8 January, 2021

2020 was a challenging year for many asset classes. Asia-Pacific REITs (AP REITs) was no different, as the COVID-19 pandemic roiled real estate markets across the globe, including Asia. Despite these challenges, regional real estate markets have gradually recovered from lows, stabilising historically predictable dividend payouts, while the “lower for longer” global interest rate environment has provided a beneficial tailwind. In this 2021 outlook, Hui Min Ng, Portfolio Manager, explains why investors traditionally have chosen REITs, and outlines why it should be an attractive investment for next year1 and beyond.

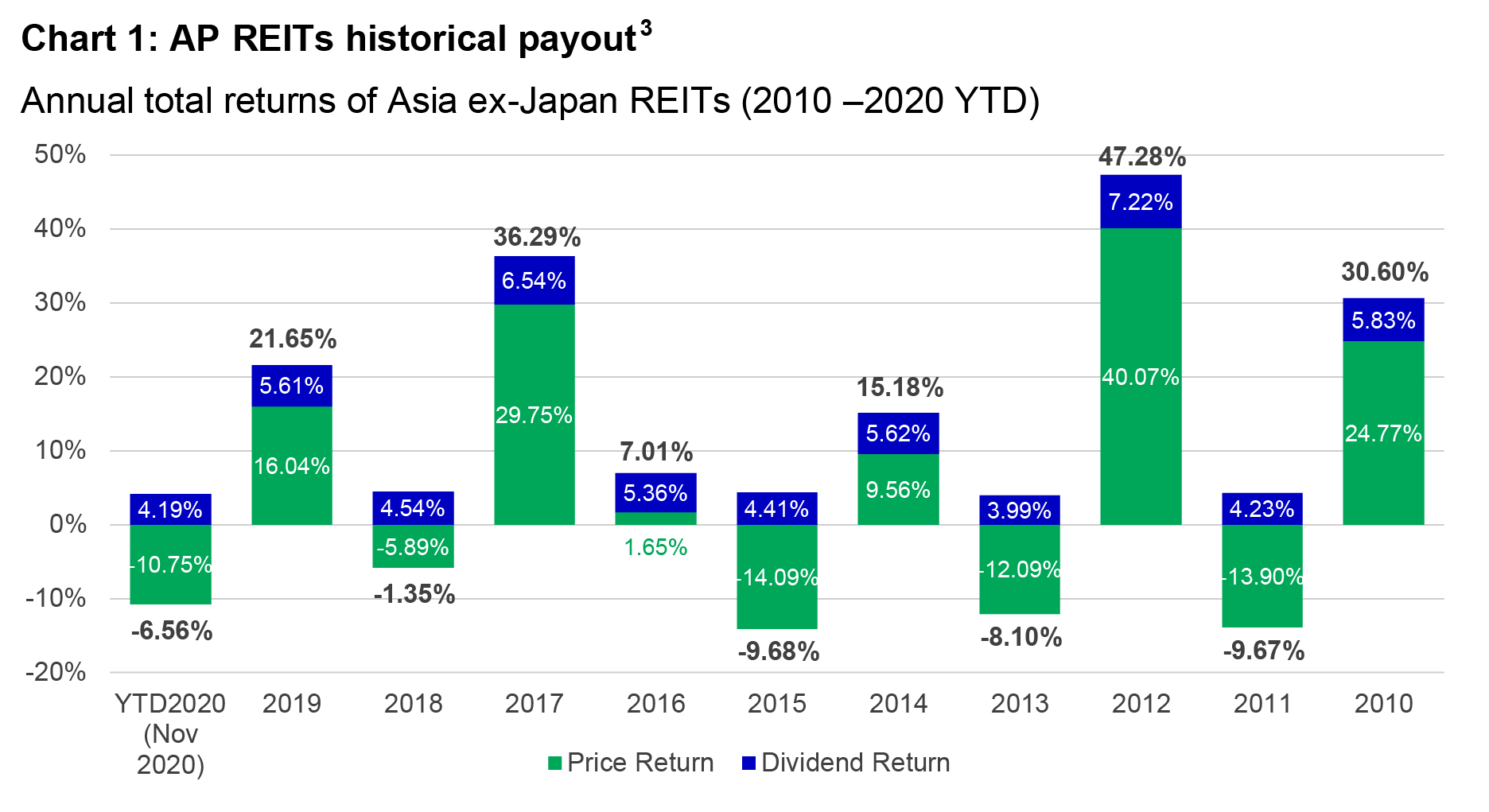

Despite a volatile and unpredictable 2020, it is always important to remember why investors choose to invest in REITs. While they certainly can offer the possibility for price appreciation (or depreciation), a stable and predictable income payout through dividends has been the main historical source of return.

