14 March 2023

Frances Donald, Global Chief Economist and Strategist, Multi-Asset Solutions Team

The closure of three tech-focused lenders over the course of four days in the United States has sent shock waves across financial markets in the form of a substantial uncertainty shock. While the development could be seen as being idiosyncratic in nature, the impact of what’s transpired—including the response from policymakers—could be far reaching. Frances Donald, Global Chief Economist and Strategist, Multi-Asset Solutions Team, discusses what this could mean for the U.S. economy and possible scenarios that could take place in the next few weeks.

Make no mistake: The events that transpired over the past few days—and what happens over the coming weeks (and possibly months)—will be studied by scholars, regulators, and historians for years to come.

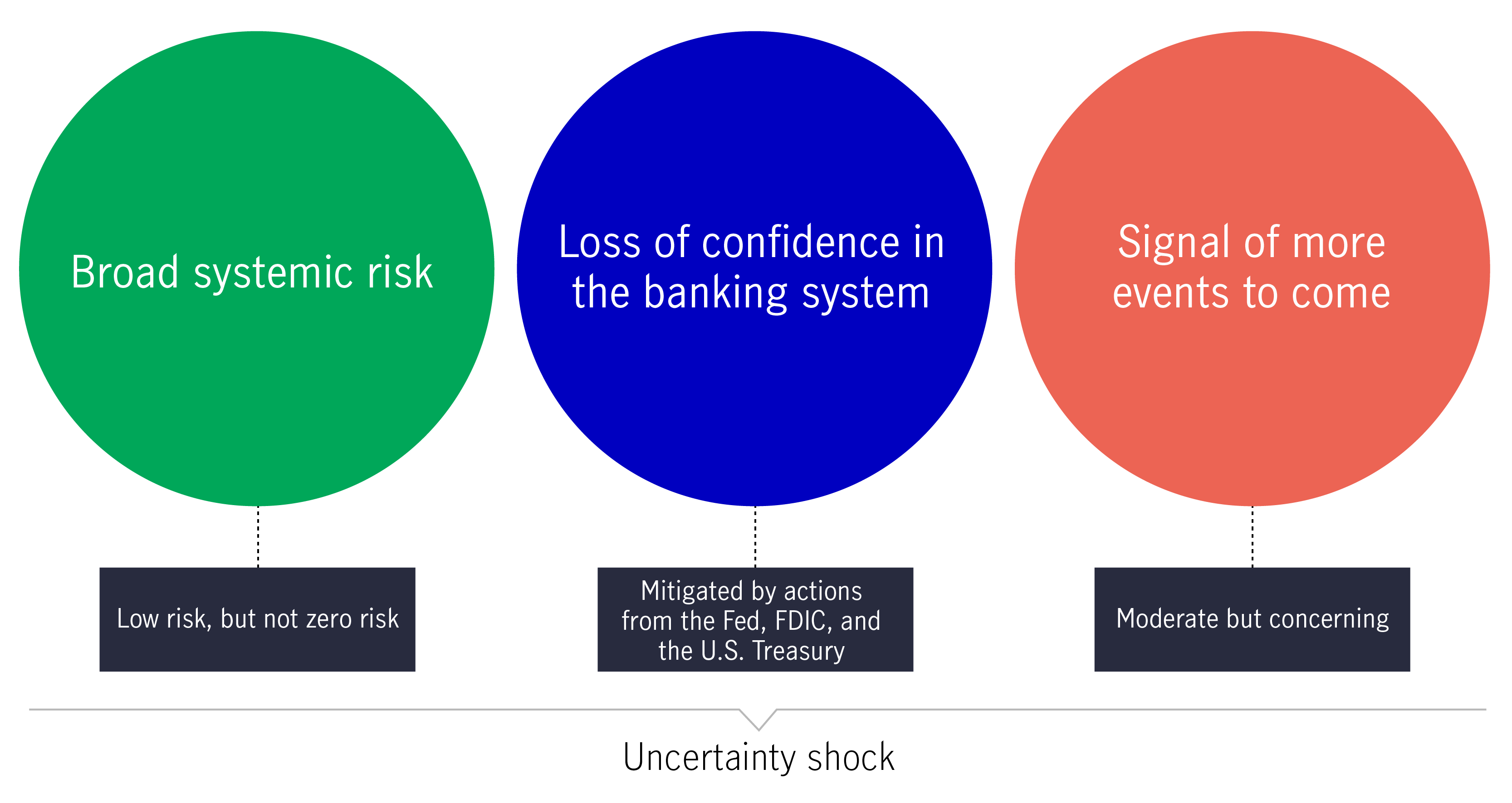

In our view, the closure of three notable banking entities has injected key risks into the macroeconomic backdrop. Investors everywhere are wondering if the event could morph into a broad systemic risk and whether it would deal an irreparable blow to investors’ confidence in the banking system. Crucially, do events from the last four days represent a canary in the coal mine? Will we see more similar events ahead?

Macro outlook: three key risks

Source: Manulife Investment Management, as of March 13, 2023. Fed refers to the U.S. Federal Reserve. FDIC refers to Federal Deposit Insurance Corporation.

Based on the information we have so far, the likelihood of current events evolving into a broader systemic risk is low; however, low doesn’t mean immaterial. As of this writing, market pricing of U.S. bank stocks on Monday suggests that confidence in the U.S. regional banking sector specifically is weakening, although it should be noted that the coordinated efforts between the U.S. Treasury, the Federal Deposit Insurance Corporation, and the U.S. Federal Reserve (Fed) have gone some way to mitigate real risks and sentiment issues over the worst-case scenario that had been percolating since March 10.

From an economic perspective, this past weekend’s events have reinforced our base-case expectations on the U.S. economy:

It’s never easy to predict what the Fed might do next, particularly in a time of duress; however, we think the Fed has now lost the luxury of framing its actions and decisions solely around inflation. The central bank must now reassess the potential costs and benefits of each incremental rate hike.

The key questions confronting the Fed in the coming weeks:

1. The Bank of Canada scenario

Probability: medium

2. The Bernanke scenario

Probability: low-medium

3. The it’s over scenario

Probability: low

There’s still a significant amount of outstanding information to process in the days and weeks ahead. Problematically, a good deal of it will come down to confidence and investor psychology, which is notoriously difficult to predict.

That said, what’s now clear is that the Fed—and other central bankers—have lost the luxury of focusing singularly on the fight against inflation. Indeed, the costs associated with higher interest rates are rising and will be weighed against what are likely declining benefits. In our view, this raises the bar for more rate hikes moving forward.

*This information may contain projections or other forward-looking statements regarding future events and is only as current as of the date indicated. There is no assurance that such events will occur, and if they were to occur, the result may be significantly different from that shown here. The information in this material, including statements concerning financial market trends, are based on current market conditions, which will fluctuate and may be superseded by subsequent market events for other reasons.

Global Healthcare Equities Q&A

This Q&A provides an updated overview of sector performance, examines the impact of recent US healthcare policy developments, and outlines key investment strategies and themes. It also highlights the growing role of artificial intelligence (AI) in healthcare innovation and shares practical tips to help investors navigate market volatility.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

Fed’s first rate cut of 2025: Implications & takeaways

After nine months on pause, the US Federal Reserve (Fed) announced another rate cut of 25 basis points (bps) on 17 September (US time), bringing the federal funds rate into a target range of 4%-4.25%. Alex Grassino, Global Chief Economist, and Yuting Shao, Senior Global Macro Strategist, share their latest views on the rate decision and its implications for Asia.