Multi-asset strategy:

Multi-Asset Diversified Strategies

Strategies that aim to achieve growth and a stable income potential together with diversification benefits

Asset allocation that actively seeks to maximise income and growth

Learn more

Strategic investment that targets long-term growth

Learn more

Seeking high, stable income through multiple traditional and non-traditional income sources

Learn more

Regions, sectors, and asset classes can all perform and correlate differently from one another under different markets conditions. A well-balanced multi-asset portfolio can help you navigate through market cycles and effectively grasp valuable investment opportunities.

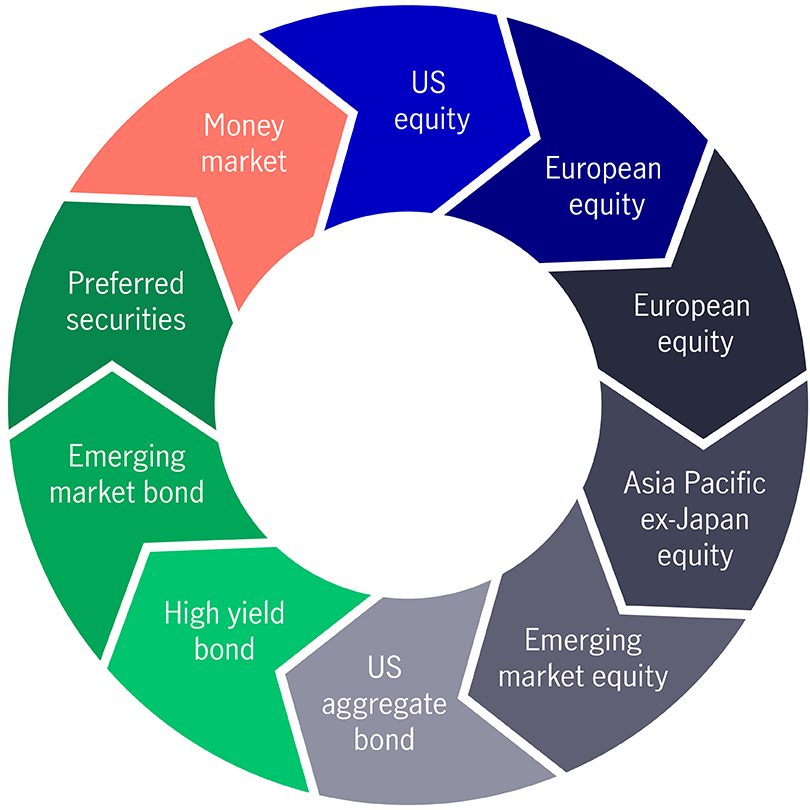

Investment universe1

Current market dislocations are creating an attractive environment for strategic and tactical allocations that aim to maximise income and growth opportunities. Strategic asset allocation serves as a solid foundation, focusing on the expected long-term returns across a broad range of asset classes. Tactical asset allocation, on the other hand, seeks to capitalise on short-term market dynamics.

Our proprietary strategic, tactical, asset allocation and rebalancing strategy aims to provide income and the potential for capital appreciation by tapping into a broad opportunity set of asset classes.

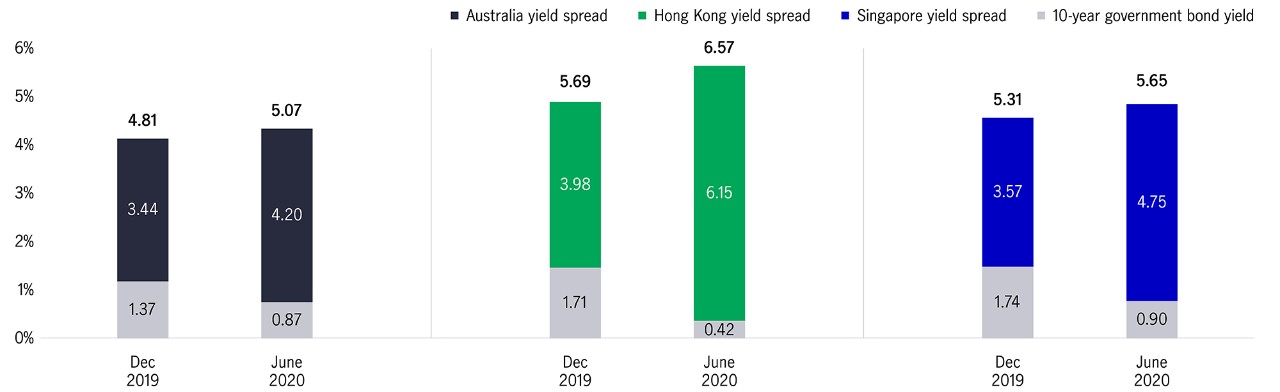

To cope with the economic challenges of COVID-19 pandemic, global central banks have provided significant amounts of stimulus to economies and liquidity to capital markets. Negative-yielding debt has become prevalent amidst the lower-for-longer interest rate environment. We believe income-oriented asset classes, such as higher-yielding and income-generating securities, should remain attractive to investors and therefore remain well bid.

A growing portion of the global fixed-income market is negative-yielding (trillion US dollar)2

The strategy aims to adopt a differentiated approach of achieving yield, minimising reliance on equity appreciation – primarily seeking yield from fixed income and an option writing strategy.

The option writing strategy generates premiums and aids drawdown management for a better downside-capture profile.

Traditional and non-traditional income sources tend to be less correlated3

Despite their high directional correlations with markets, complementing call and put writing strategies, between themselves, offer uncorrelated income sources4.

1. Remark: For illustrative purposes only and subject to change.

2. Bloomberg, as of 31 December 2021.

3. Bloomberg. Correlation coefficient is calculated based on weekly performance from from December 2006 to December 2021. Correlation ranges from +1 (perfect positive correlation) to -1 (perfect negative correlation). Relatively low correlation refers to correlation coefficients equal to or smaller than 0.5, moderate correlation between 0.5 and 0.75 (inclusive), and relatively high correlation above 0.75. Representative indices of each asset class: Global REITs refer to FTSE Nareit Global REIT Index; Preferred Securities refer to ICE BofAML US Fixed Rate Securities Index; Equity option strategies refer to 50% CBOE S&P 500 BuyWrite and 50% CBOE S&P 500 PutWrite Index; IG corporate bond refers to BBgBarc Global IG Corporate Bond Index; HY corporate bond refers to BBgBarc Global High Yield Corp Index; EM bond refers to BBgBarc EM USD Agg Index; Global equities refers to MSCI AC World Index.

4. Manulife Investment Management.

Hi {FirstName}! Thank you for interest to learn more about our products. Please expect our Wealth Specialist to get in touch with you.

Sorry

Something went wrong.

Please refresh the page and try again.