Equity strategy:

Asia Pacific REITs (AP REITs)

Potential returns from two key sources: capital appreciation and dividend income

REITs tend to be a good hedge against inflation

Learn more

Dividend income as an important source of long-term returns

Learn more

Capturing opportunities in the post COVID-19 world

Learn more

Inflation that is a result of economic growth tends to translate into greater demand for real estate and subsequent higher occupancy rates, supporting growth in REIT cash flow and dividends. From an income perspective, Asia Pacific REITs offer relative attractive forward yields compared to broader equities and government bonds.

Yield comparison vs Equity/Government bond1

The dividend component of REITs has historically offered investors relatively attractive and sustainable sources of income. Over the past 10 years (as of 31 December 2021), AP REITs have delivered an annualised return of 9.17% p.a., of which 4.71% represents capital appreciation and 4.46% is from dividend income. From a defensive perspective, we believe the stable income stream of REITs also provides a buffer to help cushion overall losses during down markets.

FTSE EPRA/NAREIT Asia ex-Japan REITs Index2

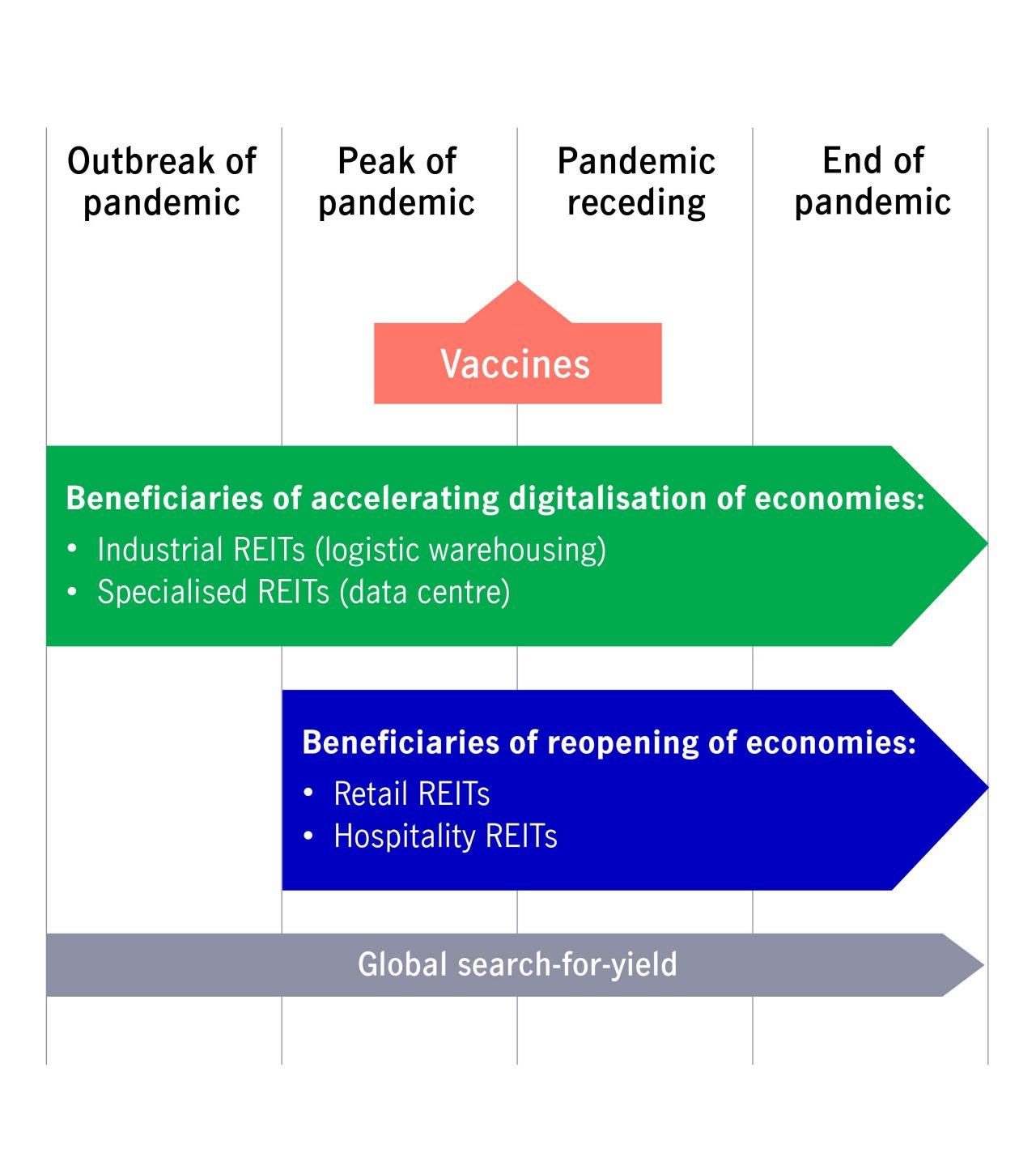

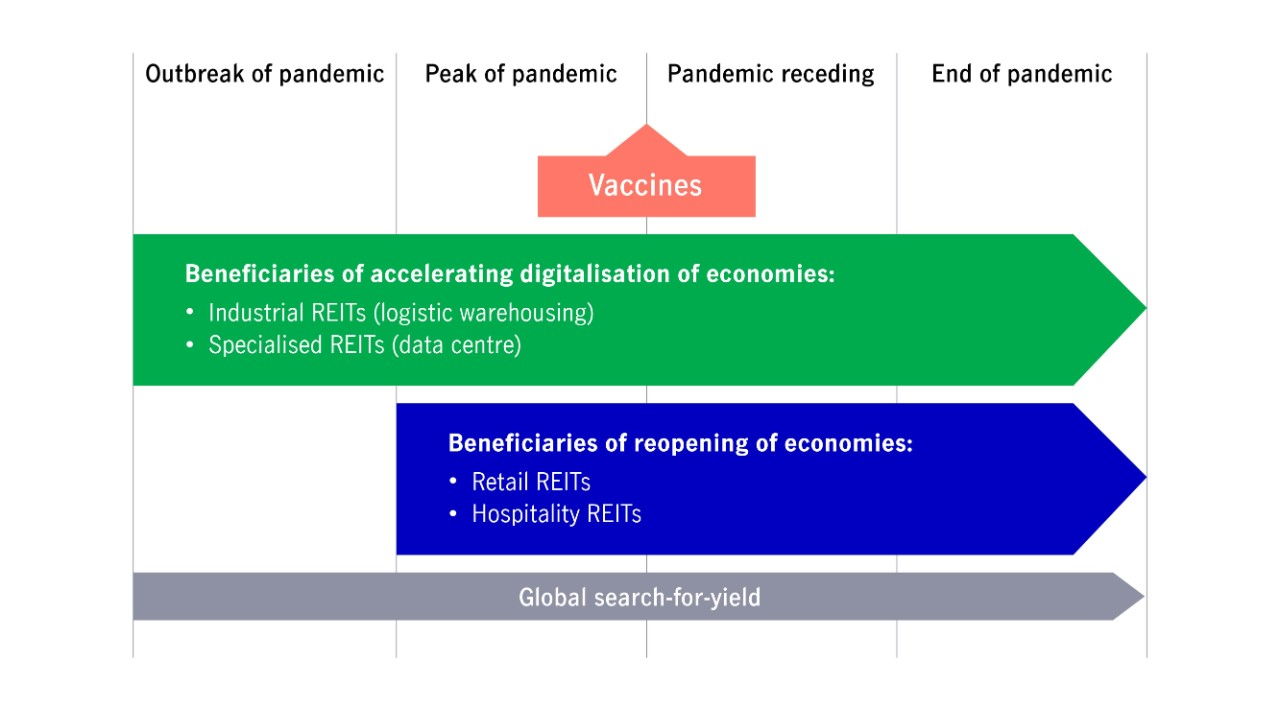

In the post COVID-19 world, industrial and specialized REITs are expected to continuously benefit from the secular trend of digitalization of economies. On the other hand, retail and hospitality REITs could see a recovery as we move towards a vaccinated economy and synchronized re-opening.

Roll-out of vaccines fueled expectations of a wider recovery3

Explore these investment options at the comfort of your home via our digital tool, Manulife iFunds! Talk to us to know more about UITFs!

