25 June 2019

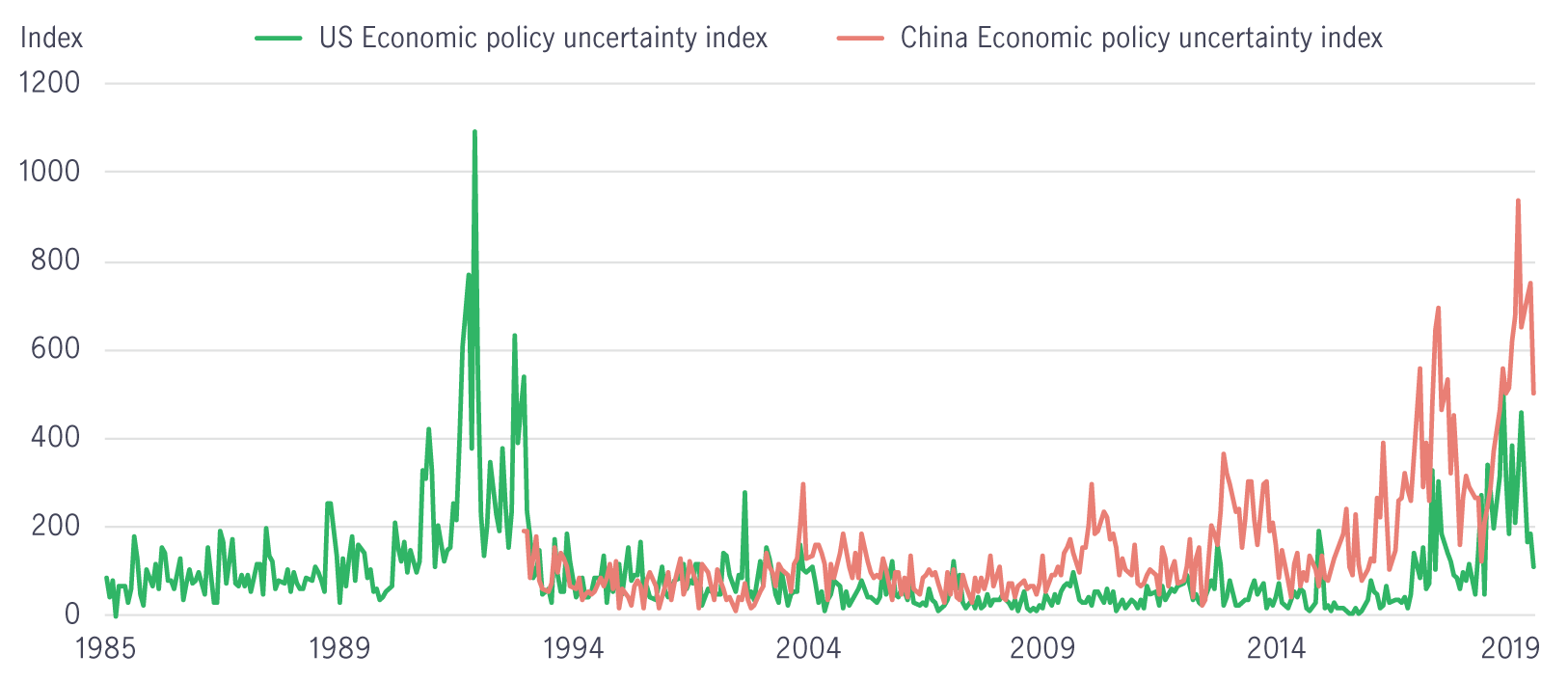

Generating economic forecasts is never straightforward, and in 2019 the task has become even more of a challenge as the world grapples with escalating volatility. Our Asset Allocation Team’s Macro Strategy Team believes that three evolving themes will dominate the global economy in the second half of the year: trade tensions, Fed monetary policy, and the impact of China’s stimulus. All three issues are shrouded in a fog of uncertainty.

An era of protracted trade tensions now seems likely, shaving growth in China, the US and Europe, and hitting US consumers hard. Meanwhile, investors who are now fixated on the Fed’s next interest-rate cut might be missing two bigger pictures. First, a longer-term shift in the Fed’s monetary policy framework that may result in a significant and structural dovish pivot. Second, that the next big policy shift with global consequences could come from China’s additional easing measures.

Generating economic forecasts is never an easy task. Models can help us most of the way there, but data can suddenly and unpredictably become distorted by a whole host of issues, from weather to labour strikes. Reliable correlations that have existed for decades break down, geopolitical events can spark sharp moves on the commodity front, and central banks can change their monetary policy decision-making functions in unpredictable ways. In a way, the forecaster’s job has become even more difficult in 2019, as new and unprecedented developments have created an elevated level of uncertainty that complicates the global economic outlook further.

