Equity strategy:

Global REITs

Offers a wide opportunity set which could potentially benefit from emerging trends

Long term growth potential

Learn more

Relatively attractive income return

Learn more

Exposure to global emerging trends

Learn more

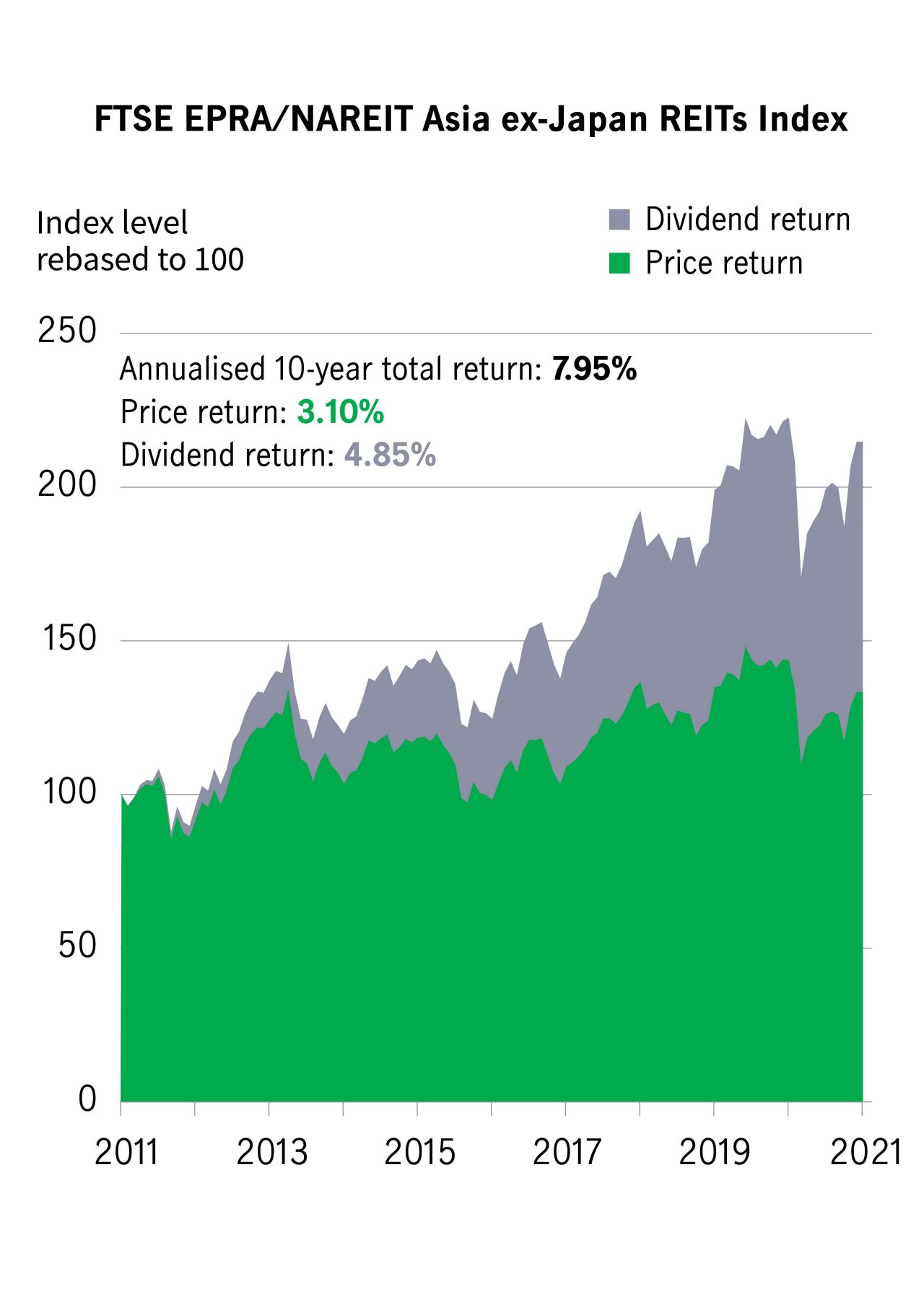

For over 20 years global REITs have significantly outperformed the broad market through multiple market and interest rate environments.

