We introduced our three-phase recovery framework last July, outlining key pillars of the recovery—a road map to help navigate a complicated economic rebound. In our view, 2021 will be the year we transition out of phase two and move into phase three: the new normal. We expect global economies to make this transition at different times, with Asia and other manufacturing-based economies exiting the recessionary environments earlier in the year, before their Western peers and other services-based economies. The transition, however, will likely be bumpy, marked by challenges for global central banks and policy makers due to the structural scarring created by the COVID-19 recession.

Phase 1 : the rapid rebound

(April to ~ September 2020)

Phase 2 : the stallout

(September 2020 to year-end 2021)

Phase 3 : the new normal

(From 2022)

In developed markets, we expect much of the first half of 2021 to be very challenging—the winter months in particular could be uncomfortable, with fiscal spending acting as a critical stopgap until normalisation can begin. While our base-case scenario doesn’t include a double-dip recession, we believe this period will be defined by soft economic data and we could even witness recession-like characteristics in some areas. However, we expect this period of weakness to be short-lived as the distribution effort for the various COVID-19 vaccines ramps up. In our view, a gradual return to a businessas-usual environment will create a very favourable outlook for the second half of the year.

First quarter

Second quarter

Third quarter

Fourth quarter

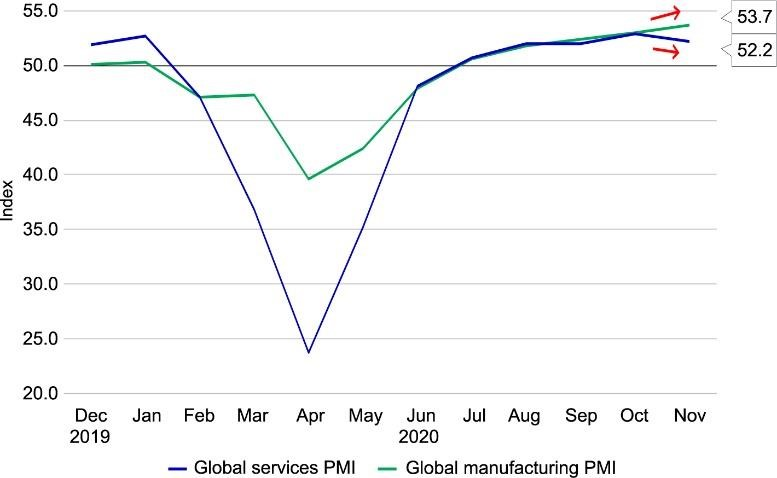

We expect the K-shaped nature of the recovery to become more accentuated in 2021 as global manufacturing sectors roar back to pre-COVID-19 levels early in the year while global services and hiring activities struggle to recoup 2020’s losses even after taking into account likely growth in the next 12 months. This divergence will likely add to the disconnect between global equity markets—typically biased toward manufacturing and tech sectors—and the global economy. It also suggests that stock markets with a bigger manufacturing component (emerging markets) could see higher returns. Crucially, a K-shaped recovery could aggravate global income inequalities.

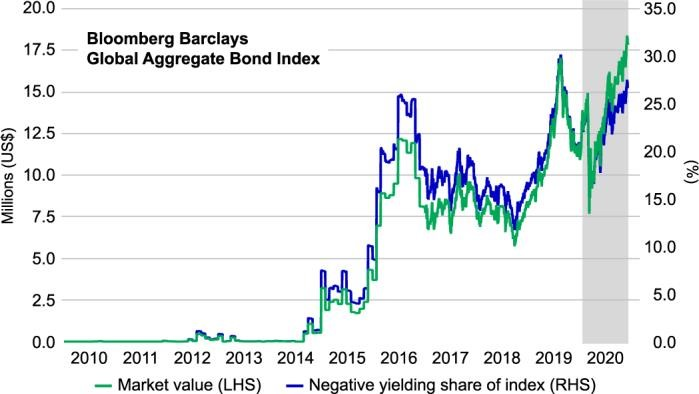

A growing divergence: global manufacturing and services Purchasing Managers’ Index (PMI)1