Global Healthcare Equities Q&A

This Q&A provides an updated overview of sector performance, examines the impact of recent US healthcare policy developments, and outlines key investment strategies and themes. It also highlights the growing role of artificial intelligence (AI) in healthcare innovation and shares practical tips to help investors navigate market volatility.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

Fed’s first rate cut of 2025: Implications & takeaways

After nine months on pause, the US Federal Reserve (Fed) announced another rate cut of 25 basis points (bps) on 17 September (US time), bringing the federal funds rate into a target range of 4%-4.25%. Alex Grassino, Global Chief Economist, and Yuting Shao, Senior Global Macro Strategist, share their latest views on the rate decision and its implications for Asia.

Source: Thomson Reuters Datastream, Manulife Asset Management as of 15 April 2019

In our view, there are three evolving themes that will shape the second half of 2019, with uncertainty being a common denominator. The interrelated nature of these themes means that developments in one area can lead to a reaction in the other, making the task of formulating a clear narrative even more arduous.

The market’s heavy focus on rising trade tension is justified. In our view, the combined impact of tariffs that have already been implemented and those that could yet come has the potential to significantly alter the outlook for the global economy and the financial markets over the next 12 months. The combined impact will also likely have a considerable effect on global central banks, specifically their approach to monetary policies in the foreseeable future. The issue at hand is highly complex—we identified at least four trade-related developments in May that carried separate and important messages to the markets. We believe each of them should be recognised as an individual economic shock with its own set of outcomes and required solutions.