Global REITs and global equities performance1

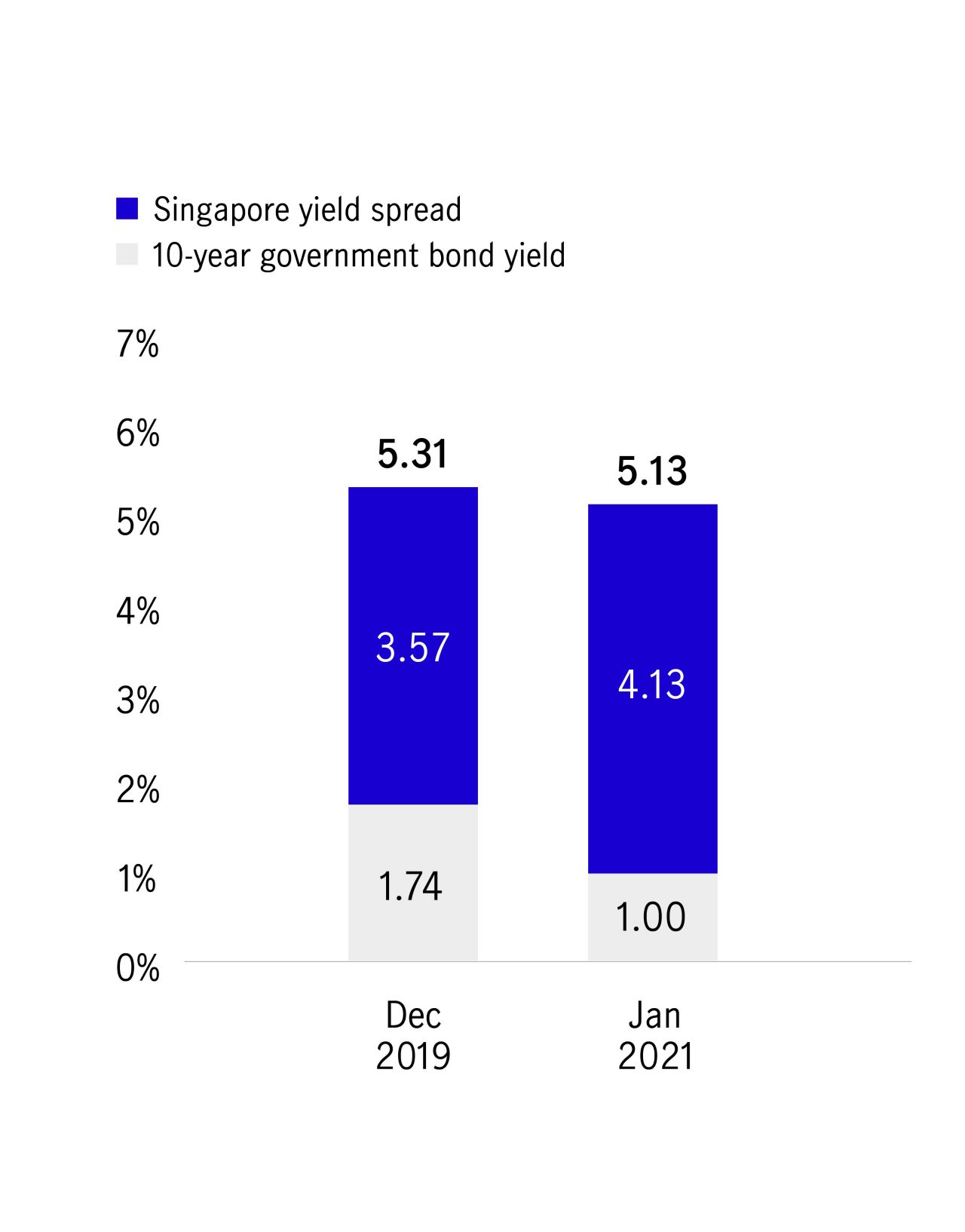

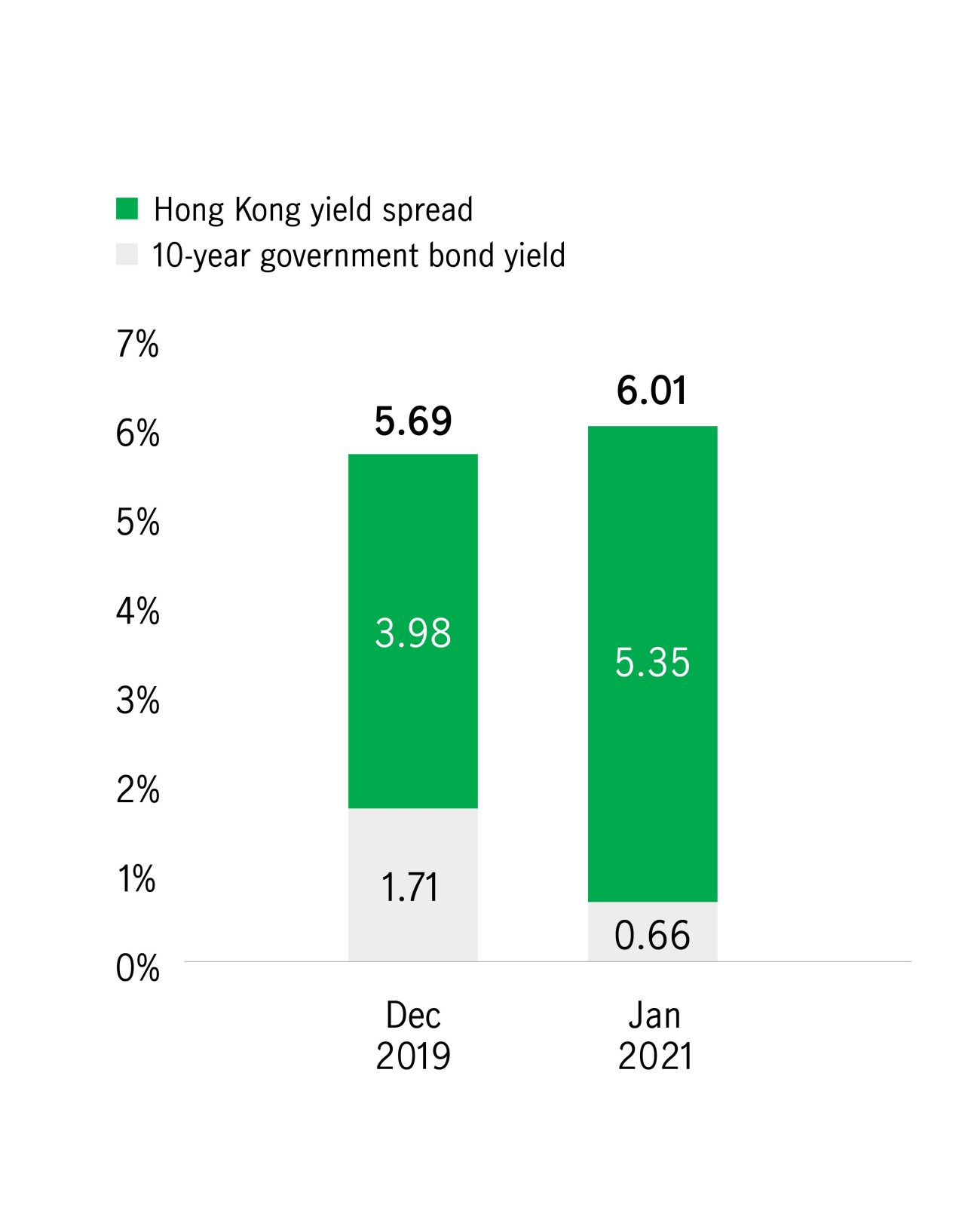

