Multi-asset strategy:

Preferred Securities

Aim to offer relatively compelling yields with high credit quality

Preferred securities offer opportunities in today's market environment

Learn more

How much yield do preferred securities offer compared to other bonds?

Learn more

What differentiates our strategy from others?

Learn more

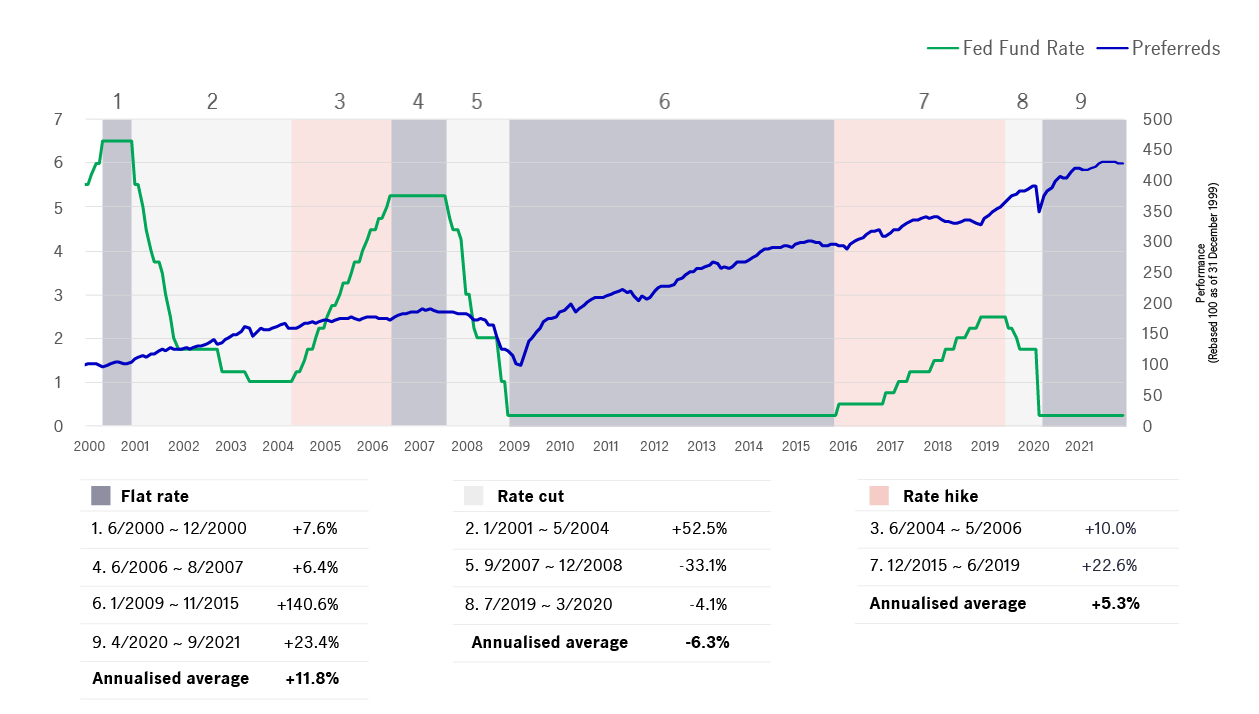

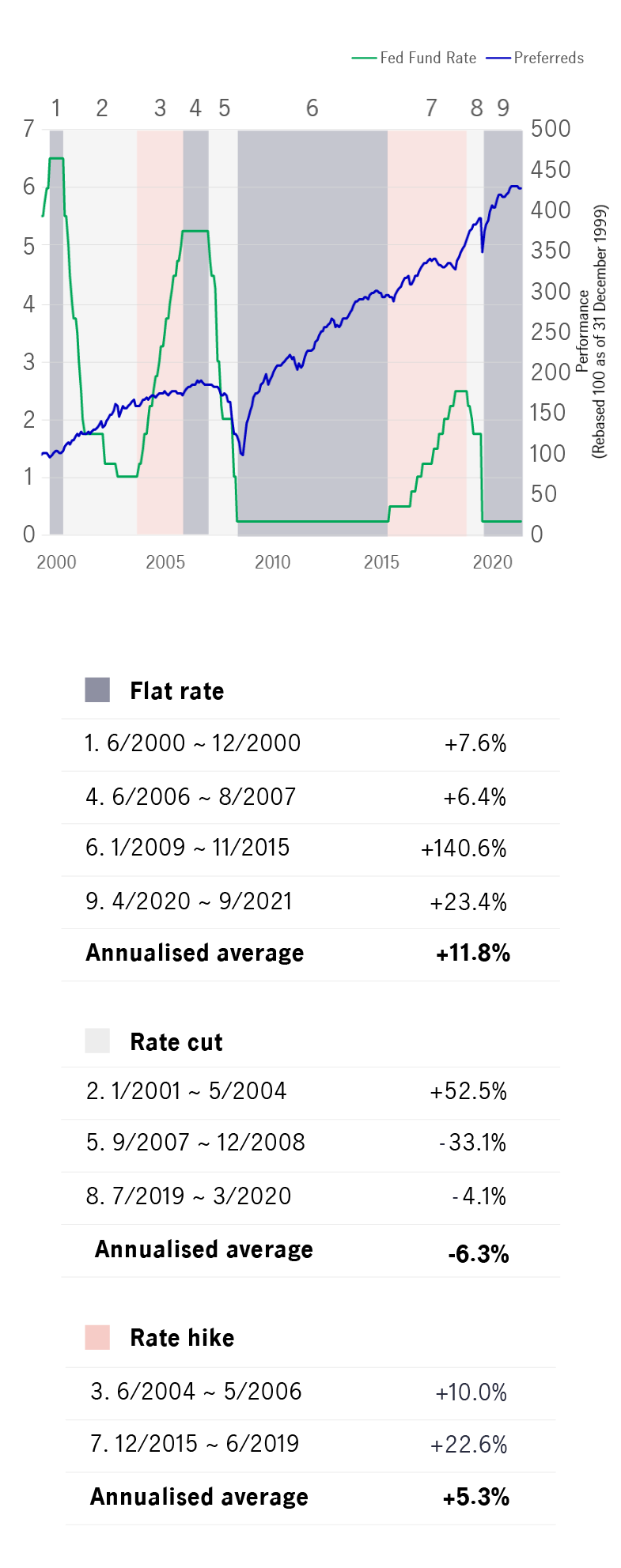

Preferred securities are historically less sensitive to interest rate changes and have been performing well in the past two rate hike cycles.

Historical performance during past rate cycles1

There are couple of reasons for preferred securities to standout:

- High-yielding buffer and extra carry: Yields of preferred securities stand out from other investment grade bonds and are as competitive as those of high yield bonds. From a total return perspective, the higher the income from yields, the more the compensation for the loss in bond price when rates hike.

- Low duration & fixed-to-floating rate coupon: Preferreds are generally low duration securities as most are callable after a certain period of time. Some preferreds having fixed-to-floating rate coupon also offer investors some coupon protection from rising rates compared with traditional bonds.

- Financial companies dominated in preferred market: Margins for banks typically improve when yield spreads widen or interest rates go higher, this can lead to higher profitability which also helps support the investment performance for preferred securities.

As the COVID situation remains fluid, pressuring recovery in the economy, investors would not only look for higher yielding asset classes but also focus on higher asset quality to seek more stable and sustainable income.

Preferred securities, with an average investment grade, are offering around 4.3% yield to maturity, which is more attractive when compared to 1.2% of US Treasuries and 2.4% of US investment grade corporate bonds.

Yield of major fixed income assets(%)2

