17 May 2023

The search for higher investment income has never been more dire than in recent years. Inflation is eroding people’s purchasing power, investment returns and dividends. Meanwhile, bank deposit rates have not risen high enough to outpace the inflation rate, resulting in a low to negative real interest rate environment.

Parking your cash savings in a bank deposit may simply not be enough in today’s investment environment. (See “Cash is king?”)

We discuss why having higher income is critical in current times and explain how to increase your income with these options.

While bank deposit (cash) rates may not be high enough to beat inflation, these investment options might help raise the income of your portfolio:

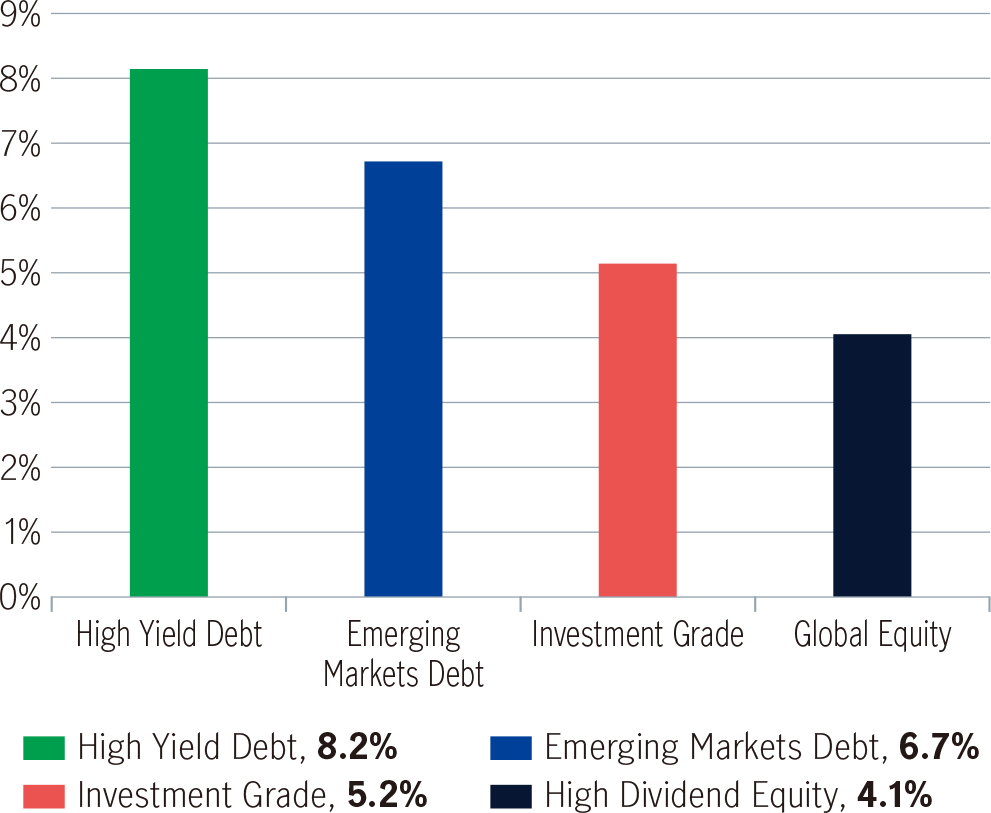

Traditional income sources include:

Effective yields of traditional income sources2

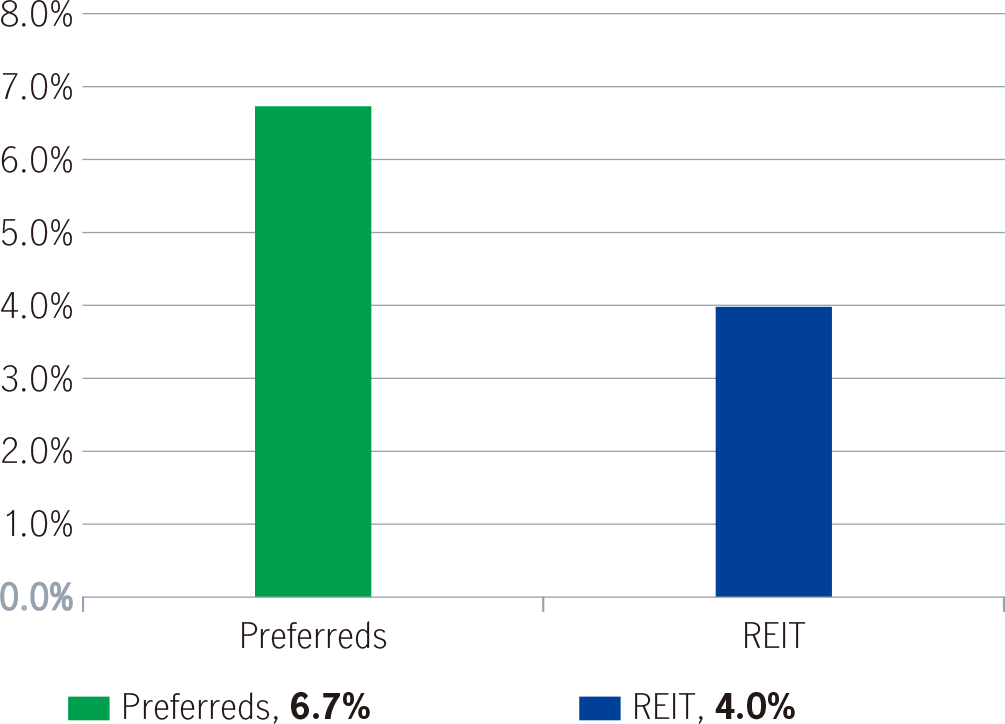

Non-traditional income sources include:

Effective yields of non-traditional income sources2

Nowadays there are non-traditional income sources that can provide dual functions of both downside protection and higher income.

Have you heard of option strategies? Selling options (also known as option writing) is an investment strategy that can meet these two objectives. It includes using options (the right to buy or sell an asset) to help enhance a portfolio’s yield. Not only can you earn dividends from the underlying asset but you can also receive premium payments from the options as income.3 They can even lower downside risk too!

While option strategies are not without risk, the premiums collected can provide a buffer of protection against return drawdowns. In many ways, options have risk and income profiles akin to high-yield bonds while providing diversification benefits away from traditional income assets and reducing overall portfolio volatility. For experienced investment managers, they can have multiple combinations of both call and put option strategies at the same time.

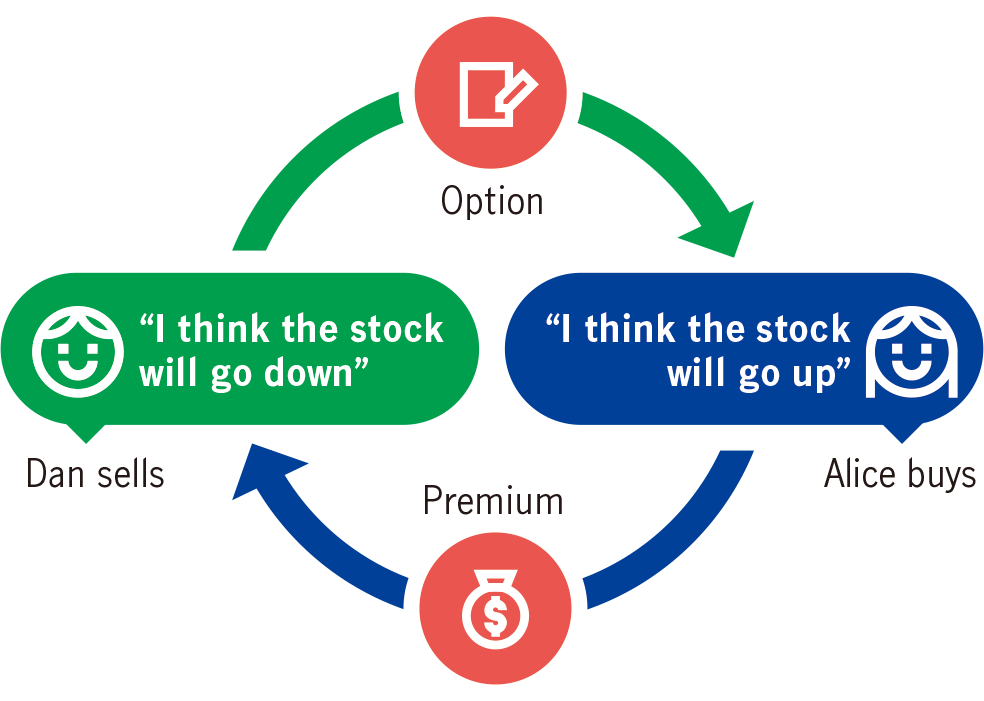

Seller’s bearish stock view

Dan thinks the price of stock A (currently $8) will go down. He sells the “right to buy” stock A at $10 (call options) because he expects stock A will drop in the future. Alice thinks the opposite (stock A will rise to $15) so she buys the call options from Dan.

