23 February, 2022

Steven Slaughter, Lead Portfolio Manager

Global equities performed well in 2021, as the economic recovery pushed forward. The development of COVID-19 diagnostics, therapeutics, and vaccines by the world’s top healthcare companies aided the gradual restoration of normal business conditions, prompting an acceleration in economic growth and corporate earnings. In this 2022 outlook, Steven Slaughter, Lead Portfolio Manager, discusses his team’s recent findings regarding the COVID-19 pandemic and outlines why the healthcare sector’s underlying fundamentals warrant a long-term allocation.

In a year filled with uncertainty and aspirations for economic normalisation, global equity markets climbed higher, building on the recovery we saw in the second half of 2020. Global healthcare equities kept pace in this environment, turning in solid absolute returns. The rollout of COVID-19 vaccines and diagnostics and progress on effective therapeutics enabled a gradual lifting of restrictions in many regions. Coupled with supportive fiscal and monetary policies, this fuelled a surge in corporate earnings and economic growth.

However, the path to economic normalisation remains fluid as the emergence of the Omicron variant has triggered renewed volatility and concerns that the recovery could be derailed. Scientists, healthcare executives, and government organisations worldwide continue to devote significant time and resources with an objective of transitioning the current pandemic to a more manageable seasonal endemic disease. The development of timely booster shots that may protect against emerging variants, coupled with the broad availability of diagnostics, will be key tools as we move forward. That said, we cannot simply vaccinate and test our way out of this pandemic. Ultimately, we will likely need effective antiviral treatments for the shift to an endemic environment and further progress toward economic normalisation.

While working on COVID-19-related advancements is a high priority for the world’s leading healthcare companies, they remain committed to addressing equally pressing clinical challenges with profound health implications. Pursuing treatments and cures for other unmet medical needs remains a core focus of the industry – these include cancer, metabolic syndrome, rare/orphan diseases, and central nervous system (CNS) disorders, to name a few.

Indeed, the ability of healthcare companies to address such unmet medical needs is one of the three guiding principles by which we allocate capital and will help inform the sector’s impressive long-term growth prospects moving forward.1

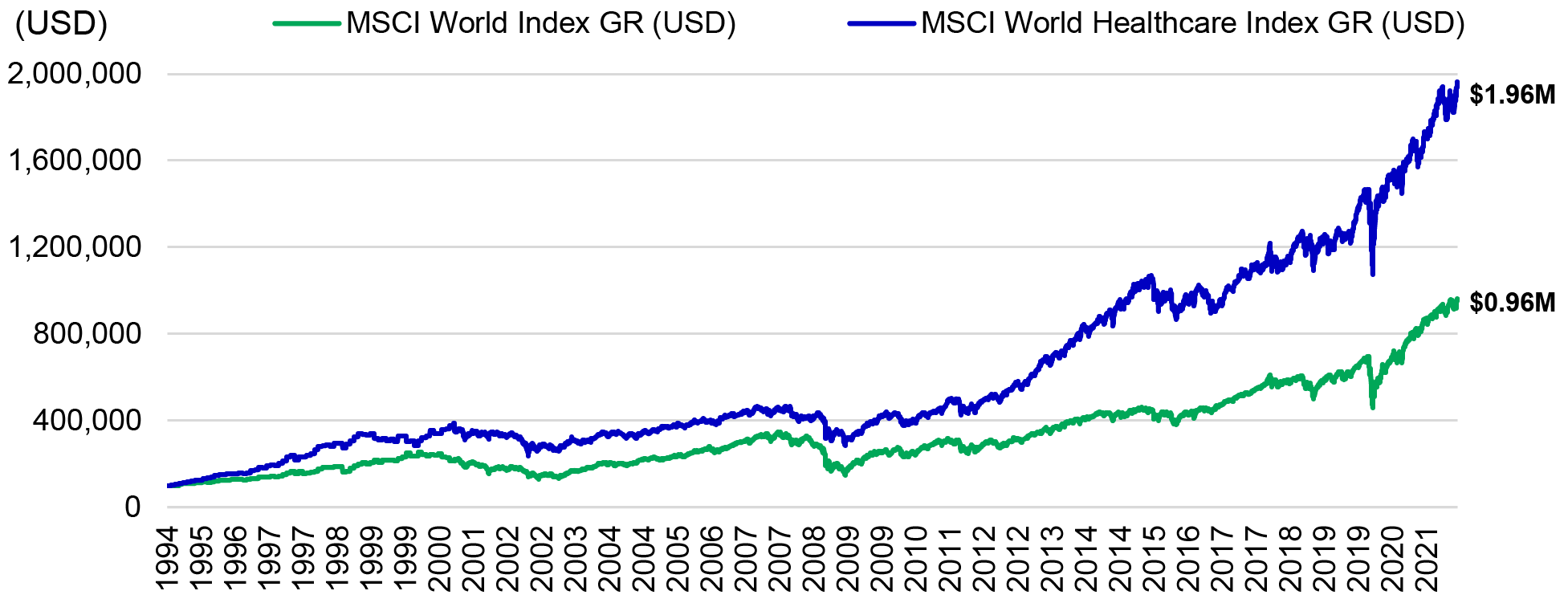

Chart 1: Investment growth for every US$100,000, from 31 December 1994 to 31 December 20211

