16 March 2022

Kai Kong Chay, Senior Portfolio Manager, Greater China Equities

This week saw the markets in China and Hong Kong tested by a perfect storm of risk-off events: geopolitical tensions, rising COVID-19 cases, and regulatory pressures from abroad. Meanwhile, China’s National People’s Congress (NPC) reaffirmed the country’s long-standing commitment to economic stability. In this investment note, Kai Kong Chay, Senior Portfolio Manager, Greater China Equities, presents an update on China and Hong Kong markets, as well as key takeaways from the NPC meeting. He also explains why despite market valuations dipping to historic lows, he sees the structural themes and sector opportunities in China and Hong Kong equities remain intact.

On 14 March, China and Hong Kong markets (Shanghai Composite -2.6%, Hang Seng China Enterprise Index HSCEI -7.2% and Hang Seng Index lower -5.0%) pulled back on several key developments:

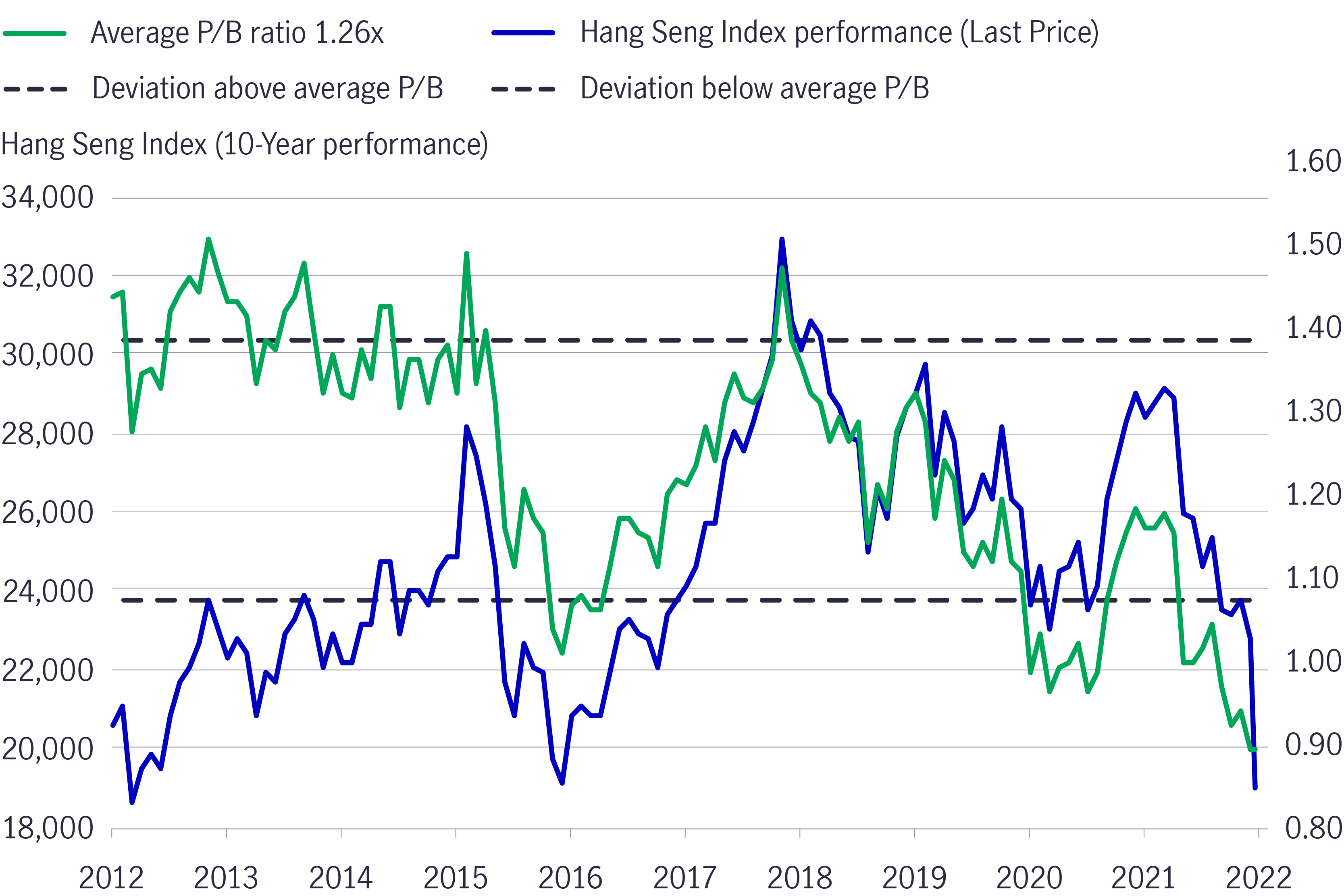

Russia-Ukraine tensions, coupled with China’s COVID-19 restrictions and regulatory risks from abroad created a panic sell-off by investors, driving market valuations to historic lows. The price-to-book multiple (P/B ratio) on Hong Kong’s Hang Seng Index (HSI) is now trading almost 0.9 times its book value, which marks a near-term bottom in the past 10 years (historic average 1.26x P/B), and trading 1 standard deviation below this historic average (see Chart 1)4.

Chart 1: Hong Kong’s market valuation at historic lows

Despite a near-term dampening investor sentiment, we believe the broad market has overlooked the long-term fundamentals of the Chinese equity market, for the following reasons:

Another event held last week also captures market attention. China concluded its annual National People’s Congress (NPC). The government outlined multi-year plans to develop the nation’s technology and science sectors, as well as reiterated its commitment to reducing energy intensity and ensuring housing prices remain stable.

