Macroeconomic Strategy Team

10 January 2023

As we consider the year ahead, we expect to see a game of two halves, where challenging conditions will prevail in the first half before improving through the second half. The aggressive pace of monetary tightening and its associated lagged effects should drive a synchronised global growth downturn in the first half.

We expect global growth to slow materially and come in substantially lower than the below 3% threshold that the International Monetary Fund uses to define global recessions. A downturn of this magnitude—excluding the COVID-19 shock and the global financial crisis—could make 2023 the worst year for global growth since the 1980s. We expect the economic slump to become more apparent in the first half of the year, with a cyclical bottom only occurring in Q2/Q3.

Our analysis shows that most advanced economies are likely to experience a recession in the year ahead. Given that the U.S. Federal Reserve (Fed) has been hiking rates at the fastest pace in decades, the U.S. economy will be facing the lingering effects of substantial policy tightening, with real rates rising while inflation eases gradually.

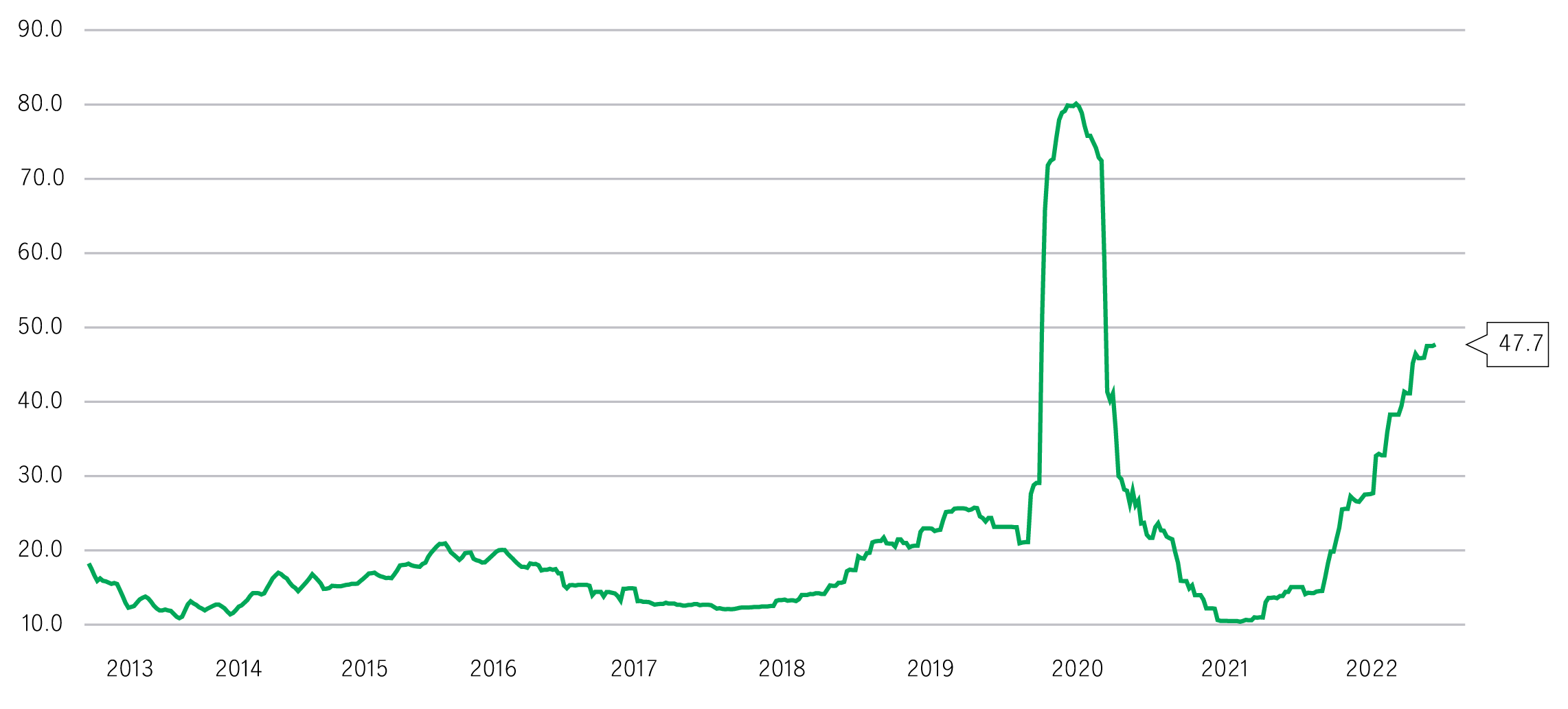

Market’s view on the probability of a global recession (%)

Source: Bloomberg, Macrobond, Manulife Investment Management, as of 13 December, 2022.

Economic weakness will be particularly pronounced in interest-rate-sensitive economies such as Canada, Australia, New Zealand, and the United Kingdom—these economies would almost certainly be confronting downside risks as a result of spillovers from their respective weaker housing markets. In Continental Europe, the growth drag will predominantly stem from particularly large negative terms-of-trade shocks.

Meanwhile, slowing final demand from advanced economies, elevated inflation, and a still-strong U.S. dollar (USD) will likely morph into material headwinds for growth in emerging markets (EM). In mainland China, a bumpy exit from zero-COVID policy, weak external demand, a still struggling property sector, and insufficient policy support look set to extend the country’s below-trend GDP into 2024. That said, the prospects for the rest of Asia’s economies are a little more mixed: We expect weak foreign demand to weigh on export growth, but North Asia is particularly vulnerable in light of a likely inventory overhang. On the other hand, weakness in ASEAN countries will likely be cushioned by a strong reopening bounce and relatively healthy household balance sheets.

Amid a macro backdrop characterized by elevated global inflation, uncertainty over when Fed rates might peak, and rising odds of a global recession, the first half of 2023 could bear witness to a series of sharper—and longer—bouts of market volatility. Thankfully, the picture does brighten slightly in the second half, during which these headwinds are likely to moderate, ushering in more conducive conditions for financial markets.

Semiconductors poised for long-term growth amid AI boom

The global semiconductor industry remains strong – arguably the most robust we have seen in over three decades. This strength is supported by cutting-edge innovation, rising revenues and robust capital spending. While risks remain, the outlook for 2026 appears constructive, with demand for artificial intelligence (AI) applications showing few signs of slowing. Beyond AI, the non-AI markets could be poised for positive revisions as cyclical recovery gains traction after several years of consolidation.

2026 Outlook: Clearer picture, better growth

This year’s outlook spotlights a world in flux – U.S. stimulus, Europe’s rebound, China’s policy pivots, and Japan’s innovation surge all shape a landscape full of both opportunities and challenges.

2026 Asian Fixed Income Outlook: Positive momentum poised to continue amid ample investment opportunities

Asian fixed income posted strong gains in 2025 amid myriad challenges. Entering the new year, the asset class is poised for continued momentum on the back of numerous beneficial tailwinds. In this 2026 Outlook, the Asian Fixed Income team analyses the key factors likely to propel performance and identifies opportunities for investors based on key themes and developments in three regional bond markets: China, Japan, and India.