Healthcare is unique in that it is a defensive sector that can produce impressive organic growth. This is supported by earnings per share and sales growth that have, on average, been historically superior to the broader market2.

This strong growth has been fuelled by long-term secular trends that we believe will propel demand for healthcare products and services higher over the longer term, regardless of the global economic cycle.

1) The ageing population should continue to drive increases in expenditures

Notwithstanding a short-term contraction driven by the pandemic, the world’s population continues to age, and life expectancy is forecast to climb over the long term. This should translate into greater demand for healthcare-related services, rising expenditure, and an expanding array of treatments and therapeutic options.

2) Medical advancements

As evidenced by the progress seen with COVID-19 treatments, diagnostic tests, and vaccines, medical advances continue to drive the sector forward.

3) Profound unmet medical needs remain

As previously mentioned, healthcare companies continue to pursue unmet medical needs beyond COVID-19. These include but are not limited to, solid tumour cancers, type-2 diabetes, obesity, Parkinson’s disease, and Alzheimer’s disease.

Healthcare equities remain relatively attractive on a forward price-to-earnings (P/E) basis versus the broader market indices. This presents a unique opportunity, as healthcare companies have historically traded at a premium to the overall market due to their defensive nature and aforementioned growth prospects. Global healthcare companies are currently trading at a discount to the overall market (16.83 times vs 18.02 times).

| Valuation Metrics (P/E) | Long-term Average3 |

As of 31/Jan/2022 |

| MSCI World Healthcare relative to MSCI World | 105% | 93% |

A new COVID-19 variant, the Omicron variant, was identified in late November 2021. It is believed to have originated in Botswana, Africa, with emergent spread identified through genomic sequencing in Pretoria, South Africa. The World Health Organization deemed it to be a “Variant of Concern” due to exponential expansion of around 58 seemingly critical point mutations in the various domains of the virus, including spike protein, receptor binding domain, and cleavage sites. These mutations are believed to confer substantive changes to the transmissibility, virulence and immune escape (from both vaccines as well as previous infection).

Early data from South Africa suggested heightened transmission relative to the earlier Beta and Delta waves. These data have now been confirmed in much of Asia, Europe, and North America.

Although the Omicron variant seems to be highly transmissible, early indications suggest that it results in milder symptoms relative to previous variants, with the contention that infectees experience less severe disease, on average, than previous variants. Generally speaking, this reduced virulence results in lower ICU hospitalisation and mortality rates.

Regarding the variant’s ability to escape immunity, early data out of South Africa, as well as more recent data in Asia, the US, and Europe, suggest that the Omicron variant does broadly escape our current vaccines’ ability to prevent transmission. Data also suggest that the Omicron variant is associated with a substantial ability to evade immunity from prior infection.

Over the past two years, our fundamental research process has enabled us to interface with many of the world’s leading clinicians, immunologists, epidemiologists, and public health officials working in real-time to research the emerging science and clinical implications of the current pandemic. With appropriate humility, neither we nor these researchers have a perfect “crystal ball” to help us see the eventual outcome of the current pandemic.

That said, our research suggests that SARS COV-2 may well be a persistent respiratory virus afflicting broad swathes of the world for years to come. Hopefully, it may eventually evolve and become comparable to other predecessors (i.e., influenza or the respiratory syncytial virus, RSV, etc.) as it moves to a seasonal endemic disease.

However, its unusual combination of high mutagenicity and transmissibility, as well as a relatively high morbidity/mortality rate, suggest that it will continue to disrupt various aspects of our healthcare systems and the broader economy, fluctuating in various geographies over the foreseeable future.

Rigorous fundamental research to sift through vast swathes of scientific data is critical when allocating capital in this sector. A bottom-up, fundamental investment process informed by the assessment of emerging scientific and medical developments, coupled with a disciplined intrinsic valuation framework, has the potential to uncover robust opportunities at fair valuations.

This approach continues to inform how we construct a portfolio. To this end, our findings above on the SARS COV-2 pandemic have led us to reallocate capital towards specific companies and sub-sectors we believe will generate above-market revenues and profits in a persistent COVID environment. Concurrently, we have allocated capital away from certain names and sub-sectors more adversely impacted in this environment.