Indeed, over the past 10 years, AP REITs have provided, on average, a 6.8% annualised return; roughly 5% of the total return came from dividend payouts2. To put this dividend yield in perspective, Asia (ex-Japan) equity markets offered, on average, a 5.4% total return, with only 2.4% coming from dividends over the same time period3.

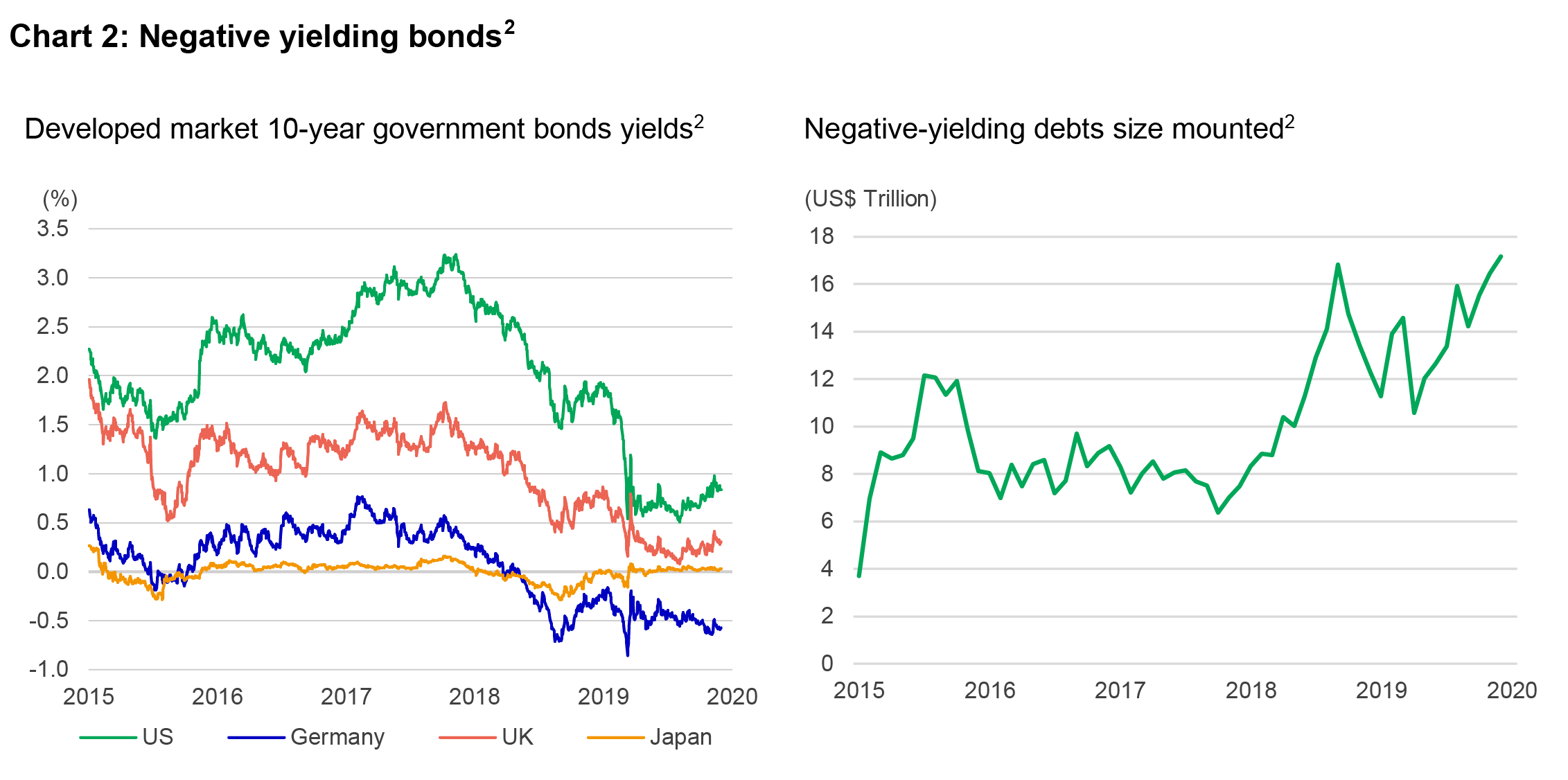

Despite the notable challenges of the past year, from another perspective, AP REITs historical yield is also attractive in the current “lower for longer” interest rate environment. As Chart 2 shows, developed markets’ sovereign bond yields have steadily declined since December 2015. In some developed markets, bond yields have even turned negative, with the current level of negative-yielding debt instruments near US$ 18 trillion and expected to climb even further in the near-term.