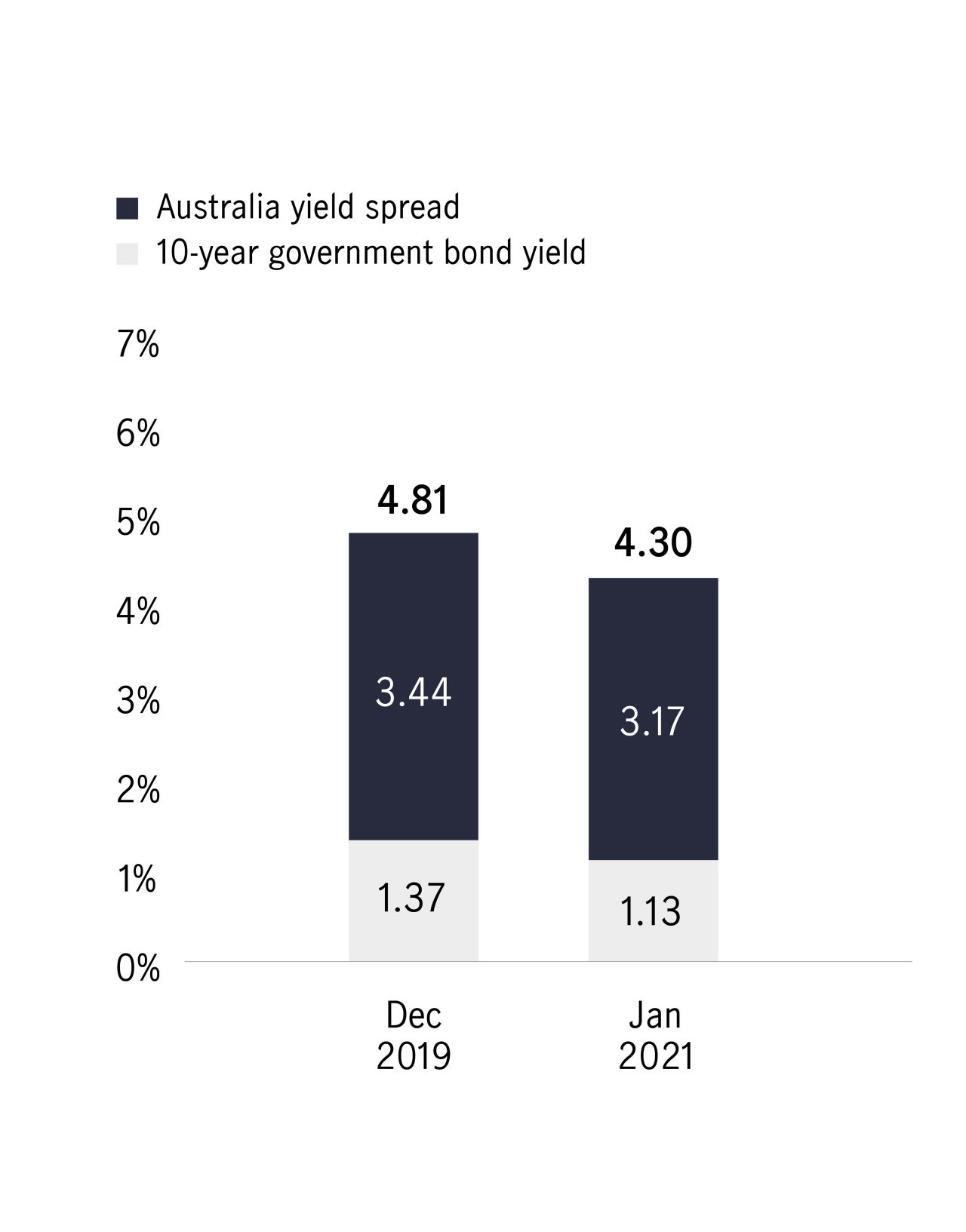

Global REITs currently offer relatively attractive yields compared to other yield-oriented securities. Over the past 20 years, dividend income has contributed around 40% of the total return of global REITs2.

