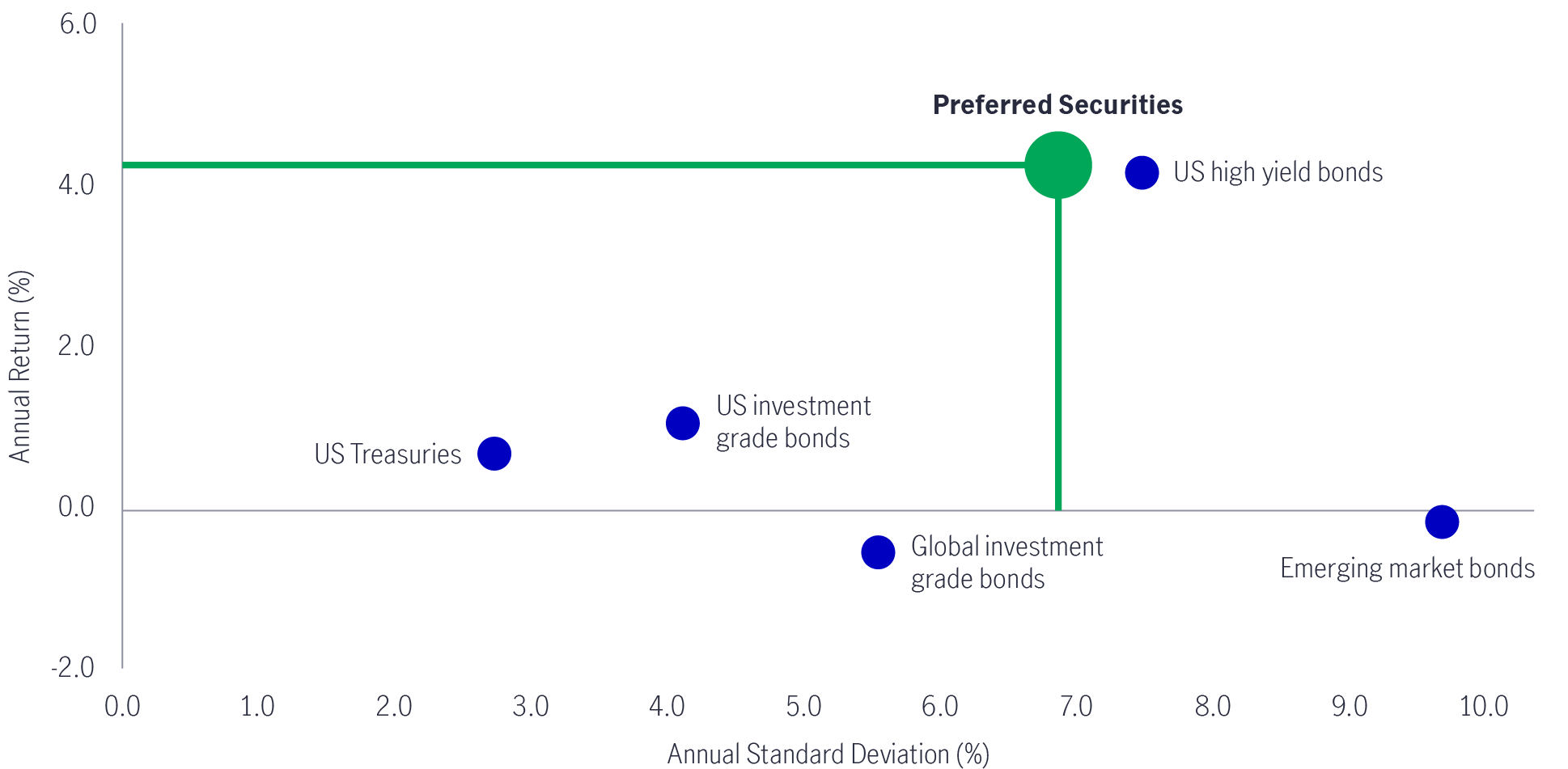

The recent volatility has provided investors with more fixed-income opportunities. Compared with other alternatives in this space, preferred is a higher-yielding, lower risk option. As illustrated in chart 4, preferred securities have the highest risk-adjusted return profile, with highest annualised return (4.27%) over the past 10 years and lower volatility/standard deviation (6.87%). US Treasuries have the lowest volatility (2.74%), but its annualised return was also low (0.69%). Additionally, rising rates have created an opportunity to buy preferreds at attractive prices. They are now trading at substantial discounts to par, levels not seen since the Global Financial Crisis in 2009. Furthermore, preferreds have risen above their 10-year highs in terms of yields5. We believe this is appealing to investors who are searching for yield.