At the meeting, there were encouraging signs that China is determined to sustain economic growth and social stability. China’s fiscal policy is generally expansionary, with intensive spending coupled with tax refunds and cuts.

In summary, the key messages from the NPC plenary meeting underpin our belief that the Chinese government’s policies are significantly different from those of developed markets. We believe that economic stability remains a top priority for policymakers and that monetary tools remain in place for China’s central bank to support growth. (See Appendix – Key takeaways from NPC meeting)

In the near term, we expect ongoing market volatility until there is more clarity on the Russia-Ukraine situation, as well as the dust settle around COVID-19 lockdown and regulatory risks from abroad. Nonetheless, the recent sharp sell-off has created some deep valuation discounts that we believe do not reflect long-term fundamentals. Here are some structural themes and sector opportunities amid the current environment:

With Asian equity markets in a broadly risk-off mode, we expect continued volatility until there is more clarity on the Russia-Ukraine situation.

While a broad market correction affects risk assets, we believe the overall impact on Chinese equities will likely be contained should the sharp risk-off episode subside: the fundamental implications for China are less prominent relative to Europe and the Western world.

In our view, China’s economy will continue to power ahead, despite global macro uncertainty, moving almost countercyclically to other emerging economies and a slower global economy. The China A-share market is typically less correlated to global geopolitical incidents and may provide a diversification opportunity to international investors.

In the near term, global inflationary concerns may heighten given elevated energy prices. For China, inflation is expected to be manageable in the near term as the government can control energy prices via a cap on the coal price. Thus, we believe China’s central bank has the monetary tools to support growth.

From a tactical perspective, as China decouples from the U.S., its equities provide alternatives to global investors who would like to diversify from the US Federal Reserve’s policy moves.

China held its annual National People’s Congress (NPC) on 5 March to 11 March. Investors paid close attention for indications of the country’s key economic targets and fiscal plans. Below are some of the key takeaways from the meeting.

While China’s gross domestic product (GDP) growth target of around 5.5% (from 6% in 2021 – see Chart 2), is the lowest in more than three decades, it is still above consensus that forecast closer to 5% and higher than the International Monetary Fund’s projection of 4.8%. For inflation, the Consumer Price Index (CPI) target is set at about 3% (the same as 2021).

China’s fiscal policy is generally expansionary, with intensive spending coupled with tax refunds and cuts. Fiscal spending will increase by 8.4% in 2022, with a more than 7% rise in China’s defence budget. The administration also announced a CNY2.5 trillion tax cut, about half of which is new and led by value-added tax (VAT) refunds for excess VAT input credits.

Chart 2: NPC’s key economic targets6

Target |

2022 |

2021 |

GDP Growth |

~ 5.5% |

> 6% |

Fiscal deficit (% of GDP) |

~ 2.8% |

~3.2% |

CPI |

~ 3% |

|

Special local government bond quota |

CNY 3.65 trillion |

|

New urban job creation |

> 11 million |

|

Surveyed jobless rate |

< 5.5% |

~ 5.5% |

The administration outlined policies to support the use of new-energy vehicles and facilitate local governments to roll out green smart-home appliances to rural areas and encourage the trading in of old appliances.

China plans to set up a financial stability fund and adopt measures to keep housing prices stable as policymakers ramp up efforts to prevent systemic risks.7

Chinese leaders called on the property sector to help address rising demand from homebuyers. It was the first time non-subsidised housing was mentioned in the key report since 2014.

China’s Ministry of Finance said it would work to address funding shortfalls in the subsidies for renewable power after years of rising debt from inadequate payments, which we believe could be positive for wind or solar farm operators.8

At the meeting, the government also indicated that China would remain committed to its five-year goal of reducing energy intensity by 13.5% from 2021 to 2025. The country will continue to develop massive wind and solar power bases in desert regions and improve electricity grids.

To support the long-term development of the nation's science and technology sector, the government presented a ten-year plan to enhance basic research in those areas and a three-year plan to reform the scientific and technological systems. There may also be policies to promote the development of venture capital, as well as new financial products and services.

1 Bloomberg, 14 March 2022.

2 Bloomberg, 10 March 2022.

3 Reuters, 15 March 2022.

4 Bloomberg, 15 March 2022.

5 Bloomberg, 15 March 2022.

6 Bloomberg, 5 March 2022

7 Bloomberg, 5 March 2022

8 Bloomberg, 7 March 2022.

Global Healthcare Equities Q&A

This Q&A provides an updated overview of sector performance, examines the impact of recent US healthcare policy developments, and outlines key investment strategies and themes. It also highlights the growing role of artificial intelligence (AI) in healthcare innovation and shares practical tips to help investors navigate market volatility.

Q&A: Potential market impact of a US government shutdown

The US Senate failed to pass a last-minute funding deal, triggering the first federal government shutdown in nearly seven years starting from 1 October. Our Multi-Asset Solutions Team shares insights on how markets have responded during past shutdowns, and how investors can position themselves amid the uncertainty.

Fed’s first rate cut of 2025: Implications & takeaways

After nine months on pause, the US Federal Reserve (Fed) announced another rate cut of 25 basis points (bps) on 17 September (US time), bringing the federal funds rate into a target range of 4%-4.25%. Alex Grassino, Global Chief Economist, and Yuting Shao, Senior Global Macro Strategist, share their latest views on the rate decision and its implications for Asia.