26 May 2022

Mark Canizares, Head of Equities, Philippines

In anticipation of the forthcoming transition to the new administration, Philippine market investors are watching the unfolding of the composition of the cabinet members and top economic officials that will drive new economic priorities. This important step will influence the short-term direction of the market given its implication on the country’s growth trajectory for the next six years. Volatility is likely to persist as investors await the appointment of the new slate of leaders who will steer the economy toward a sustainable recovery.

In two out of the last three presidential elections, equity markets rallied from the date of elections until the end of the year. The market rallied during the election years of Gloria Macapagal Arroyo and Benigno Aquino Jr. by 17% and 33%, respectively. Meanwhile the market was down 2% for the same relative period when President Rodrigo Duterte won the elections in 2016. This year, the Philippine equity market has weakened by 1.51% since May 9, 2022 despite higher than expected gross domestic product (GDP) growth for the first quarter.1 The decline in the market was driven by a mix of uncertainty over the economic policies to be presented by the incoming administration, rising inflation, and global economic slowdown. 2

Appointments of cabinet members and top economic officials, specifically for the following positions are crucial for the first 100 days of the incoming administration:

The appointees to these agencies will shape the direction of economic policies in the next six years. Moreover, given the country’s pandemic exit, these key policy makers can boost confidence that the country’s recovery will continue while ensuring that the country’s fiscal position will remain sound. Investors and the private sector currently favor a combination of professionals and technocrats for cabinet ministers and advisers. 3

As early as May 2016, President Rodrigo Duterte had indicated his choice of cabinet members in key areas, including the Department of Finance, Budget, Education, Justice, Tourism, Economic Development and Foreign Affairs.4 This shored up investors’ confidence despite concerns that he had no prior experience in national government. Looking at the market movement during that period, the Philippine Index was up around 14% 3 months after the May 9, 2016 elections.5

The Philippine economy grew 8.3% year-on-year in the first quarter of 2022, signaling that the country is starting to recover from the crippling impact of the COVID-19 pandemic. However, the country’s economic recovery remains fragile given that consumer spending is also at risk of slowing down following a sustained uptick in prices. Inflation reached 4.9% as of April, driven by a confluence of higher global commodity prices and supply chain issues abroad, vis a vis a recovery in domestic demand.

The country’s debt to GDP rose to 63.5% in the first quarter of 2022 from 42% in 2019. Meanwhile, the budget deficit in 2021 was 8.6% of GDP, significantly higher than the 3.6% level in 2019. Government spending ballooned in support of the COVID-19-related amelioration and vaccination programs to help cushion the impact of the pandemic and contain its spread.6

Higher rates are also on the horizon as affirmed by the forward guidance of the BSP. The BSP increased its main policy rate and deposit facility rate by 25 basis points this month to rein in upward inflation pressures as economic recovery gathers strength. It expects GDP expansion to quicken to 7%-9% this year along with inflation, which the BSP forecast to reach 4.6%.

Given this backdrop, key to building the market’s confidence in the incoming administration would be clarity on its economic platform that will support solid recovery from the pandemic. During his campaign7, Marcos focused on the following key areas:

Key to the success of these programs is the passage of revenue enhancing measures that can expand the contribution of fiscal spending to economic growth. This will allay fears of a blowup in the country’s fiscal balances and a runaway increase in debt levels which hounded the later years of the first Marcos presidency.

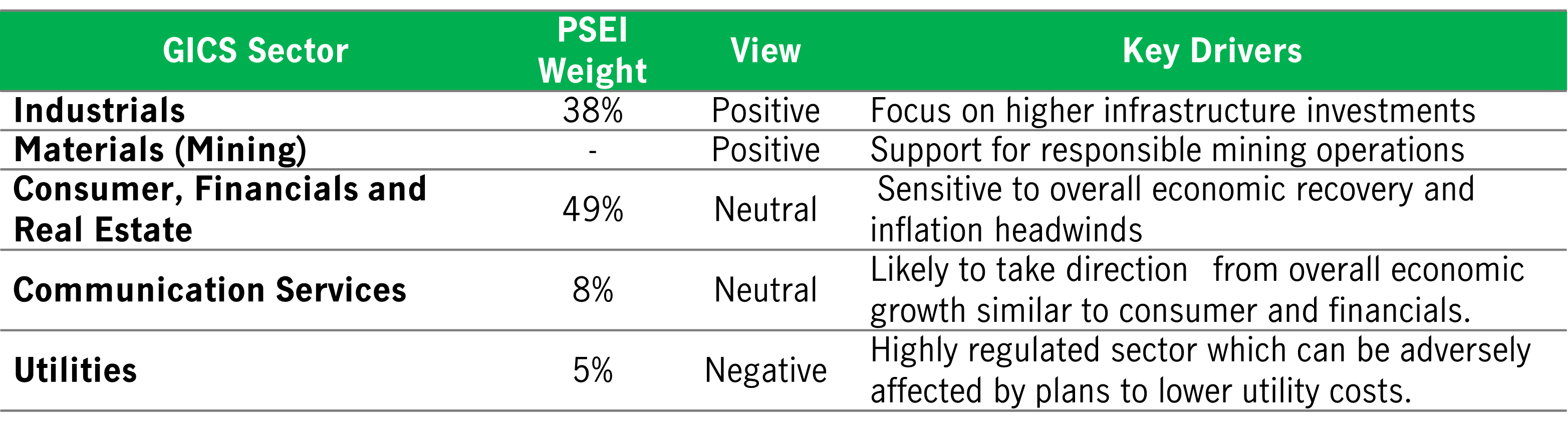

Infrastructure-related sectors are likely to benefit from the priorities of the incoming administration. We expect a continuation of the decentralization of infrastructure investments in the country as Marcos is from Luzon and Duterte is from Mindanao. Note that under the current administration, Mindanao became a major recipient of infrastructure projects, helping rebalance investments that mostly went to Luzon in prior years.8