In terms of sector allocation, we differ greatly from our peers and the preferred market, as we have smaller allocations in financials, and higher allocation in electric utilities where most operators have a regulated rate of return. This can help provide highly stable and predictable stream of earnings that are secured by a lack of competition and low sensitivity from commodity prices and the economic cycle.

Sector Allocation(%)3

Sources:

1. Bloomberg, as of 31 December 2021. Preferred securities market is represented by the ICE BofAML US Capital Securities Index (C0CS) for the performance period of 2000 to 2012 as ICE BofAML All Capital Securities Index (I0CS) has shorter history starting from April 2012; Rebased to 100 on 31 December 1999. Monthly data.

2. Bloomberg, as of 31 December 2021. Index ratings refer to Bloomberg composite rating. US HY bonds are represented by ICE BofA US High Yield Index; Preferred securities are represented by ICE BofA US All Capital Securities Index; US IG Corp bonds are represented by ICE BofA US Corporate Index, US treasuries are represented by ICE BofA US Treasury & Agency Index. A positive distribution yield does not imply a positive return. For illustrative purposes only. Past performance is not indicative of future performance.

3. Bloomberg, Manulife Investment Management, as of 31 December 2021. Preferred securities market is represented by the ICE BofAML All Capital Securities Index. Performance is for reference only. Sector breakdown by Bloomberg Barclay level 2-3 classification. Portfolio holdings and characteristics are subject to change at any time. Information about the asset allocation is historical and is not an indication of the future composition. The securities described are for illustrative purpose only and do not constitute any investment recommendation or advice. It should not be assumed that an investment in these securities or equities was or will be profitable. Due to rounding, the total may not be equal to 100%.

Hi {FirstName}! Thank you for interest to learn more about our products. Please expect our Wealth Specialist to get in touch with you.

Sorry

Something went wrong.

Please refresh the page and try again.