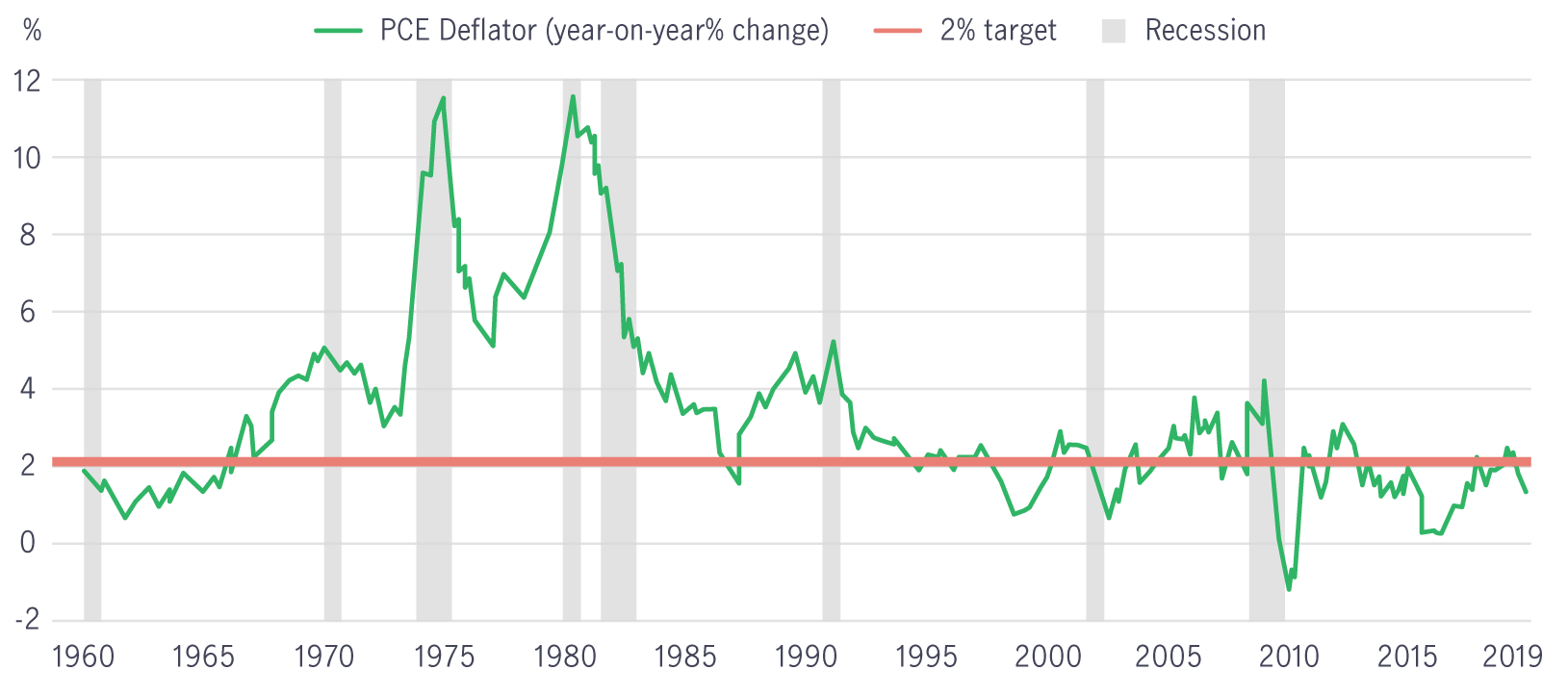

Markets are currently expecting the Fed to cut interest rates almost three times in the next 18 months, with the first cut arriving in September4. Our view isn’t as aggressive: We expect the Fed to cut interest rates twice, starting in the fourth quarter, in response to a deteriorating economic outlook. Should trade tensions escalate further and the economic consequences of this uncertainty manifest themselves in weaker data over the summer, the probability of earlier rate cuts and/or more than two rate cuts will rise. Markets will no doubt obsess about when the Fed will cut rates, but I think that risks missing a more important development that’s currently taking place and could have important longer-term implications for investors. Recent communications from the Fed suggest it might be shifting its monetary policy framework. Having consistently missed its inflation target, the Fed has expressed concerns about the structural weakness in price pressures and appears to be increasingly focused on allowing a prolonged and persistent inflationary overshoot that will bring average inflation higher and closer to its 2% mandate.

Source: Thomson Reuters Datastream, Manulife Asset Management as of 15 April 2019

Fed Vice Chairman Richard Clarida noted that any shift resulting from the Fed’s review of its monetary policy framework is more likely to be an “evolution” as opposed to a “revolution.”5 We don’t expect the Fed to announce a radical or formalised shift in its framework this year. However, if the Fed were to evolve—even informally—toward an “average” inflation framework, it would represent a significant and structural dovish pivot on its part, signalling its intention to stoke inflationary pressures more aggressively than at any time in the past 10 years. Note that this would imply that an overheating economy is no longer by itself a sufficient reason for the Fed to hike rates if inflation is trending below 2%. More important, if the Fed were indeed successful at nudging inflation expectations higher, we could expect the US yield curve to steepen, as the front end will likely remain anchored as the longer end rises. For now, however, we’ll wait for the outcome of the Fed’s policy review.

The various stimulus measures that China introduced in the last three quarters are starting to produce an observable stabilising effect on its economy. Theoretically, this should be good news for all—in the past, Chinese stimulus has lifted Chinese demand for industrial goods, which had in turn supported global trade activity, giving the global economy a boost, particularly emerging economies. This time, however, is different: There are a few key reasons why this wave of Chinese stimulus may be less effective at lifting all boats and why the China-influenced outlook is murkier than usual.

1. A focus on boosting domestic consumption

Over the past year, China’s fiscal stimulus has been predominantly focused on boosting domestic consumption; for instance, authorities announced the country’s largest-ever personal income-tax cut, which has boosted middle-class incomes. This is in stark contrast to previous rounds of stimulus that focused on the property sector—the most commodity-intensive sector—and infrastructure projects, which created demand for intermediary goods, commodities, and foreign products.

2. Elevated inventory levels

Economic data suggests that individual Asian economies are suffering from issues such as elevated inventories, particularly in South Korea and Taiwan, which wasn’t the case in 2015/2016. This implies that a potentially longer lead time could be necessary for real economic growth in Asia to take place after trade channels have been reawakened.

3. Reversing production cuts and keeping a lid on commodity prices

China hasn’t engaged in production/capacity cuts that, in the past, had lifted commodity prices. Production cuts in 2015/2016 led to higher capacity utilisation rates that pushed prices higher, boosting profits in the sector. This time around, however, the opposite occurred— some production cuts were reversed, keeping a lid on commodity prices and by extension, any positive impact on emerging market (EM) economies that would typically benefit from the exercise.

Critically, while investors are likely to train their focus on the Fed’s next move, we believe the next big policy shift with global consequences could come from China—in the form of additional easing measures.

The fog of uncertainty has no doubt thickened, making it even more difficult to paint a clear picture of the future. As economists, we’re armed with models and data gleaned from past experiences, and we have an intimate understanding of the cyclical nature of economic growth. From an investment perspective, the somewhat murky outlook may call for additional vigilance in the near term, but as with most cycles, this too shall pass; at some point, the fog will lift, and the path ahead will become clear again.

1 US Trade representative, Statement By U.S. Trade Representative Robert Lighthizer on Section 301 Action, 10 May 2019

2 US President Donald Trump’s twitter, twitter.com/realDonaldTrump/status/1126815128106799104, 10 May 2019.

3 Statement from the President Regarding Emergency Measures to Address the Border Crisis, The White House, 30 May 2019.

4 Bloomberg, as of 4 June 2019.

5 “The Federal Reserve’s review of its monetary policy strategy, tools, and communication practices,” Bank for International Settlements, 9 April, 2019.