11 May 2022

With contributions from the Asian Fixed Income, China Fixed Income, Singapore Fixed Income, Taiwan Fixed Income, and Malaysia Fixed Income Teams. Additional inputs from the India, Malaysia, Indonesian Investment Specialist Team and Philippine Equity Teams.

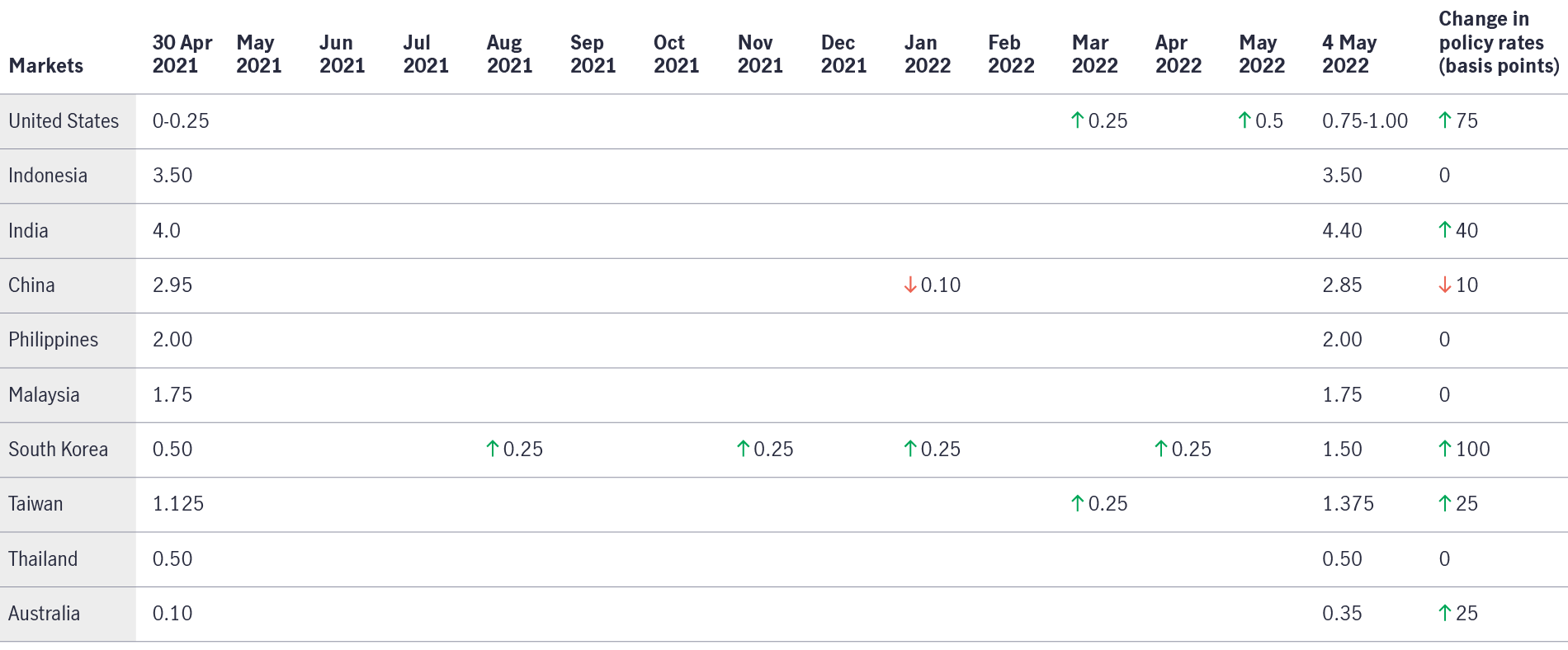

Global central banks started to hike interest rates in 2021, with the US Federal Reserve (Fed) following suit this year. Meanwhile, rate rises across Asia have been more gradual, mainly due to a relatively benign inflationary outlook. In this Investment Note, we draw insights from our pan-Asia fixed income and equity teams, who examine the impact of US-dollar strength and what this means for currencies in the region.

The region’s currencies – a granular outlook

Conclusion

US-dollar strength, a hawkish Fed, and slowing growth in China should continue to place pressure on Asian currencies through the summer months. Even though the region’s central banks are expected to normalise monetary policy, this will be at a slower rate than developed markets. More positively, the outlook for the second half of the year is relatively upbeat.

1 The Bank of Korea has already increased its policy rate by 75 basis points (bps) so far this year, while on 3 May, the RBA hiked the official cash rate by 25 bps to 0.35%, from a record low 0.10%, with the central bank signalling the likelihood of more increases in the coming months. Australian consumer prices rose 5.1% on year in the first quarter, with core inflation rising 3.7%.

2 In the last six months, MAS moved to raise the slope of the band twice amid rising inflation, including an off cycle move in January 2022.

3 Note that in terms of consensus estimates, current account deficit is estimated to remain elevated in 2022 to 2023. Meanwhile consensus estimates point towards a depreciating PHP until 2024.

Global Healthcare Equities Q&A

This Q&A provides an updated overview of sector performance, examines the impact of recent US healthcare policy developments, and outlines key investment strategies and themes. It also highlights the growing role of artificial intelligence (AI) in healthcare innovation and shares practical tips to help investors navigate market volatility.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

Fed’s first rate cut of 2025: Implications & takeaways

After nine months on pause, the US Federal Reserve (Fed) announced another rate cut of 25 basis points (bps) on 17 September (US time), bringing the federal funds rate into a target range of 4%-4.25%. Alex Grassino, Global Chief Economist, and Yuting Shao, Senior Global Macro Strategist, share their latest views on the rate decision and its implications for Asia.