While the first half of 2021 will likely be focused on downside risks and growth challenges, we’re confident that the global economy will continue to be supported in important ways: extraordinary accommodation from central banks and rising fiscal spending from national governments. These policies carry two important implications for investors in the year ahead: First, the search for yield narrative will continue to dominate, sending investors further out on the risk spectrum and deeper into alternative asset classes; second, as fiscal spending rises, so will government issuance (particularly at the long end of the curve), potentially driving up long-term rates, steepening the yield curve.

Our base-case expectations for 2021 contain no surprises—we think it’s almost predictable given the context within which we’re working, knowing what we know, even though we’re still facing an incredible level of uncertainty. However, in light of the sizable policy responses to COVID-19, and the economic transformations and acceleration of macro trends in the months since the health crisis, we’ve identified some nascent themes that bare monitoring in 2021. To be clear, these themes aren’t likely to be primary growth drivers in 2021, but they will, in our view, become increasingly relevant to investors.

Themes to monitor3 :

1. Monetary policy and fiscal policy convergence, and the gradual rise in popularity of the modern monetary theory

2. An increased mainstream focus on cryptocurrencies as a reaction to massive central banking easing and the growing size of government

3. A shift in central bank focus toward broader social issues, including income and racial inequalities, climate change, and housing affordability

4. The continued rise of sustainable investing through the lens and the incorporation of green government spending

1. Source: Macrobond, Manulife Investment Management, as of 21 December 2020.

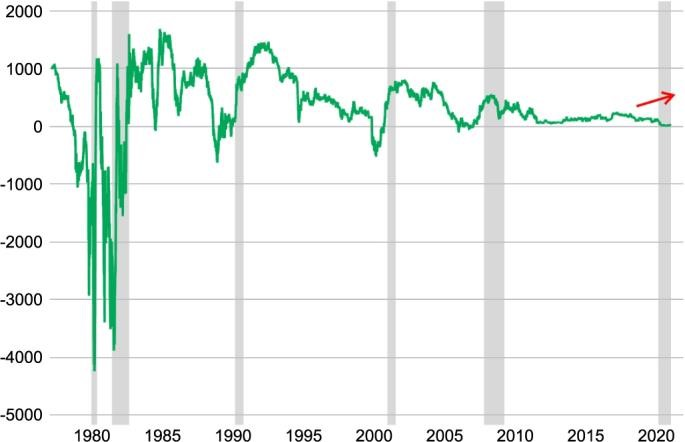

2. Macrobond, Manulife Investment Management, as of 11 December 2020. The gray areas represent recession.

3. Source: Chicago Board Options exchange, Manulife Investment Management, as of 28 September 2020.

Semiconductors poised for long-term growth amid AI boom

The global semiconductor industry remains strong – arguably the most robust we have seen in over three decades. This strength is supported by cutting-edge innovation, rising revenues and robust capital spending. While risks remain, the outlook for 2026 appears constructive, with demand for artificial intelligence (AI) applications showing few signs of slowing. Beyond AI, the non-AI markets could be poised for positive revisions as cyclical recovery gains traction after several years of consolidation.

2026 Outlook: Clearer picture, better growth

This year’s outlook spotlights a world in flux – U.S. stimulus, Europe’s rebound, China’s policy pivots, and Japan’s innovation surge all shape a landscape full of both opportunities and challenges.

2026 Asian Fixed Income Outlook: Positive momentum poised to continue amid ample investment opportunities

Asian fixed income posted strong gains in 2025 amid myriad challenges. Entering the new year, the asset class is poised for continued momentum on the back of numerous beneficial tailwinds. In this 2026 Outlook, the Asian Fixed Income team analyses the key factors likely to propel performance and identifies opportunities for investors based on key themes and developments in three regional bond markets: China, Japan, and India.