REIT yield comparison vs government bonds3

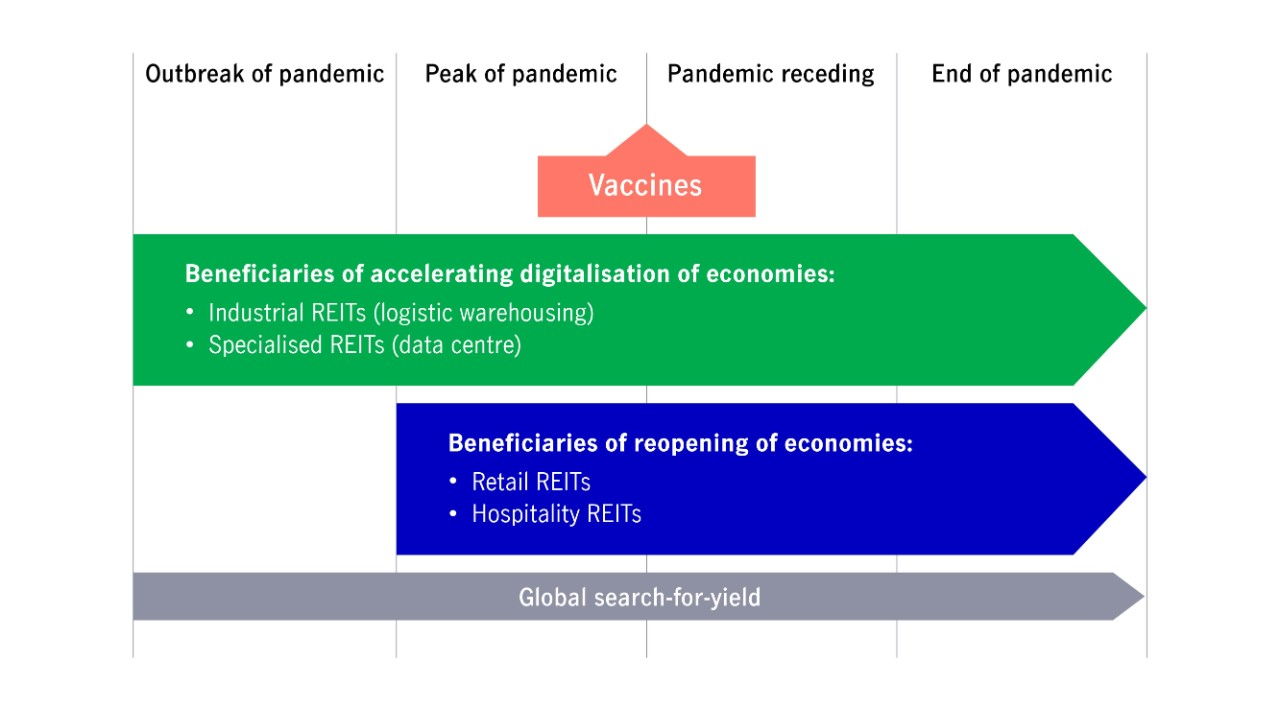

Global REITs offer a wide opportunity set which could potentially benefit from current and long-term trends..

Sources:

1. Bloomberg as of 31 March 2022. Global REITs measured by S&P Global REITs TR USD Index. Global equities measured by MSCI World GR USD Index. Monthly data. Total return. Data rebased to 100 on 30 April 2000.

2. Bloomberg as of 31 March 2022. Global REITs measured by S&P Global REITs TR USD Index.

3. Bloomberg, 31 March 2022. 10 Year Government Bond Yield measured by Local Generic 10- year Government Bond Yield. Australia REITs measured by S&P/AX 200 A-REIT Index (AS51PROP), UK REITs measured by FTSE EPRA/NAREIT UK REITs (ENUKRG), Hong Kong REITs measured by measured by FTSE EPRA/NAREIT Developed REITs Hong Kong Index (ERGLHKU), Japan REITs measured by TSE REIT Index (TSEREIT), Singapore REITs measured by FTSE EPRA/NAREIT Developed REITs Singapore Index (ERGLSGE), US REITS measured by FTSE EPRA/NAREIT United States (UNUS). Due to rounding, some totals may not equal to the sum of separate figures.

Hi {FirstName}! Thank you for interest to learn more about our products. Please expect our Wealth Specialist to get in touch with you.

Sorry

Something went wrong.

Please refresh the page and try again.