Sources:

1. Bloomberg as of 31 December 2021. REIT Yield and Equity Dividend Yield are the projected 12-month yield from Bloomberg consensus. REIT Yield: Australia REIT – S&P/ASX 200 A-REIT Index, Hong Kong REIT – Hang Seng REIT Index, Singapore REIT – FTSE ST Real Estate Investment Trusts index. Equity Dividend Yield: Straits Times Total Return Index, Hang Seng Index, S&P/ASX 200 index. 10 Year Government Bond Yield = Local Generic 10- year Government Bond Yield. Projections or other forward-looking statements regarding future events, targets, management discipline or other explanations are only current as of the data indicated. There is no assurance that such events will occur, and if they were to occur, the result may be significantly different than that shown here.

2. Bloomberg, as of 31 December 2021. Total return of AP REITs performance is the FTSE EPRA Nareit Asia ex-Japan REITs Total Return USD Index, while price return is taken from the FTSE EPRA Nareit Asia ex-Japan REITs Index. Dividend returns are calculated as the difference between the two indices. Indices are rebased to 100 as of 31 December 2011. Past performance is not indicative of future performance.

3. Manulife Investment Management, as of 31 December 2021. Projections or other forward-looking statements regarding future events, targets, management discipline or other explanations are only current as of the data indicated. There is no assurance that such events will occur, and if they were to occur, the result may be significantly different than that shown here.

Hi {FirstName}! Thank you for interest to learn more about our products. Please expect our Wealth Specialist to get in touch with you.

Sorry

Something went wrong.

Please refresh the page and try again.