18 March 2019

Following pronounced market volatility and the US Federal Reserve’s tilt toward dovishness in January, the markets have been broadly characterised by stronger equity prices and lower bond yields. This combination is a potent mix that, in our view, will serve to extend the business cycle. Over the last month, that behavior will have only been reinforced, as other major central banks have followed suit and adopted a dovish stance: The Bank of Canada toned down its rhetoric around normalisation, the Bank of England doubled down on its wait-and-see approach, and the European Central Bank changed course and extended its dovish forward guidance. Combined, these shifts have had a pronounced impact across asset classes. In this edition of Monthly Macro View, Asset Allocation’s Macro Strategy Team analyses what could lie ahead for investors in the next two quarters.

A key catalyst of the global risk-off environment that we saw in late 2018 was a growing consensus that global growth was deteriorating quickly. Going forward, the markets will need to believe that the global economy isn’t imminently falling into a recession in order to maintain its current riskon mode.

We believe Beijing’s efforts to arrest the slowdown in the Chinese economy in the next 12 to 18 months are likely to be sufficient. With this in mind, we turn our attention to the US and Europe, where we expect growth prospects in both continents to continue to frustrate investors.

However, we do see some scope for a mild upswing in Europe and expect a notable improvement in US economic data this spring. This, we believe, should go some distance to easing fears of a global recession for the time being and provide some incentive for investors to add back some risks. However, we believe those same concerns will resurface in the fourth quarter of 2019.

When asked about the economic outlook for the US, we’ve taken to answering with a question of our own: What’s your time horizon? This is an important question, as we expect US economic data to operate in three distinct phases this year:

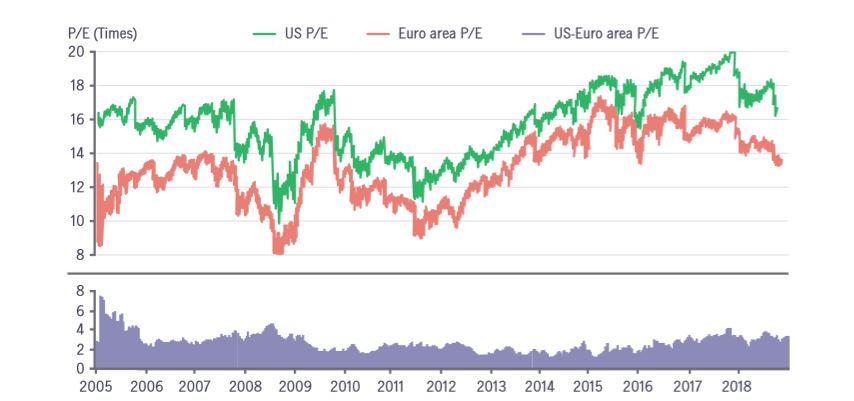

Pessimism about European growth has been rampant over the second half of 2018 and into 2019, and European stocks, from a valuation perspective, appear relatively cheap. Indeed, the gap between US and European price to earnings is approaching decade highs.2 Is it time to get excited about Europe again?

Economic data in Europe has been very weak, with most major euro economies suffering from rapidly declining Purchasing Managers’ Indexes (PMIs), faltering export activity, and slowing employment growth. Germany is in a manufacturing recession; the Italian economy also flirted with a recession in the second half of 2018, and prospects for growth are, to put it charitably, modest. Europe’s troubles have been multipronged:

These issues, however, now appear well priced into European assets; indeed, the European Citi Surprise Index has started to marginally improve (Chart 2). European data is not yet surprising to the upside, but the scope of its ability to disappoint is lessening.

Global Healthcare Equities Q&A

This Q&A provides an updated overview of sector performance, examines the impact of recent US healthcare policy developments, and outlines key investment strategies and themes. It also highlights the growing role of artificial intelligence (AI) in healthcare innovation and shares practical tips to help investors navigate market volatility.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

Fed’s first rate cut of 2025: Implications & takeaways

After nine months on pause, the US Federal Reserve (Fed) announced another rate cut of 25 basis points (bps) on 17 September (US time), bringing the federal funds rate into a target range of 4%-4.25%. Alex Grassino, Global Chief Economist, and Yuting Shao, Senior Global Macro Strategist, share their latest views on the rate decision and its implications for Asia.

Source: Bloomberg, Manulife Asset Management.

In our view, there are some moderate tailwinds that could help Europe find bottom in the second quarter.

Tail risks remain significant

As much as we believe that the balance of risks for European growth is tipped more to the upside than the downside, we’re not ready to be positive about the region’s outlook until (i) we see a stabilisation in economic data and (ii) we’re past two important tail risks:

1 Market data sourced to Bloomberg, as of 28 February 2019, unless otherwise noted.

2 Manulife Asset Management, FactSet, February 2019.

3 Exante data, as of 28 February 2019. 4 Bloomberg, OPEC, EIA, as of 19 February 2019.

4 Bloomberg, OPEC, EIA, as of 19 February 2019.