While the lower for longer interest rate environment is a headwind for many fixed income segments, it is supportive for REITs due to lower borrowing costs.

Despite these traditional strengths, 2020 was indeed a challenging year for REITs globally as well as Asia, as the economic impact of the COVID-19 pandemic called into the question the asset class’s predictable history of dividend payout.

The global outbreak of COVID-19 had a varying impact across the sub-sectors of real estate, but initially led many to question the viability of dividend pay-outs in a worsening environment. The worst hit sector globally was retail as a result of national lockdowns and social distancing requirements.

In contrast, industrial/specialised real estate assets continued to generate stable cashflows and high-income visibility, as the acceleration in ecommerce trends led to stronger demand in warehousing and logistics facilities.

Many segments of AP REITs have gradually recovered from the economic shock due to unprecedented monetary and fiscal policy measures. Policy responses from governments such as Singapore and Australia have helped save jobs and companies, with some packages totalling up to 20% of GDP. At the same time, central banks across the region have slashed rates, with the Reserve Bank of Australia starting quantitative easing for the first time in 2020.

The top priority across all landlords and REITs managers has been to ensure high cleaning/maintenance standards, temperature checks to ensure safety for all their tenants and instil confidence for people to visit their facilities. The pandemic has brought about unprecedented economic impact and all stakeholders in one form or another must bear some pain from it.

Landlords for commercial assets in Singapore and Australia are mandated to provide rental holidays for tenants who were badly affected by the loss of sales/income. landlords have also offered help in terms of rental commissions, waiver of management fees, lease restructuring to tide tenants through the difficult period.

We saw suburban retail landlords have also accelerated their digital marketing plans to help their tenants to sell their products online or food delivery services for their food and beverage tenants, with more people working from home, these suburban malls have ramped out digital offering to capture the sales in their neighbourhood.

Moving into 2021, we envisage the macroeconomic backdrop should gradually improve across the region, with significant dispersion in economic growth across the region4. Despite the economic rebound, we expect that the low interest rate environment should remain a strong tailwind for the asset class. The low cost of borrowing continues to underpin healthy demand in trophy assets across Asia.

Our base case scenario is that key markets like Singapore, Hong Kong, and Australia should not enter into national lockdowns given policy learnings and experiences. The positive newsbytes on vaccines successes could restore confidence in consumer and corporate spending in 2021.

Retail landlords should enjoy recovery in cashflows given the low base in 2020 (high rental reliefs) and industrial REITs remain stable with growth boosted from accretive acquisitions.