Mining is another sector that could be in focus. Marcos has previously said that he wants better laws and regulations on mining for the industry to contribute more to the economy. 9

Table 1 Sector Views

Disclaimer

A widespread health crisis such as a global pandemic could cause substantial market volatility, exchange-trading suspensions and closures, and affect portfolio performance. For example, the novel coronavirus disease (COVID-19) has resulted in significant disruptions to global business activity. The impact of a health crisis and other epidemics and pandemics that may arise in the future, could affect the global economy in ways that cannot necessarily be foreseen at the present time. A health crisis may exacerbate other pre-existing political, social and economic risks. Any such impact could adversely affect a portfolio’s performance, resulting in possible losses to one’s investment.

Investing involves risks, including the potential loss of principal. Financial markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. These risks are magnified for investments made in emerging markets. Currency risk is the risk that fluctuations in exchange rates may adversely affect the value of a portfolio’s investments.

The information and/or analysis contained herein have not been reviewed by, are not registered with any securities or other regulatory authority and have been compiled or arrived at from sources believed to be reliable but Manulife Investment Management does not make any representation as to their accuracy, correctness, usefulness or completeness and does not accept liability for any loss arising from the use hereof or the information and/or analysis contained herein. The information herein may contain projections or other forward-looking statements regarding future events, targets, management discipline, or other expectations, and is only current as of the date indicated. Statements concerning financial market trends, are based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Manulife Investment Management disclaims any responsibility to update such information.

Neither Manulife Investment Management nor its affiliates, nor any of their directors, officers or employees shall assume any liability or responsibility for any direct or indirect loss or damage or any other consequence of any person acting or not acting in reliance on the information contained herein. The information and contents herein were prepared solely for informational purposes and do not constitute a recommendation, professional advice, an offer, solicitation or an invitation by or on behalf of Manulife Investment Management to any person to buy or sell any security or adopt any investment strategy, and are no indication of trading intent in any fund or account managed by Manulife Investment Management. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Diversification or asset allocation does not guarantee a profit or protect against the risk of loss in any market. Unless otherwise specified, all data is sourced from Manulife Investment Management. Past performance does not guarantee future results. Nothing herein constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to one’s individual circumstances, or otherwise constitutes a personal recommendation to a prospective investor. Past performance is not an indication of future results.

The information provided herein does not take into account the suitability, investment objectives, financial situation, or particular needs of any specific person. A prospective investor should consider the suitability of any type of investment for his/her circumstances and, if necessary, seek professional advice.

Manulife Investment Management

1 Nikkei Asia. “Philippine GDP grows 8.3% in Q1 ahead of Marcos inauguration” 12 May 2022 Nikkei Asia; PSEi data as of May 26, 2022 from Bloomberg.

2 Philippine Star. “Philippine Stocks open lower elections jitters” 10 May 2022 Philstar, Time. “Marcos Philippine Economy”. 13 May 2022 Time

3 Reuters. “What Will Marcos Presidency Look Like” 10 May 2022 Reuters

4 CNN Philippines “President Elect Duterte to Present Cabinet” 31 May 2016 President-elect Duterte to present Cabinet

5 Manila Times. “PSEI bounces back on Duterte economic plan”. 14 May 2016 Manila Times

6 Inquirer “PH Ends 2021 with record high” 1 March 2022 Deficit and Bureau of Treasury “National Government Expenditures Beat Target in 2019” 26 February 2020 Link, Inquirer “Philippine Debt now 63.5% of GDP” 12 May 2022 Debt, PSA “Summary Inflation Report” 5 May 2022 Inflation

7 Business Mirror. “BBM Seen completing Duterte’s government reforms” 10 May 2022 Business Mirror.

GMA Network. “Bongbong Sara to push for Nuclear Energy Adoption” 9 March 2022 GMA Network.

Business Mirror. “BBM Sees lower power rates with RE…” 15 March 2022 Business Mirror.

8 Philippine News Agency. “Mindanao major recipient of Build Build Build projects” 16 September 2020 PNA

9 Philippine Senate. “Next Admin must have a vision to realize potential of the country’s mining industry” 18 September 2015 Philippine Senate

Global Healthcare Equities Q&A

This Q&A provides an updated overview of sector performance, examines the impact of recent US healthcare policy developments, and outlines key investment strategies and themes. It also highlights the growing role of artificial intelligence (AI) in healthcare innovation and shares practical tips to help investors navigate market volatility.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

Fed’s first rate cut of 2025: Implications & takeaways

After nine months on pause, the US Federal Reserve (Fed) announced another rate cut of 25 basis points (bps) on 17 September (US time), bringing the federal funds rate into a target range of 4%-4.25%. Alex Grassino, Global Chief Economist, and Yuting Shao, Senior Global Macro Strategist, share their latest views on the rate decision and its implications for Asia.