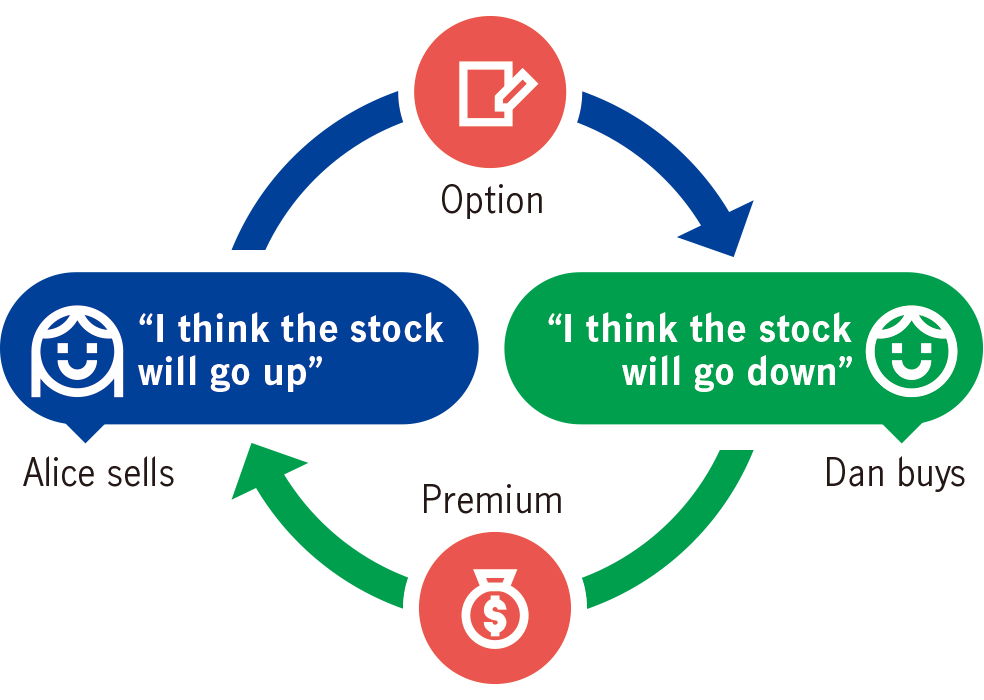

Seller’s bullish stock view

Alice thinks the price of stock B (currently $10) will go up. She sells the “right to sell” stock B at $12 (put options) because she expects stock B will rise higher in the future. Dan thinks the opposite (stock B will decline to $8) so he buys the put options from Alice.

For illustrative purposes only.

In current times, stay invested in assets that can deliver higher income. Simply leaving your cash to earn bank deposit rates may not be enough. Inflation continues to persistently erode your purchasing power and may even devalue your retirement savings. Be proactive in exploring options to boost your income before it’s too late!

1 Manulife Investment Management, Multi-Assets: Opportunities await as global rates take new turns, 17 January 2023.

2 Source: ICE Data Indices, LLC, Bloomberg as of April 28, 2023. Effective yield adjusts for call options as if exercised. High Yield Debt represented by ICE BofA US High Yield Index, Emerging Markets Debt represented by ICE BofA Emerging Markets Corporate Plus Index, Investment grade represented by ICE BofA US Corporate Index, Preferred Securities represented by ICE BofAML US All Capital Securities Index, High Dividend Equity represented by MSCI ACWI High Dividend Yield Index as of 31 March, 2023, REIT represented by MSCI ACWI REITs as of 31 March, 2023.

3 The two commonly used strategies are “covered call” or “put writing”: By selling (writing) a “covered call”, you receive the call option premium while holding the stock at the same time. If the share price declines, the chances are that the call option won’t be exercised. You get to keep the stock you’re holding and the option premium as well. When writing a put, if the stock price rises, the chances are that the put option won’t be exercised. You get to keep option premium and cash you’re holding as well.

Risk Diversification

There is no free lunch. But Risk Diversification comes close in investing. A diversified portfolio was shown to optimize returns with lower volatility in the long run.

Disadvantages of fixed deposit: is fixed income a better option?

What is a Fixed Deposit? What is Fixed Income? We explain why is fixed income now a potentially better option than fixed deposits.

Seven questions about dividends

Dividends can be a significant source of returns for equity investors. What are dividends? How do dividends fit into portfolio construction?