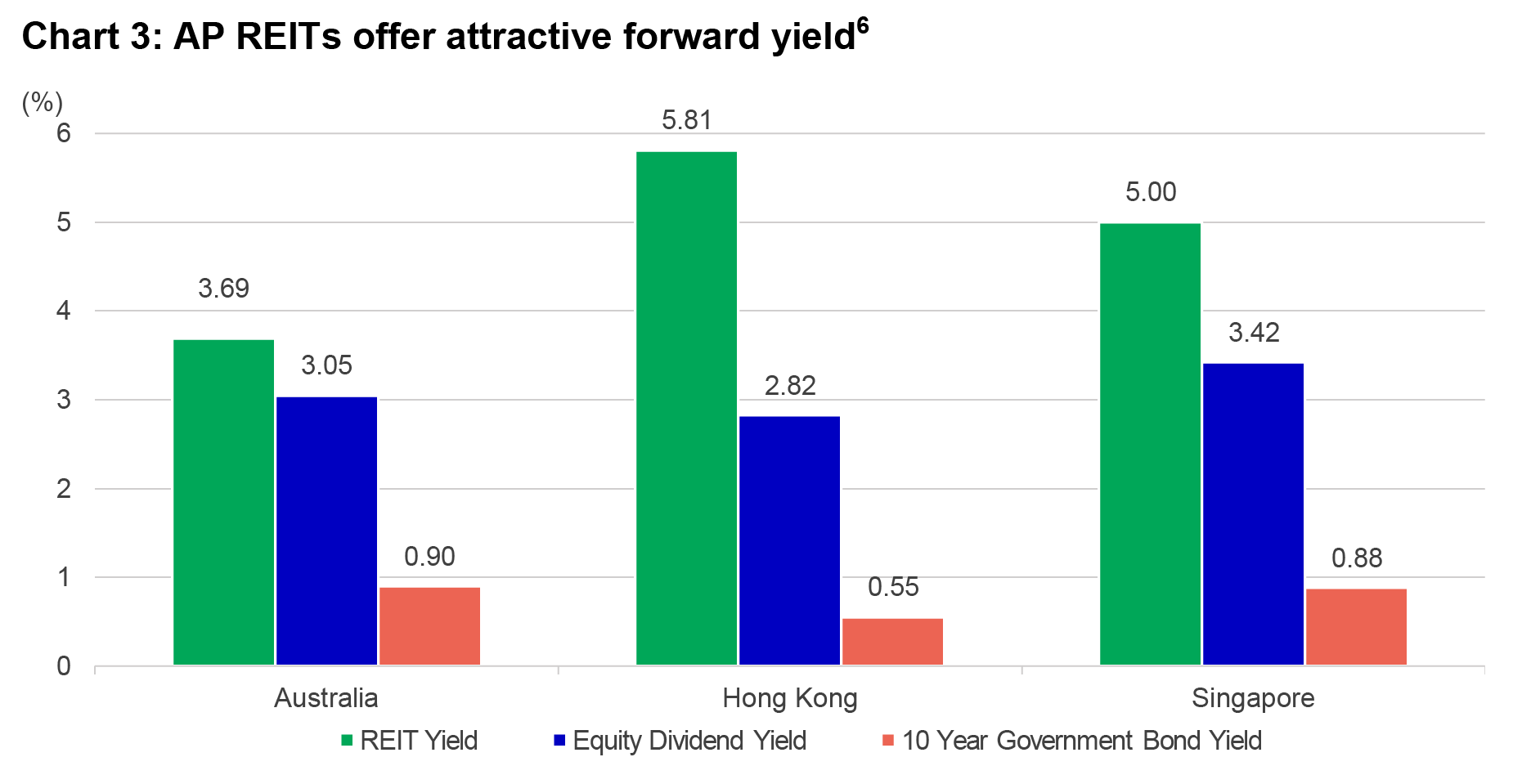

Based on this base case and favourable macro backdrop, the outlook for yields of AP REITs should remain attractive next year (see Chart 3). Forecasted yield for AP REITs is approximately 5.1% compared to a 2.1% yield for Asian equities5. In our view, this payout is expected to remain stable over the long-term, largely due to the strength of the asset class and improved economic conditions.

In our view, the main attraction of AP REITs as an asset class is the stable, sustainable payout of dividends to investors. While this assumption was challenged in early 2020, the response by governments and central banks helped to stabilise the real estate sector. Moving into 2021, we believe an improving economic outlook and continued low interest rates should be beneficial for the asset class.

1 As of this writing, December 2020.

2 Bloomberg, as of 30 November 2020.

3 Bloomberg, as of 30 November 2020, Asia ex-Japan REITs are represented by FTSE EPRA/NAREIT Asia ex-Japan REITs Index. Performance in US dollar.

4 Bloomberg, as of 15 December. The consensus growth estimate for Asia-Pacific in 2021 is 5.5%. India and China are expected to lead the region at 8%, with Southeast Asian countries experiencing a slower expected rebound.

5 Bloomberg, as of 4 January 2021.

6 Bloomberg as of 30 November 2020. REIT Yield and Equity Dividend Yield are the projected 12-month yield from Bloomberg consensus. REIT Yield: Australia REIT – S&P/ASX 200 A-REIT Index, Hong Kong REIT – Hang Seng REIT Index, Singapore REIT – FTSE ST Real Estate Investment Trusts index. Equity Dividend Yield: Straits Times Total Return Index, Hang Seng Index, S&P/ASX 200 index. 10- Year Government Bond Yield = Local Generic 10-year Government Bond Yield. Projections or other forward-looking statements regarding future events, targets, management discipline or other explanations are only current as of the data indicated. There is no assurance that such events will occur, and if they were to occur, the result may be significantly different than that shown here.

Semiconductors poised for long-term growth amid AI boom

The global semiconductor industry remains strong – arguably the most robust we have seen in over three decades. This strength is supported by cutting-edge innovation, rising revenues and robust capital spending. While risks remain, the outlook for 2026 appears constructive, with demand for artificial intelligence (AI) applications showing few signs of slowing. Beyond AI, the non-AI markets could be poised for positive revisions as cyclical recovery gains traction after several years of consolidation.

2026 Outlook: Clearer picture, better growth

This year’s outlook spotlights a world in flux – U.S. stimulus, Europe’s rebound, China’s policy pivots, and Japan’s innovation surge all shape a landscape full of both opportunities and challenges.

2026 Asian Fixed Income Outlook: Positive momentum poised to continue amid ample investment opportunities

Asian fixed income posted strong gains in 2025 amid myriad challenges. Entering the new year, the asset class is poised for continued momentum on the back of numerous beneficial tailwinds. In this 2026 Outlook, the Asian Fixed Income team analyses the key factors likely to propel performance and identifies opportunities for investors based on key themes and developments in three regional bond markets: China, Japan, and India.