When the Fed pivots, preferred securities are expected to see a robust rebound, potentially delivering double-digit total returns for investors. With attractive yields and a focus on high-quality names, the overweight to the defensive utility sector and greater investment flexibility, we think this approach should be able to navigate the volatile and changing market, while generating potential excess returns as US interest rates stabilise.

Chart 4: Preferred securities delivered higher risk-adjusted returns6

1 US consumer Price Index (CPI) recorded a 9.1% year-on-year increase in June 2022, the fastest pace in four decades. The latest CPI was 7.7% in October 2022. Source: The Bureau of Labor Statistics, November 2022.

2 Source: Bloomberg PORT, data as of 30 November 2022. Performance is in USD and total return. Preferred securities are represented by ICE BofA US All Cap Securities index. Retail preferreds are represented by ICE BofA Core Plus Fixed Rate Preferred Securities Index. Institutional preferreds are represented by ICE BofA US Capital Securities Index. Global Corporate Bonds represented by ICE BofA Global Corporate Bond Index. Emerging market bonds are represented by JPM EMBI Global Diversified Index. US Corporate bonds are represented by ICE BofA US Corporate Index, US treasury is represented by ICE BofA US Treasury & Agency Index. US high yield bonds are represented by ICE BofA US High Yield Index; Past performance is not indicative of future performance. It is not possible to invest directly in an index.

3 Manulife Investment Management, 30 November 2022.

4 Source: Bloomberg, National Bureau of Economic Research (NBER), as of 30 November 2022. Preferred securities market is represented by ICE BofA US Capital Securities Index (C0CS) for the performance period of 2000 to 2012 as ICE BofA US All Capital Securities Index (I0CS) has shorter history starting from April 2012; Rebased to 100 on 31 December 1999. Monthly data. US recession periods showed the latest three recession periods declared by NBER.

5 The yield to maturity for preferred securities (reference to ICE BofA US All Capital Securities Index) reached a 10-year high of 8.05% during the period 4 November 2022 to 7 November 2022 – this was above the 10-year average of 5.4%. As of 30 November 2022, the yield to maturity was 7.59%. Source: Bloomberg and Manulife Investment Management.

6 Morningstar and Manulife Investment Management, data as of 30 November 2022. Preferred securities are presented by ICE BofA US All Capital Securities Index; US investment grade bonds are represented by Bloomberg US Aggregate Bond Index; US Treasuries are represented by Bloomberg US Treasuries Index; Global investment grade bonds are represented by Bloomberg Global Aggregate Bond Index; US high yield bonds are represented by ICE BofA US High Yield Index ; Emerging market bonds are represented by JPM EMBI Global Diversified Index. The above information is for illustrative purpose only and do not constitute any investment recommendation or advice. Past performance is not indicative of future returns. It is not possible to invest directly in an index.

Semiconductors poised for long-term growth amid AI boom

The global semiconductor industry remains strong – arguably the most robust we have seen in over three decades. This strength is supported by cutting-edge innovation, rising revenues and robust capital spending. While risks remain, the outlook for 2026 appears constructive, with demand for artificial intelligence (AI) applications showing few signs of slowing. Beyond AI, the non-AI markets could be poised for positive revisions as cyclical recovery gains traction after several years of consolidation.

2026 Outlook: Clearer picture, better growth

This year’s outlook spotlights a world in flux – U.S. stimulus, Europe’s rebound, China’s policy pivots, and Japan’s innovation surge all shape a landscape full of both opportunities and challenges.

2026 Asian Fixed Income Outlook: Positive momentum poised to continue amid ample investment opportunities

Asian fixed income posted strong gains in 2025 amid myriad challenges. Entering the new year, the asset class is poised for continued momentum on the back of numerous beneficial tailwinds. In this 2026 Outlook, the Asian Fixed Income team analyses the key factors likely to propel performance and identifies opportunities for investors based on key themes and developments in three regional bond markets: China, Japan, and India.