First, we advocate for an overweight exposure to various biopharmaceutical companies with market-leading COVID-19 therapeutics and vaccines. This is consistent with our thesis that the pandemic/endemic may well persist for several more quarters, if not years. In our view, these companies are expected to see consistently robust demand for their COVID-19 treatments and vaccines well above street estimates. On top of strong COVID-19 tailwinds, we believe this is an area of the healthcare sector that offers reasonable valuations with the potential for further price appreciation.

Secondly, the ongoing COVID-19 pandemic heightens the urgency to effectively manage pre-existing disease states (cancer, metabolic syndrome, asthma, and other immunologic disorders) that, according to our research, predisposes these patients to higher morbidity and mortality from COVID-19. Accordingly, we have over indexed our positions in select therapeutic names to reflect these findings.

Thirdly, select established leaders in the COVID-19 diagnostics space offer a unique investment opportunity, as we believe the market is currently underappreciating these businesses' durability. For the world to remain open in a persistent COVID environment (schools, small businesses, office environment, public events, etc.), on-demand and repeated testing will be required. We believe this significant demand for COVID-19 diagnostic testing will be needed for far longer than the market estimates. As such, our proprietary cashflow models are estimating future revenues that are well above sell-side estimates.

Finally, and as previously noted, we have allocated capital away from select biopharmaceutical, healthcare services, and medical-device companies over indexed to various disease states and product markets that have been disproportionately adversely impacted by the persistent COVID environment. These would include various companies with exposure to orthopaedic surgery, hospital services, and select oncology conditions.

We continue to believe that new modalities in treatment and prevention will continue to drive long-term governmental outlays toward healthcare products and services. Irrespective of incremental tailwinds and headwinds associated with COVID-19, the underlying secular trends of ageing demographics, medical advancements, and profound unmet medical needs continue to support long-term exposure to global healthcare companies in a well-balanced investment strategy.

We believe that select companies within the healthcare space offer the potential for strong long-term outperformance and that this is an opportune time to invest in the sector, with a focus on the importance of stock selection as a primary driver of outperformance.

1 eVestment, 31 December 1994 to 31 December 2021.

2 FactSet, from 2005 to 2022.

3 FactSet, from 2005 to 2022.

Global Healthcare Equities Q&A

This Q&A provides an updated overview of sector performance, examines the impact of recent US healthcare policy developments, and outlines key investment strategies and themes. It also highlights the growing role of artificial intelligence (AI) in healthcare innovation and shares practical tips to help investors navigate market volatility.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

Fed’s first rate cut of 2025: Implications & takeaways

After nine months on pause, the US Federal Reserve (Fed) announced another rate cut of 25 basis points (bps) on 17 September (US time), bringing the federal funds rate into a target range of 4%-4.25%. Alex Grassino, Global Chief Economist, and Yuting Shao, Senior Global Macro Strategist, share their latest views on the rate decision and its implications for Asia.

2026 Singapore Fixed Income Outlook: A Sanctuary for Investors in Uncertain Times

Singapore bonds posted strong performance in 2025 amid a raft of global challenges on the back of structural inflows and sovereign strength. In this 2026 Outlook, the Singapore Fixed Income team outlines the underlying fundamentals and catalysts supporting positive momentum for the asset class in the new year and why the market is increasingly seen as a sanctuary for investors in uncertain times.

2026 AP REITs Outlook: From Rate Relief to Growth Revival

After posting positive performance in 2025, Asia Pacific ex-Japan REITs (AP REITs) are set for a pivotal transition from a period of rate-driven relief to a phase of growth revival. In this 2026 Outlook, Portfolio Managers Hui Min Ng and Derrick Heng analyse how declining interest rates are opening two avenues of growth for the asset class – organic growth via interest cost savings and inorganic growth via capital recycling. Additionally, the team explains how catalysts such as favourable historic relative valuations and positive policy changes in regional exchanges enhance the attractiveness of AP REITs for investors, ending with sectors that the team favours for the new year.

2026 Outlook Series: Global Equity Diversified Income

Equity market leadership could broaden in 2026 beyond mega-cap technology, creating opportunities across sectors and regions. Global economic growth is expected to stabilize, supported by fiscal spending and easing monetary policy in key markets. Europe and select Asian economies offer attractive valuations and improving fundamentals, complementing US resilience. Value and income-focused strategies may regain prominence alongside growth, supported by quality fundamentals. The Global Equity Diversified Income strategy is positioned for diversification across geographies, sectors, and styles, aiming for income and capital appreciation.